The borrow interest rates come from the Utilization Rate U.

_U _is an indicator of the availability of capital in the pool. The interest rate model is used to manage liquidity risk through user incentivizes to support liquidity:

When capital is available: low interest rates to encourage loans.

When capital is scarce: high interest rates to encourage repayments of loans and additional deposits.

About Utilization Rate

The utilization ratio U__ for each market a__ unifies supply and demand into a single variable:

Ua = Borrowsa / (Casha + Borrows__a)

Interest Rate Model

WePiggy’s interest rate strategy is calibrated to manage liquidity risk and optimise utilization.

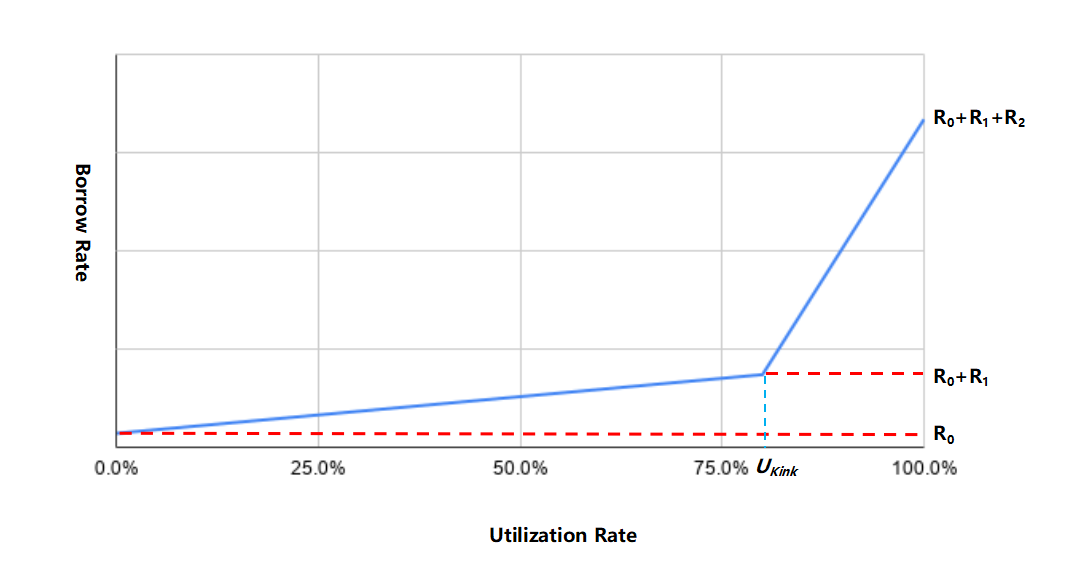

Liquidity risk materializes when utilization is high, its becomes more problematic as U gets closer to 100%. To tailor the model to this constraint, the interest rate curve is split in two parts around an optimal utilization rate U**kink**. Before U**kink** __ the slope is small, after it starts rising sharply.

The interest rate follows the model:

when U < U**kink **:

when U ≥ U**kink** :

Asset Type Classification

According to the risk level and characteristics of assets, WePiggy classifies all assets into 4 types:

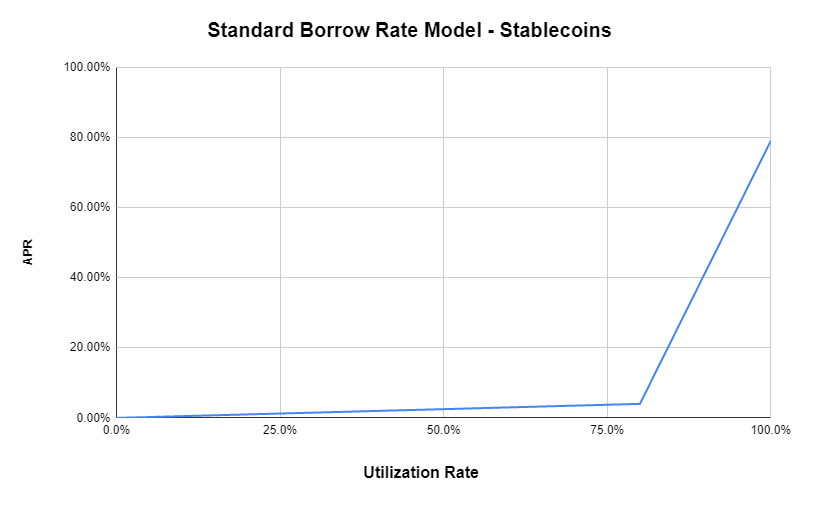

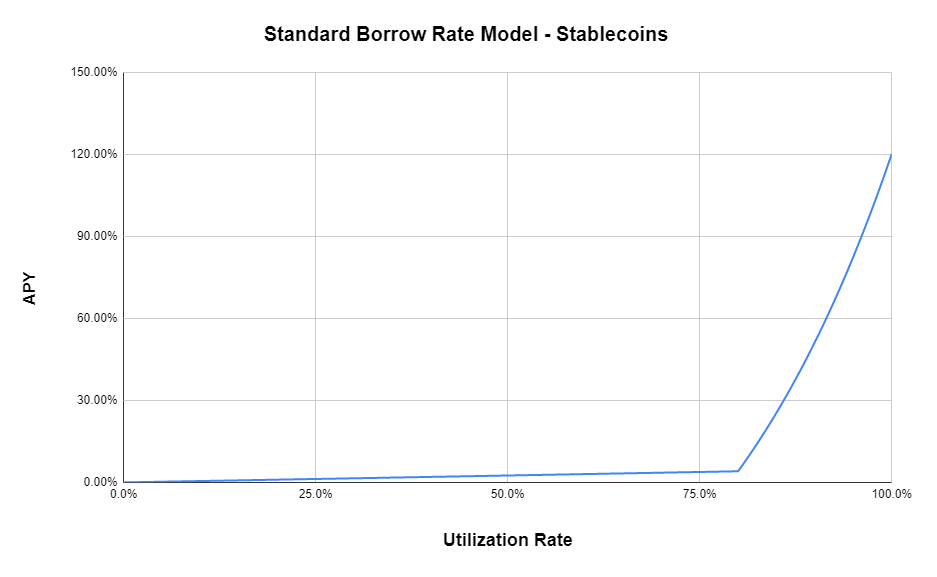

1. Stablecoins

Refer to a cryptocurrency whose price and the U.S. dollar are pegged 1:1 through a certain mechanism.

Since there is no upper limit on the total supply of stablecoin minting, and it is not difficult for users to obtain stablecoins, it is necessary to maintain a low interest rate level as much as possible to attract borrowing demand.

Unless a large number of stablecoins in the market have been borrowed, in order to facilitate the repayment of borrowers or attract more deposits, the borrowing interest rate will be appropriately increased to maintain market stability.

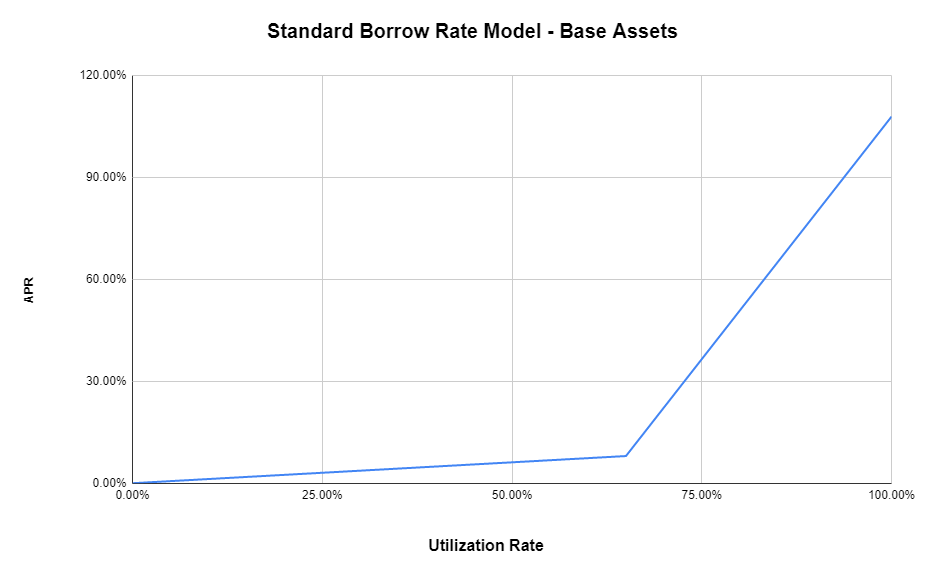

2. Base Assets

Refer to ETH and various wraped currencies of ETH and BTC.

Due to the long-term bullishness of these assets and depositing underlying assets to borrow other types of assets is the main demand of the market. Less borrowing of underlying assets leads to low utilization rates, so a low interest rate level needs to be maintained usually.

These assets are long-term bullish, the market demand is mainly to deposit the base assets to borrow other types of assets. Since users borrow less base assets and the utilization rate is often very low, the borrow rate should also be maintained at a low level.

Unless a large number of base assets in the lending market have been borrowed, in order to facilitate the repayment of borrowers or attract more borrowing, the borrowing interest rate will be appropriately increased to maintain market stability.

In addition, due to the greater difficulty of supply, the optimal utilization rate of base assets comes earlier than the stablecoins.

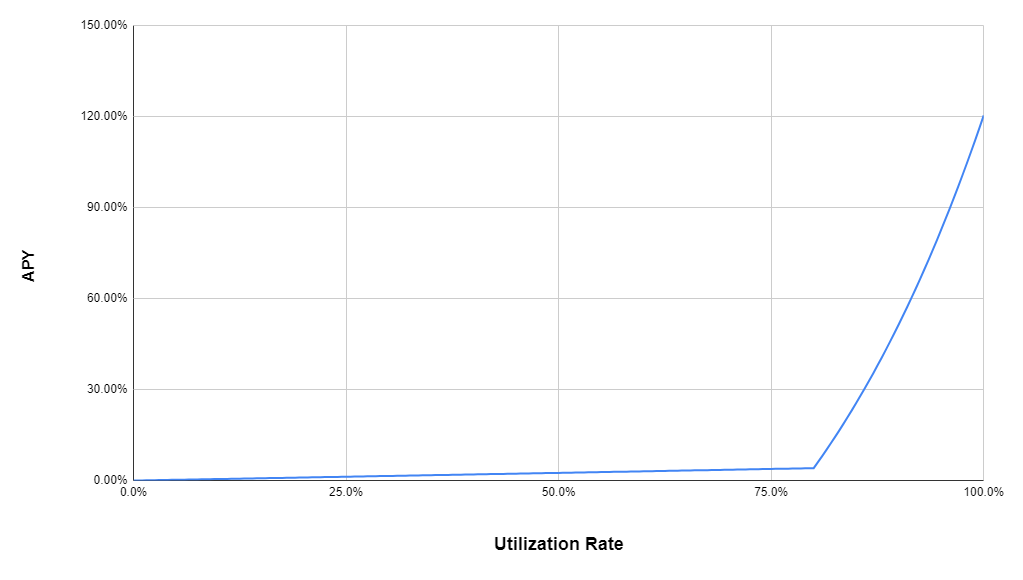

3. Mainstream Assets

Mainly refers to some top-ranked assets by market capitalization, such as LINK and SUSHI.

The market value of these assets has stabilized, and the usual borrowing demand is not large. However, if there are some market activities, there will be a short-term situation of rapid increase in borrowing, such as arbitrage, mining, etc. Correspondingly, the borrow interest rate should rise quickly to prevent liquidity from drying up and affecting system security.

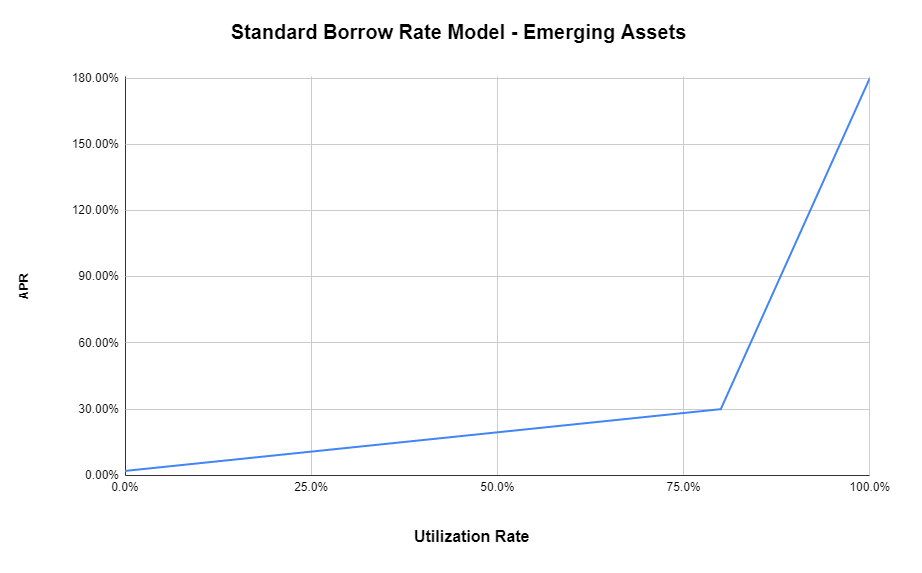

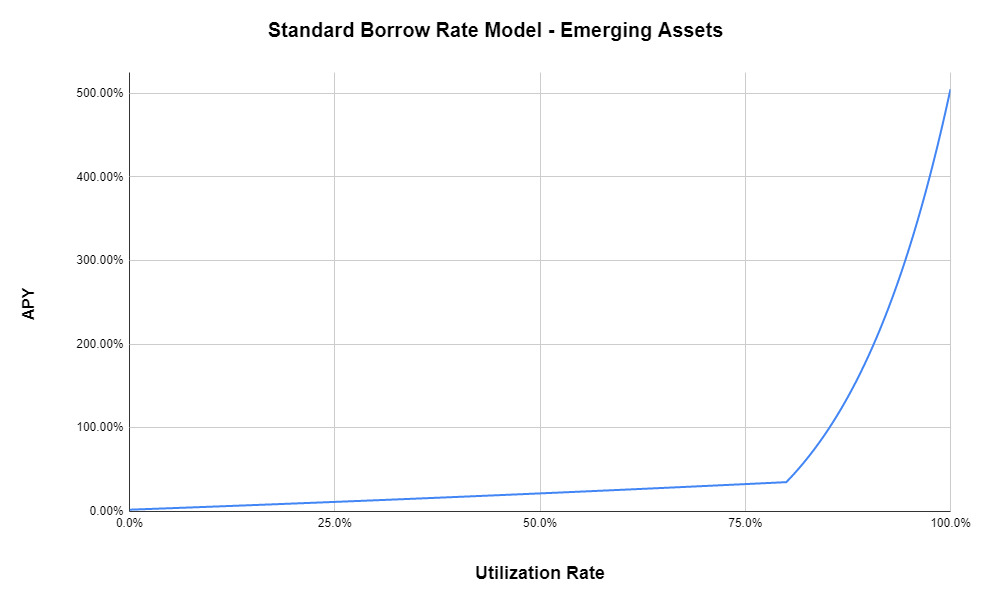

4. Emerging Assets

Mainly refers to some new currencies with large market popularity.

When the market is hot, the borrowing demand for such assets is extremely strong, and the utilization rate is high. However, because the price of such assets fluctuates greatly, after the optimal utilization rate is exceeded, the borrow interest rate should greatly increase to stimulate users to deposit more of the asset to prevent a liquidity crunch.

Standard Borrow Rate Model for Each Types of Assets

For the sustainable development of the market, different types of assets have different interest rate models.

From the basic formula of borrowing interest rate, we know that the borrow rate curve can be well controlled by adjusting 4 key parameters: R**0,R1,R2,Ukink**.

Below are 4 sets of typical values, for the 4 different types of assets:

1. Stablecoins

| U**kink** | R**0** | R**1** | R**2** |

|---|---|---|---|

| 80% | 0% | 4% | 75% |

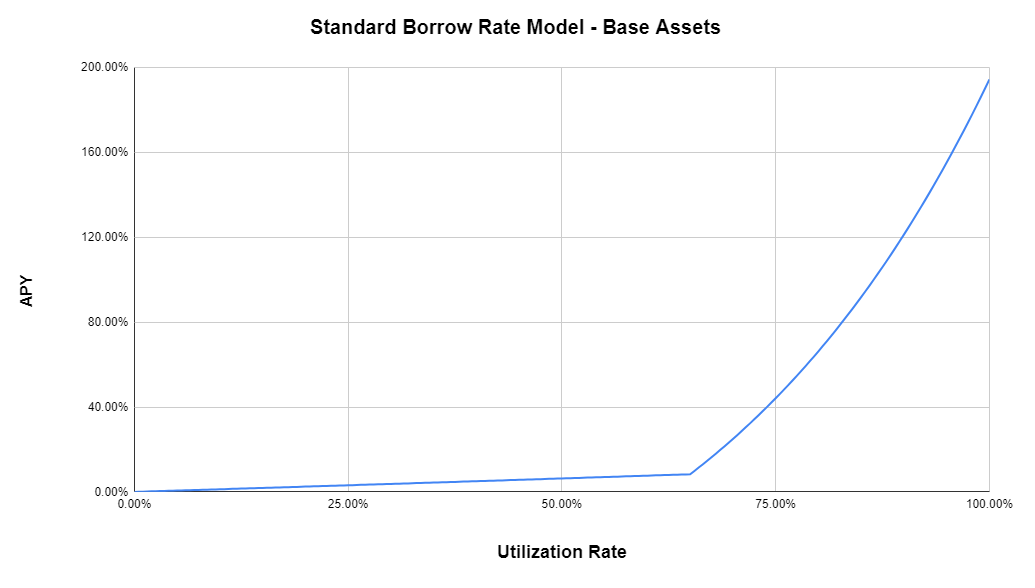

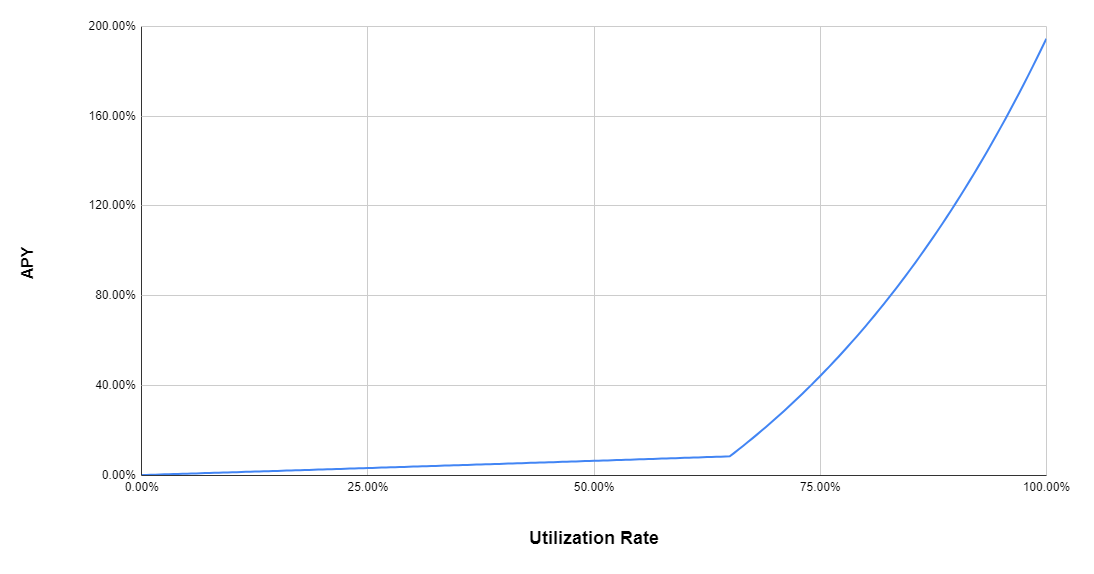

2. Base Assets

| U**kink** | R**0** | R**1** | R**2** |

|---|---|---|---|

| 65% | 0% | 8% | 100% |

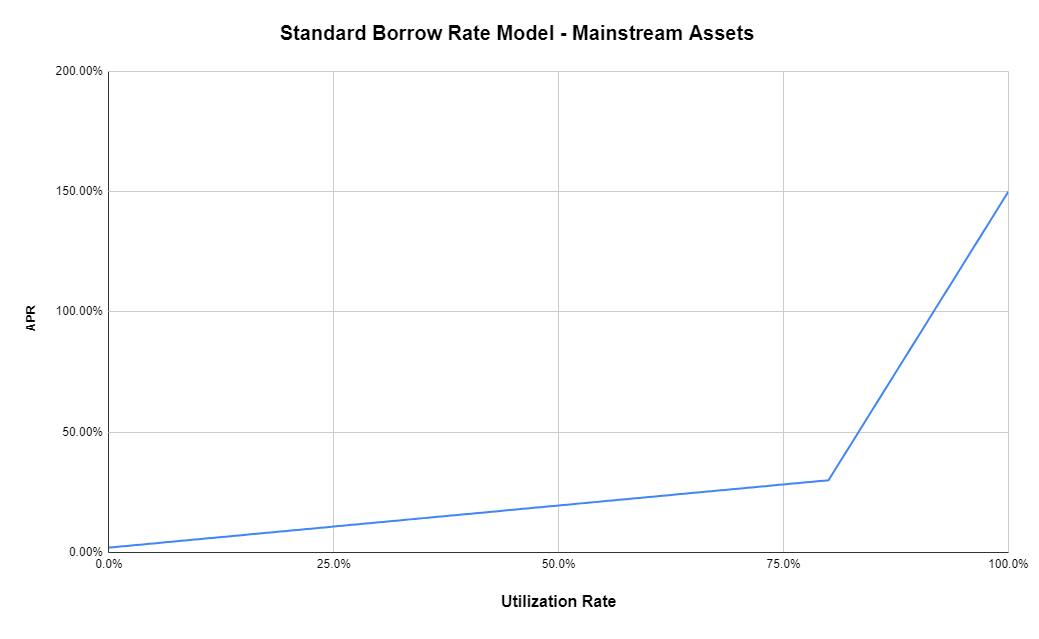

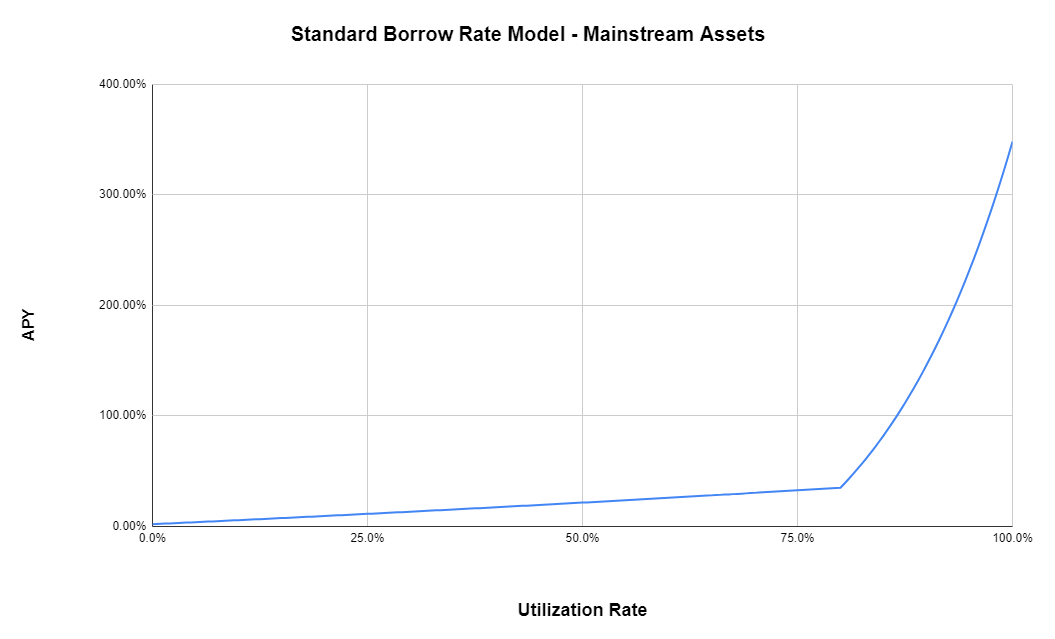

3. Mainstream Assets

| U**kink** | R**0** | R**1** | R**2** |

|---|---|---|---|

| 80% | 2% | 28% | 120% |

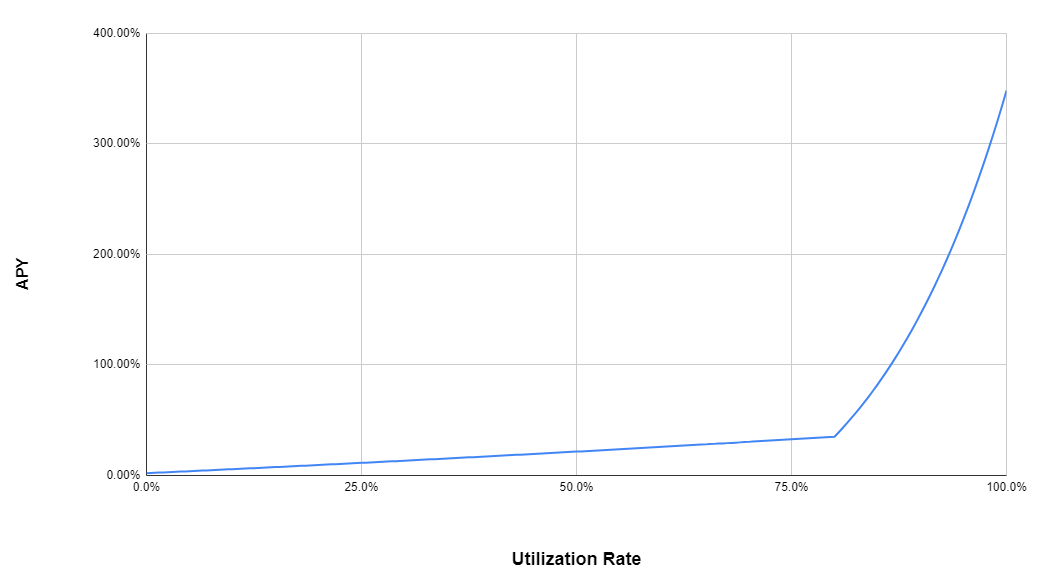

4. Emerging Assets

| U**kink** | R**0** | R**1** | R**2** |

|---|---|---|---|

| 80% | 2% | 28% | 150% |

APR Curve:

APY Curve:

Borrow Interest Rate Curves for the Listed Assets

Parameters

| Asset | U**kink** | R**0** | R**1** | R**2** |

|---|---|---|---|---|

| BUSD | 80% | 0% | 4% | 75% |

| USDC | 80% | 0% | 4% | 75% |

| USDT | 80% | 0% | 4% | 75% |

| DAI | 80% | 0% | 4% | 75% |

| ETH | 65% | 0% | 8% | 100% |

| WBTC | 65% | 0% | 8% | 100% |

| ONE | 80% | 2% | 28% | 120% |

BUSD | USDC | USDT | DAI Borrow Rate Curve

ETH | WBTC Borrow Rate Curve

ONE Borrow Rate Curve