摘要:本期聊一聊经济运行逻辑。

这是桥水基金的创始人瑞·达利欧(Ray Dalio),在08年金融危机之后做的短片。其介绍了经济运行的基本逻辑。比尔盖茨对这个视频的推荐语是这样的:

“This knowledge would help everyone as investors and citizens. Watching it for 30 minutes is a worthwhile investment.” “这些知识对每个人都有帮助,无论是投资者还是普通人;看三十分钟本身就是一个值得的投资。”

🌵 | 经济机器 | A Simple Machine

经济就像机器一样

经济就像机器一样,但是很多人却不懂得这一点,或是对经济的运行方式有着不同的观点。于是就产生了许多不必要的经济损失。

The economy works like a simple machine. But many people don’t understand it or they don’t agree on how it works and this has led to a lot of needless economic suffering.

看似复杂,其实很简单

尽管经济看起来很复杂,但它的运行方式其实是非常简单和机械的。经济由几个简单的零部件和许多无数次重复的简单交易组成。

Though the economy might seem complex, it works in a simple, mechanical way. It’s made up of a few simple parts and a lot of simple transactions that are repeated over and over again a zillion times.

驱动经济的 3 股主要力量

这些交易首先是由人性驱动而形成,进而形成了驱动经济的 3 股主要的动力。

These transactions are above all else driven by human nature, and they creat 3 main forces that drive the economy.

- 生产率的提高 | Productivity Growth

- 短期债务周期 | The Short Term Debt Cycle

- 长期债务周期 | The Long Term Debt Cycle

🌵 | 交易 | Transactions

经济其实就是交易的总和,而交易其实是一件非常简单的事情。你无时无刻不在进行交易。

An economy is simply the sum of the transactions that make it up and transaction is a very simple thing. You make transactions all the time.

你每次买东西,都创造了一次交易。在每一次交易中,买方使用货币或信用和卖方交换商品、服务或金融资产。

Every time you buy somthing you creat a transaction. Each transaction consists of a buyer exchanging money or credit with a seller for goods, services or financial assests.

总支出 = 支出的信用 + 支出的货币

信用和货币一样,所以你的总支出是支出的货币和信用的总和:

Credit spends just like money, so adding together the money spent and the amount of credit spent, you could know the total spending.

价格 = 支出 ÷ 销量

支出的总额是经济的驱动力。如果用支出除以销量,就可以得出价格。这就是交易,非常简单。

The total amount of spending drives the ecnomy. If you divide the amount spent by the quantity sold, you get the price. And that’s it. That’s a transaction.

交易是经济机器的基础部件。所有经济周期和动力都是交易驱动的。所以,了解了交易,就了解了经济。

It is the building block of the economic machine. All cycles and all forces in an economy are driven by transactions. So, if we can understand transactions, we can understand the whole economy.

市场由买卖同一件东西的买家和卖家组成。例如,有小麦市场,汽车市场,股票市场和许多其他的市场。经济就是由不同市场中的交易所组成的。总支出和总销量,就是经济的全部信息。就是这么简单。

A market consists of all the buyers and all the sellers making transactions for the same thing. For example, there is a wheat market, a car market, a stock market and markets for millions of things. An economy consists of all of the transactions in all of its markets. If you add up the total spending and the total quantity sold in all of the market, you have everything you need to know to understand the economy. It’s just that simple.

个人,公司,银行和政府,都以这种方式进行着交易:通过货币或信用交换商品、服务或交融资产。

People, businesses, banks and goverments all engage in transactions the way I just described: exchanging money and credit for goods, services and financial assets.

政府是最大的买方和卖方。政府有两个重要的部门:中央政府和中央银行。中央政府负责收税和花钱;中央银行负责控制经济中的货币和信用总量。央行通过影响利率和发行货币来实现对经济的控制。

The biggest buyer and seller is the goverment, which consists of two important parts: a Central Goverment that collects taxes and spends money…and a Central Bank, which is different from other buyers and sellers because it controls the amount of money and credit in the economy. It does this by influencing interest rates and printing new money.

🌵 | 信贷 | Credit

所以,中央银行在信贷流通中扮演着重要的角色。

For these reasons, the Central Bank is an important player in the flow of Credit.

信贷是经济中最重要的组成部分,但是也可能是人们最不了解的一部分。信贷之所以重要,是因为其是经济中最大和最变化莫测的一部分。

Credit is the most important part of the economy and probably the least understood. It is the most important part because it is the biggest and most volatile part.

贷款人和借款人在市场交易中和买方、卖方没有什么区别。贷款人希望自己的钱可以生出更多的钱,而借款人希望买那些他们无法负担的东西,例如房子、汽车,或者创业。

Just like buyers and sellers go to the market to make transactions, so do lenders and borrowers. Lenders usually want to make their money into more money and borrows usually want to buy something they can’t afford, like a house or car or they want to invest in something like starting a business.

借贷可以同时满足贷款人和借款人的需要。借款人承诺偿还借款,即本金,并支付额外的一部分钱款,称为利息。当利率高时,借贷减少,因为所需偿还的利息变高。当利率低时,借贷增加,因为所需偿还的利息降低。

Credit can help both lenders and borrowers get what they want. Borrowers promise to repay the amount they borrow, called the principal, plus an additional amount, called interest. When interest rates are high, there si less borrowing because it’s expensive. When interest rates are low, borrowing increases because it’s cheaper.

当借款人承诺还款,而贷款人相信其承诺时,信贷就产生了。

When borrowers promise to repay and lenders believe them, credit is created.

任何两个人都可以凭空创造出信贷。信贷看似简单,实际上却很复杂。信贷一旦产生,立即转变为债务。债务是贷款人的资产和借款人的负债。未来,当借款人偿还贷款并支付利息时,负债才会消失,并且交易得以完成。

Any two people can agree to create credit out of thin air. That seems simple enough but credit is tricky because it has different names. And soon as credit it created, it immediately turns into debt.Debt is both an asset to the lender, and a liability to the borrower. In the future, when the borrower repays the loan ,plus interest, the asset and liability disappear and the transaction is settle.

为什么信贷如此重要呢?因为一旦贷款人获得了信贷,他就可以增加其支出。而支出,是经济的驱动力。这是因为一个人的支出是另一个人的收入。你每花一块钱,另一个人就挣一块钱;你每挣一块钱,另一个人就花一块钱。所以,你花的越多,别人挣得就越多。当某个人的收入增加,其信用度也会随之增加,贷款人就更容易把钱借给他。

So, why is credit so important? Because when a borrower receives credit, he is able to increase his spending. And remember, spending drives the economy. This is because one person’s spending is another person’s income. Every dollar you spend, someone else earns, and every dollars you earn, someone else has spent. So when you spend more, someone else earns more. When someone’s income rises it makes lenders more willing to lend him money because now he’s more worthy of credit.

有信誉的贷款人需要具备两个条件:偿还债务的能力和抵押物。

A creditworthy borrower has two things: the ability to repay and collateral.

收入债务比率高,借款人就具备偿还能力。当他无法偿还时,还可以将有价值的、可出售的资产作为抵押物。这让贷款人可以放心地把钱借给他们。所以,收入增加使得借贷增加,从而增加支出。由于一个人的支出是另一个人的收入,这就使得借贷进一步增加,不断循环。这一自我驱动的模式使得经济得以增长,并产生了经济周期。

Having a lot of income in relation to his debt gives him the ability to repay. In the event that he can’t repay, he has valuable assets to use as collateral that can be sold. This makes lenders feel comfortable lending him money. So increased income allows increased borrowing which allows increased spending. And since one person’s spending is another person’s income,this leads to more increased borrowing and so on. This self-reinforcing pattern leads to economic growth and is why we have Cycles.

🌵 | 经济周期 | Cycles

在交易中,你必须支付某些东西来换取另一些东西,你的获得多少东西取决于你能生产多少东西。知识会随着时间而逐渐增多,我们积累的知识也可以提高我们的生活水平,我们将其称之为生产率的提高。

In a transaction, you have to give something in order to get something and how much you get depends on how much you produce. Over time we learned and that accumulated knowledge raises are living standards we call this productivity growth.

善于创新和勤奋的人,将比那些容易自满和懒惰的人更快提高生产率和生活水平,但是这在短时期内不一定会体现出来。长期来看,生产率最为重要;但是短期来看,信贷更为重要。这是因为生产率的提高不会剧烈波动,因此不是经济起伏的重要动力。但是债务是这种动力,因为我们通过借债让消费超过产出(还债时不得不让消费低于产出)。

Those who were invented and hard-working raise their productivity and their living standards faster than those who are complacent and lazy, but that isn’t necessarily ture over the short run. Productivity matters most in the long run, but credit matters most in the short run. This is because productivity growth doesn’t fluctuate much, so it’s not a big driver of economic swings. Debt is — because it allows us to consume more than we produce when we acquire it and it forces us to consume less than we produce when we pay it back.

债务波动有两大周期:一个大约会持续 5-8 年,另一个大约会持续 75-100 年。

Debt swings occur in two big cycles: One takes about 5 to 8 years and the other takes about 75 to 100 years.

大部分人能够感受到波动,但是由于离波动太近,每天、每周都身临其境,通常不会认为这是周期。

While most people feel the swings, they typically don’t see them as cycles because they see them too up close — day by day, week by week.

如上所述,经济的波动不取决于创新和工作的努力程度,而主要是看信贷情况。设想一个没有信贷的经济模式。在没有信贷的经济模式中,只有提高收入才可以增加支出,因此需要提高生产率和工作量。提高生产率是经济增长的唯一途径。当我或其他人的生产效率提高时,经济就会增长。如果我们观察各种交易,加以总结,就会发现一条类似于生产率增长轨迹的渐进线。但是由于借贷的存在,经济周期就产生了。其原因并不在于法律和规则,而是在于人的天性和信贷运作方式。

As mentioned, swings around the line are not due to how much innovation or hard work there is, they’re primarily due to how much credit there is. Let’s for a second imagine an economy without credit. In this economy, the only way I can increase my spending is to increase my income, which requires me to be more productive and do more work. Increased productivity is the only way for growth. Since my spending is another person’s income, the economy grows every time I or anyone else is more productive. If we follow the transactions and play this out, we see a progression like the productivity growth line. But because we borrow, we have cycles. This isn’t due to any law or regulation, it’s due to human nature and the way that credit works.

借贷不过就是提前消费。为了购买现在买不起的东西,你的支出将会超过你的收入。因此,你需要借钱,实际上是和将来的自己借钱。你给自己设定了一个未来的时间,届时你的支出必须小于你的收入,以便偿还债务。于是,马上形成了一个周期。通常,只要你开始借贷,你就创造了一个周期。对于个人是这样,对于整个经济运行也是如此。

Think of borrowing as simply a way of pulling spending forward. In order to buy something you can’t afford, you need to spend more than you make. To do this, you essentially need to borrow from your future self. In doing so you create a time in the future that you need to spend less than you make in order to pay it back. It very quickly resembles a cycle. Basically, anytime you borrow you create a cycle. This is as ture for an individual as it is for the economy.

这就是为什么一定要了解信贷,因为信贷触发了一系列机械的、可预测的、将在未来发生的事件。这使得信贷不同于货币。完成交易需要使用货币。当你用现金在酒吧买一瓶啤酒时,交易立即完成。但是如果你用信用购买一瓶啤酒,比如赊账。你相当于承诺你以后会为其付钱。你和酒吧一起创造了一笔资产和一笔负债。你们凭空创造出了信贷。只有在今后你偿还了这笔债务后,上述的资产和负债才会消失,债务还清,交易完成。

This is why understanding credit is so important because it sets into motion a mechanical, predictable series of events that will happen in the future. This makes credit different from money. Money is what you settle transactions with. When you buy a beer from a bartender with cash, the transaction is settled immediately. But when you buy a beer with credit, it’s like starting a bar tab. You are saying you promise to pay in the future. Together you and the bartender create an asset and a liability. You just created credit. Out of thin air. It’s not until you pay the bar tab later that the asset and liability disappear, the debt goes away and the transaction is settled.

现实中,大部分所谓的钱其实都是信贷。美国国内的信贷总额大约为 50 万亿,而货币总额只有大约 3 万亿。不要忘记,在没有信贷的经济模式中,提高生产是增加支出的唯一方法。但是在信贷体系中,你还可以通过借贷来增加自己的支出。因此,信贷可以增加支出,并且使收入增长在短期内超过生产率增长,但是长期并非如此。

The reality is that most of what people call money is actually credit. The total amount of credit in the United Sates is about $50 trillion and the total amount of money is only about $3 trillion. Remember, in an economy without credit: the only way to increase your spending is to produce more. But in an economy with credit, you can also increase your spending by borrowing. As a result, an economy with credit has more spending and allows incomes to rise faster than productivity over the short run, but not over the long run.

请不要误解其中的含义,信贷不一定是坏事,其只是会导致经济的周期性变化。超过偿还能力的过度消费,会造成不良信贷。但是,信贷如果高效率地分配资源和产生收入,让人可以偿还债务,就是良性信贷。

Now, don’t get me wrong, credit isn’t necessarily something bad that just causes cycles. It’s bad when it finances over-consumption that can’t be paid back. However, it’s good when it efficiently allocates resources and produces income so you can pay back the debt.

例如,如果你借钱买了一台大彩电,彩电并不会给你带来任何收入。但是,如果你借钱买了一台拖拉机,其帮助你收获更多的庄稼和赚更多的钱,你就可以偿还你的债务并提高生活水平。

For example, if you borrow money to buy a big TV, it doesn’t generate income for you to pay back the debt. But, if you borrow money to buy a tractor — and that tractor let’s you harvest more crops and earn more money — then, you can pay back your debt and improve your living standards.

在有信贷的经济体系中,我们可以跟踪各种交易,观察信贷如何带来经济的增长。例如,假设你每年赚 10 玩美元,并且没有任何债务。你有不错的信用,一年可以借 1万美元,那么即使你一年只能挣10 万美元,但是你一年却可以花 11 万美元。由于你的支出是另一个人的收入,那么有人就挣了 11 万美元。挣了 11 万美元的人,如果没有信贷就可以借 1.1 万美元,所以他就可以花 12.1 万美元,即使他的年收入只有 11 万美元。由于他的支出又是另一个人的收入。如果我们跟踪各种交易,就可以看到这个过程在不断地自我强化。但是不要忘了,信贷形成了周期,周期会上升,最终也会下降。

In an economy with credit, we can follow the transactions and see how credit creates growth. For example: Suppose you earn $100,000 a year and have no debt. You are creditworthy enough to borrow $10,000 dollars — say on a credit card — so you can spend $110,000 dollars even though you only earn $100,000 dollars. Since your spending is another person’s income, someone is earning $110,000 dollars. The person earning $110,000 dollars with no debt can borrow $11,000 dollars, so he can spend $110,000 dollars. He spending is another person’s income and by following the transactions we can begin to see how this process works in a self-reinforcing pattern. But remember, borrowing creates cycles and if the cycle goes up, it eventually needs to come down.

🌵 | 短期债务周期 | Short Term Debt Cycle

随着经济活动的增加,出现了扩张 —— 这是短期债务周期的第一个阶段。支出增加,物价上升。其原因是,信贷使得支出增加,而信贷可以凭空产生。当支出和收入的增长速度超过商品的生产速度时,价格就会上涨,我们将价格上涨称之为“通货膨胀”。央行不希望通货膨胀过高,因为这会导致出现许多问题。看到价格上涨,央行就会提高利率。利率提高,借钱的人就会减少,同时现有的债务成本也会上升。这就相当于你每个月需要还的信用卡额度会增加。由于人们借债减少,还款额度增长,他们可用于消费的钱也会减少,支出速度放缓;由于一个人的支出是另一个人的收入,环环相扣,人们的整体收入将会下降。当人们的支出减少,价格也会随之下降。我们将其称为“通货紧缩”。经济活动减少,经济进入衰退期。

As economic activity increases, we see an expansion — the first phase of the short term debt cycle. Spending continues to increase and prices start to rise. This happens because the increase in spending is fueled by credit — which can be created instantly out of thin air. When the amount of spending and incomes grow faster than the production of goods: When prices rise, we call this inflation. The Central Bank doesn’t want too much inflation because it causes problems. Seeing prices rise, it raises interest rates. With higher interes rates, fewer people can afford to borrow money. And the cost of existing debt rise. Think about this as the monthly payments on your credit card going up. Because people borrow less and have higher debt repayments, they have less money leftover to spend, so spending slows… and cince one person’s spending is another person’s income, incomes drop… and so on and so forth. When people spend less, prices go down. We call this deflation. Economic activity decreases and we have a recession.

如果经济衰退的过于严重,并且通货膨胀不再是问题,那么央行就会降低利率,使经济活动重新增长。随着利率下降,偿还债务的成本也下降;借贷和支出增加,经济又出现了扩张。可见经济就像机器一样运行着。

If the recession becomes too severe and inflation is no longer a problem, the Central Bank will lower interest rates to cause everything to pick up again. With low interest rates, debt repayments are reduced and borrowing and spending pick up and we see another expansion. As you can see, the economy works like a machine.

在短期债务周期中,限制支出的唯一因素就是贷款人和借款人的贷款和借款意愿。如果信贷易于获得,经济就会扩张;如果信贷不易获得,经济就会衰退。注意,这个周期主要是银行控制的。短期债务周期大概会持续 5-8 年,在几十年中不断重复。但是,请注意在每个周期的低谷和高峰后,经济增长和债务都将超过前一个周期。因为这是人促成的。人们总是更喜欢借钱和花钱而不喜欢偿还债务。这是人的天性。因此,长期以来,债务增加的速度将超过收入,从而形成长期债务周期。

In the short term debt cycle, spending is constrained only by the willingness of lenders and borrowers to provide and receive credit. When credit is easily available, there is an economic expansion. When credit isn’t easily available, there is a recession. And note that this cycle is controlled primarily by the Central Bank. The short term debt cycle typically lasts 5-8 years and happens over and over again for decades. But notice that the bottom and top of each cycle finish with more growth than the previous cycle and with more debt. Because people push it — they have an inclination to borrow and spend more instead of paying back debt. It’s human nature. Because of this, over long periods of time, debts rise faster than incomes creating the Long Term Debt Cycle.

🌵 | 长期债务周期 | Long Term Debt Cycle

尽管人们的债务增加,但是贷款人会提供更宽松的信贷条件,这是为什么呢?因为人们都以为形势一片大好!人们总是注重眼前的事情。眼前的事是什么呢?收入在增加!资产在增值!股票在上升!现在是繁荣时期!用借来的钱买商品、服务和金融产品很划算!

Despite people becoming more indebted, lenders even more freely extend credit. Why? Because everybody thinks things are going great! People are just focusing on what’s been happening lately. And what has been happening lately? Incomes have been rising! Asset values are going up! The stock market roars! It’s a boom! It pays to buy goods, services, and financial assets with borrowed money!

当人们过度借贷消费时,泡沫便产生了。因此,尽管债务一直在增加,收入的速度也一样在增加,从而抵消了许多债务。我们把债务与收入的比率称之为债务负担。只要收入继续上升,债务负担就可以承受。同时,资产的价值迅速上升。人们开始大量借钱来购买资产,因为投资促使资产价格日益升高。人们感觉自己很富有。因此,尽管积累了大量的债务,收入和资产价值的上升帮助借款人在长期内可以保持良好的信誉。

When people do a lot of that, we call it a bubble. So even though debts have been growing, income have been growing nearly as fast to offset them. Let’s call the ratio of debt-to-income the debt burden. So long as incomes continue to rise, the debt burden stays manageable. At the same time asset values soar. People borrow huge amounts of money to buy assets as investments causing their prices to rise even higher. People feel wealthy.So even with the accumulation of lots of debt, rising incomes and asset values help borrowers remain creditworthy for a long time.

但是,这种情况显然无法一直持续下去,事实也是如此。几十年来,债务负担慢慢增加,使还债成本越来越高。到了一定的时候,偿还债务成本的增加速度超过收入,迫使人民不得不削减支出。由于一个人的支出是另一个人的收入,收入开始下降。人们的信用因此降低,导致借贷减少。

But this obviously can not continue forever. And it doesn’t. Over decades, debt burdens slowly increase creating larger and larger debt repayments. At some point, debt repayments start growing faster than incomes forcing people to cut back on their spending. And since one person’s spending is another person’s income, incomes begin to go down… which makes people less creditworthy causing borrowing to go down.

还债成本进一步增加,使得支出进一步减少,周期开始逆转。这时到达长期债务顶峰,债务负担变得过重。美国、欧洲和很多其他地区,在 2008 年发生了种种的情况。1989 年的日本和 1929 年的美国也发生了。现在,经济进入去杠杆化时期。

Debt repayments continue to rise which makes spending drop even further… and the cycle reverses itself. This is the long term debt peak. Debt burdens have simply become too big. For the US, Europe and much of the reat of the world this happened in 2008. It happened for the same reason it happened in Japan in 1989 and in the US back in 1929. Now the economy begins Deleveraging.

🌵 | 去杠杆化时期 | Deleveraging

在去杠杆化时期,人们的支出减少,收入下降,信贷消失,资产价格下降,银行紧缩,股票暴跌,社会紧张加剧,整个过程开始下滑并形成恶性循环。随着收入下降和还债成本的增加,借款人倍感拮据。随着信用消失,信贷枯竭,借款人再也无法借到足够的钱来偿还债务。为了填补这个窟窿,借款人不得不出卖自己的资产。支出下降,出售热潮,使得市场上充斥着代售资产;股票市场暴跌,不动产市场萎靡,银行陷入困境。

In deleveragin, people cut spending, incomes fall, credit disappears, assets prices drop, banks get suqeezed, the stock market crashes, social tensions rise and the whole thing atarts to feed on itself the other way. As incomes fall and debt repayments rise, borrowers get squeezed. No longer creditworthy, credit dries up and borrowers can no longer borrow enough money to make their debt repayments. Scrambling to fill this hole, borrowers are forces to sell assets. The rush to sell assets floods the market. This is when the stock market collapses, the real estate market tanks and banks get into trouble.

随着资产价格下跌,借款人能够提供的抵押物的价值下降,这进一步降低了借款人的信用。人们觉得自己很穷,信贷迅速消失。支出减少、收入减少、财富减少、信用减少、借贷减少。这是一个恶性循环。

As asset prices drop, the value of the collateral borrowers can put up drops. This makes borrowers even less creditworthy. People feel poor. Credit rapidly disappears. Less spending > less income > less worth > less credit > less borrowing and so on. It’s a vicious cycle.

它看起来与衰退很相似,但不同之处是,无法通过降低利率来挽回局面。在衰退中,可以通过降低利率来刺激借贷。但是在去杠杆化过程中,由于利率低到近乎于 0,从而丧失了刺激功能,因此降低利率无法起到作用。美国的利率在 1930 年代的去杠杆化期间下降到 0,在 2008 年也是如此。

This appears similar to a recession but the difference here is that interest rates can’t be lowered to save the day. In a recesiion, lowering interest rates works to stimulate the borrowing. However, in a deleveraging, lowering interest rates doesn’t work because interest rates are already low and soon hit 0% — so the stimulation ends. Interes rates in the US hit 0% during the deleveraging of the 1930s and again in 2008.

衰退与去杠杆化之间的差别在于,去杠杆化过程中,借款人的债务负担变得过重,无法通过降低利率来减轻,贷款人意识到,债务过于庞大,根本无法足额偿还。借款人失去了偿债能力,其抵押物失去了价值,他们觉得受到债务的伤害,不想再借入更多债务!

The differece between a recession and a deleveraging is that in a deleveraging borrowers’ debt burdens have simply gotten too big and can’t be relieved by lowering interest rates. Borrowers have lost their ability to repay and their collateral has lost value. They feel crippled by the debt — they don’t even want more!

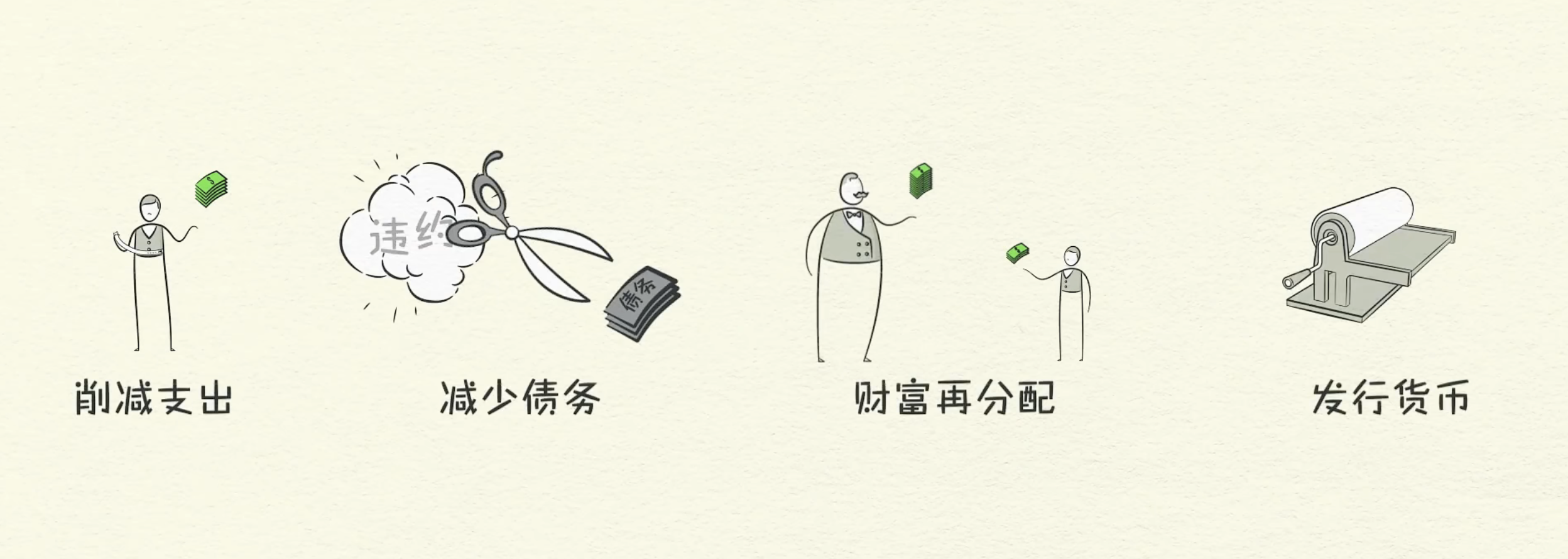

贷款人停止放贷,借款人停止借贷。整个经济体与个人一样都失去了信用,那么该如何去杠杆化呢?问题在于,债务负担过重,必须减轻;为此可以采用四种方法。

Lenders stop lending. Borrowers stop borrowing. Think of the economy as being not-creditworthy, just like an individual. So what do you do about a deleberaging? The problem is debt burdens are too high and they must come down.

- 个人、企业和政府都削减支出。| People, businesses, and goverments cut their spending.

- 通过债务违约和重组来减少债务。| Debts are reduced through defaults and restructurings.

- 财富再分配,将财富从富人转给穷人。| Wealth is redistributed from the ‘haves’ to the ‘have nots’.

- 发行更多的货币。| The Central Bank prints new money.

这四种办法都被用于现代历史上的每一个去杠杆化过程。

These 4 ways have happened in every deleveraging in modern history.

通常,第一个措施就是削减支出。个人、企业、银行和政府都要勒紧裤腰带,削减支出,从而减少债务。我们经常将其称之为“紧缩”。当借款人不再借入新的债务,并开始减少旧债务时,你会认为债务负担减轻了,但情况正好相反!支出减少了,而一个人的支出是另一个人的收入,这就导致收入下降。收入下降速度超过还债速度,因此债务负担实际上更重,削减支出引起通货紧缩,令人痛苦。

Usually, spending is cut first. As we just saw, people, businesses, banks and even goverments tighten their belts and cut their spending so taht they can pay down their debt. This is often referred to as austerity. When borrowers stop taking on new debts, and start paying down old debts, you might expect the debt burden to decrease. But the opposite happens! Because spending is cut — and one man’s spending is another man’s income — it causes incomes to fall. They fall faster than debts are repaid and the debt burden actually gets worse. As we’ve seen, this cut in spending is deflationary and painful.

企业不得不削减成本,这意味着工作机会减少,失业率上升。这导致下一个步骤,即必须减少债务!很多借款人无法偿还债务,借款人的债务是贷款人的资产,若借款人不偿还债务,人们会担心银行无法返回其存款。因此,人们纷纷从银行取款,银行受到挤兑。而个人、企业和银行出现债务违约,这种严重的经济收缩就是萧条。

Businesses are forced to cut costs… which means less jobs and higher unemplyment. This leads to the next step: debts must be reduced! Many borrowers find themselves unable to repay their loans — and a borrower’s debts are a lender’s assets. When borrowers don’t repay the bank, people get nervous that the bank won’t be able to repay them so they rush to withdraw their money from the bank. Banks get squeezed and people, bussinesses and banks default on their debts. This severe economic contraction is a depression.

萧条的主要特征是,人们发现他们原来以为属于自己的财富中有很大一部分实际上并不存在。还拿酒吧举例。当你用赊账的方式买一瓶啤酒,是在承诺今后偿还酒吧赊账。但是,如果你不兑现承诺,不偿还酒吧的赊账,实际上是债务违约,那么酒吧的这项“资产”实际上一文不值,它实际上是消失了。很多贷款人不希望自己的资产消失,同意债务重组。

A big part of a depression is people discovering much of what they though was their wealth isn’t really there. Let’s go back to the bar. When you bought a bear and put it on a bar tab, you promised to repay the bartender. Your promise became an assset of the bartender. But if you break your promise — if you don’t pay him back and essentially defualt on your bar tab — then the ‘asset’ he has isn’t really worth anything. It has basically disappeared. Many lenders don’t want their assets to disappear and agree to debt restrucurting.

债务重组意味着贷款人得到的还款减少或偿还期现延长,或利率低于当初商定的水平。无论如何,合约被破坏,结果是债务减少,贷款人希望多少收回一些贷款,这强过血本无归。债务重组让债务消失,但由于导致收入和资产价值以更快速度消失,债务负担继续日趋沉重。

Debt restructuring means lenders get paid back less or get paid back over a longer time frame or at a lower interest rate that was first agreed. Somehow a contract is broken in a way that reduces debt. Lenders would rather have a little of something than all of nothing. Even though debt disappears, debt resturing causes income and asset values to disappear faster, so the debt burden continues to gets worse.

削减债务与减少支出一样,令人痛苦和导致通货紧缩。所有后果都会对中央政府产生影响,因为收入降低和失业率增加会使得政府的税收减少。同时,由于失业率上升,中央政府需要增加支出。很多失业者储蓄不足,需要政府财政资助。此外,政府制定刺激计划和增加支出,以弥补经济活动的减少。在去杠杆化的过程中,政府的预算赤字飙升,原因是政府的支出超过税收。新闻中所听到的预算赤字就是这种情况。政府必须加税或举债,以填补赤字。但是在收入下降和很多人失业的时候,应该向谁融资呢?富人。

Like cutting spending, debt reduction is also painful and deflationary. All of this impacts the Central Government because lower incomes and less employment means the government collects fewer taxes. At the same time it needs to increase its spending because unemployment has risen. Additionally, governments create stimulus plans and increase their spending to make up for the decrease in the economy. Governments’ budget deficits explode in a deleveraging because they spend more than they earn in taxes. This is what is happening when you hear about the budget deficit on the news. To fund their deficits, governments need to either raise taxes or borrow money. But with incomes faling and so many unemployed, who is the money going to come from? The rich.

由于政府需要更多的钱,而大量的财富都集中于少数人的手里,政府自然而然地增加对富人的税收,以帮助经济中的财富再分配。财富从富人那转给穷人,正在困苦中的穷人开始怨恨富人。承受经济疲弱、资产贬值和税收压力的富人开始怨恨穷人。萧条如果继续下去,就会爆发社会动荡。不仅国家内部的紧张加剧,而且国家与国家之间也会如此,债务国和债权国之间尤其如此。这种局势可以导致政治变革,有时是极端的变革。1930 年代,这种局势导致希特勒掌权,欧洲爆发了战争,美国发生大萧条。必须采取行动来结束萧条的压力越来越大。

Since governments need more money and since weaith is heavily concentrated in the hands of a small percentage of the people, governments naturally raise taxes on the wealthy which facilitates a redistribution of wealth in the economy — from the ‘haves’ to the ‘have nots’. The ‘have nots’, who are suffering, being to resent the wealthy ‘haves’. The wealthy ‘haves’ being sueezed by the weak economy, falling asset prices, higher taxes, begin to resent the ‘have nots’. If the depression continues social disorder can break out. Not only do tensions rise within countries, they can rise between countries — especially debtor and creditor countries. This situation can lead to political change that can sometimes be extreme. In the 1930s, this led to Hitler coming to power, war in Europe, and depression in the US. Pressure to do something to end the depression increases.

不要忘记,人们心中的货币实际上大部分是信贷。所以,一旦信贷消失,人们的钱不够花。人们需要钱,而谁又可以发行钱呢?中央银行可以。

Remember, most of what people thought was money was actually credit. So, when credit disappears, people don’t have enough money. People are desperate for money and you remember who can print money? The Central Bank can.

央行已经把利率降到接近 0 的水平,现在不得不发行更多货币。发行货币和削减支出、减少债务和财富再分配不同,会引起通货膨胀和刺激经济。中央央行不可避免地凭空印发更多货币,并使用这些货币来购买金融资产和政府债券。这发生在美国大萧条期间和 2008 年,当时美国中央银行——美联储增加发行了两万多亿美元。世界各地能够这样做的还有其他央行,也增加了很多货币。

Having already lowered its interest rates to nearly 0 — it’s forced to print money. Unlike cutting spending, debt reduction, and wealth redistribution, printing money is inflationary and stimulative. Inevitably, the Central Bank print new money — out of thin air — and uses it to buy financial assets and government bonds. It happened in the United States during the Great Depression and again in 2008, when the US’s Central Bank — the Federal Reserve — printed over two trillion dollars. Other Central Banks around the world that could, printed a lot of money, too.

央行通过这些货币购买金融资产,帮助推升了资产价格,从而提高了人们的信用。但是,这仅仅有助于那些有金融资产的人。央行可以印发货币,但是只能购买金融资产。而另一方面,中央政府可以购买商品和服务,可以向人民送钱,但是无法印发钞票。所以为了刺激经济,两个部门必须合作。

By buying financial assets with this money, it helps drive up asset prices which makes people more crediworthy. However, this only helps those who own financial assets. You see, the Central Bank can print money but it can only buy financial assets. The Central Government, on the other hand, can buy goods and services and put money in the hands of the people but it can’t print money. So, in order to stimulate the economy, the two must cooperate.

央行通过购买政府债券,其实就是把钱借给政府,使其能够运行赤字预算,并通过刺激计划和失业救济金增加购买商品和服务的支出,这增加收入,也增加政府债务。但是,这个办法可以降低经济中总债务的负担,这是一个风险很大的时刻。

By buying governments bonds, the Central Bank essentially lends money to the government, allowing it to run a deficit and increase spending on goods and services through its stimulus programs and unemployment benefits. This increases people’s income as well as the goverment’s debt. However, it will lower the economy’s total debt burden. This is a very risky time.

决策者需要平衡考虑降低债务负担的四种办法。必须平衡兼顾通货紧缩的办法和通货膨胀的办法,以便保持稳定。如果达到平衡,就可以带来和谐的去杠杆化。

Policy makers need to balance the four ways that debt burdens come down. The deflationary ways need to balance with the inflationary ways in order to maintain stability. If balanced correctly, there can be a Beautiful Deleveraging.

🌵 | 和谐地去杠杆化 | Beautiful Deleveraging

去杠杆化可以是痛苦的,也可以是和谐的。怎么才能实现和谐地去杠杆化呢?尽管去杠杆化是艰难的,但以尽可能好的办法来处理艰难的局势却是一件好事。这比去杠杆化阶段大量举债产生过度失衡现象要好得多。在和谐破的去杠杆化过程中,债务收入比率下降,经济实际上是正增长。同时通货膨胀并不是一个问题,这是通过适当的平衡所取得的。为了取得平衡,需要结合削减支出,减少财富、转移财富、发行货币等方式以保持经济和社会稳定。

A deleverging can be ugly or it can be beautiful. How can a deleveraging be beautiful? Even though a deleveraging is a difficult situation, handing a difficult situation in the best possible way is beautiful. A lot more beautiful than the debt-fueled, unbalanced excesses of the leveraging phase. In a beautiful deleveraging, debts decline relative to income, real economic growth is positive, and inflation isn’t a problem. It is achieved by having the right balance. The right balance requires a certain mix of cutting spending, reducing debt, transferring wealth and printing money so that economic and social stability can be maintained.

有人问,发行货币是否会加剧通货膨胀?如果增发的货币抵消贷款的降幅,就不会印发通货膨胀。不要忘记,重要的是支出。每一块钱的支出无论支付的是货币还是信用,对价格的影响都是一样的。央行可以通过增加货币发行量来弥补小时的信贷。央行为了扭转局面,不仅需要推动收入的增长,而且需要让收入的增长率超过所积债务的利率,这是什么意思?收入的增长一定要比债务的增长快。

People ask if printing money will raise inflation? It won’t if it offsets falling credit. Remember, spending is what matters. A dollar of spending paid for with money has the same effect on price as a dollar spending paid for with credit. By printing money, the Central Bank can make up for the disappearance of credit with an increase in the amount of money. In order to turn things around, the Central Bank needs to not only pump up income growth but get the rate of income growth higher than the rate of interest on the accumulated debt. So, what do I mean by that? Basically, income needs to grow faster than debt grows.

例如:假设有一个国家正在经历去杠杆化。其债务收入比率是 100%,这意味着,债务量相当于整个国家一年的收入。假设这些债务的利率是 2%,如果债务以 2% 的利率速度增加而收入的增长率仅有大约 1%。那么债务负担永远不会减轻,必须发行更多货币,使收入增长率超过利率。然而,发行货币太简单了,而且比其他的方法受欢迎,因此,这个方法容易被滥用。

For example: Let’s assume that a country going through a deleveraging has a debt-to-income ratio of 100%. That means that the amount of debt it has is the same as the amount of income the entire country makes in a year. Now think about the interest rate on that debt, let’s say it 2%. If debt is growing at 2% because of that interest rate and income is only growing at around only 1%, you will never reduce the debt burden. You need to print enough money to get the rate of income growth aboue the rate of interest. However, printing money can wasily be abused because it’s so easy to do and people prefer it to the alternatives.

关键是避免像 1920年代去杠杆化的德国那样,发行过多的货币,从而导致恶性通货膨胀。如果决策层取得适当的平衡,去杠杆化过程就不会那样激烈。经济增长速度放缓,但是债务负担会减轻,这就是和谐的去杠杆化。

The key is to avoid printing too much money and causing unacceptably high inflation, the way Germany did during its deleveraging in the 1920’s. If policymakers achieve the right balance, a deleveraging isn’t so dramatic. Growth is slow but debt burdens go down. That is a beautiful deleveraging.

当收入上升时,借款人信用度提高,借款人一旦显得更有信用,贷款人会开始逐步恢复贷款。债务开始下降,人们又可以借到钱,就可以增加消费,经济开始恢复增长,长期债务周期从而进入通货再膨胀阶段。虽然去杠杆化的过程如果处理不当会非常可怕,但是如果处理得当,最终会解决问题。

When incomes begin to rise, borrowers begin to appear more creditworthy. And when borrowers appear more creditwoorhty, lenders begin to lend money again. Debt burdens finally begin to fail. Able to borrow money, people can spend more. Eventually, the economy begins to grow again, leading to the reflation phase of the long term debt cycle. Though the deleveraging process can be horrible if handled badly, if handled well, it will eventually fix the problem.

为使债务负担下降和经济活动恢复正常,大约需要十年或更久的时间,因此就会有“失去的十年”这种说法。

It takes roughly a decade or more for debt burdens to fall and economic activity to get back to normal — hence the term ‘lost decade’.

🌵 | 总结 | In Closing

经济当然要比这个模式更复杂。

The economy is a little more complicated than this template suggests.

然而,把短期债务周期、长期债务周期和生产率增长轨迹结合起来分析,我们会得到一个不错的模式,可以看清我们在过去和当前的处境以及未来可能的发展方向。

However, laying the short term debt cycle on top of the long term debt cycle and then laying both of them on top of the productivity growth line gives a reasonably good template for seeing where we’ve been, where we are now and where we are probably headed.

最后,希望大家学到三条经验法则:

So in summary, there are three rules of thumb that I’d like you to take away:

第一:不要让债务的增长超过收入,因为负债最终会把你压垮。

First: Don’t have debt rise faster than income, because your debt burdens will eventually crush you.

第二:不要让收入的增长速度超过生产率,因为这最终将使你失去竞争力。

Second: Don’t have income rise faster than productivity, because you will eventually become uncompetitive.

第三:尽一切努力提高生产率,因为生产率在长期内起着关键的作用。

Third: Do all that you can to raise your productivity, because, in the long run, that’s what matters most.