- SS17 Alternative Investments

- R50 Introduction to Alternative Investments

- a compare alternative investments with traditional investments;

- b describe hedge funds, private equity, real estate, commodities, infrastructure, and other alternative investments, including, as applicable, strategies, subcategories, potential benefits and risks, fee structures, and due diligence; (combined with e)

- c describe potential benefits of alternative investments in the context of portfolio management;

- d describe, calculate, and interpret management and incentive fees and net-of fees returns to hedge funds;

- e describe issues in valuing and calculating returns on hedge funds, private equity, real estate, commodities, and infrastructure;

- f describe risk management of alternative investments.

- R50 Introduction to Alternative Investments

SS17 Alternative Investments

R50 Introduction to Alternative Investments

a compare alternative investments with traditional investments;

- Basic differences

traditional investments: publicly traded stocks, bonds, cash

alternative investments:

- type __of assets and securities:

derivatives; leverage; short securities; real estate

- structure __of the investment vehicles:

hedge funds; private equity funds; various types of real eatate investment; some ETFs

- fee __structures:

higher management fees on average; additional incentive fees based on performance

- characteristics** of alternative investment**

- less liquidity of assets held

- more specialization by investment managers

- less regulation and transparency

- more problematic and less available historical return and volatility data

- different legal issues and tax treatments

- relatively low correlations with returns of traditional investments

- high fees

- restrictions on redemptions

- relatively more concentrated portfolios

- categories of alternative investments

- hedge funds

These funds may use leverage, hold long and short positions, use derivatives, and invest in illiquid assets

They do not necessarily hedge risk as the name might imply.__

- private equity funds

equity of companies that are not publicly traded

equity of publicly traded firms that the fund intends to take private.

Leveraged buyout (LBO) funds; venture capital funds;

securities of financially distressed companies to be private equity [hedge funds may hold these also__]

- real estate

residential properties; commercial properties; real estate backed debt

structures: leveraged ownership; individual real estate backed loans; private and publicly traded securities backed by pools of properties or mortgages; limited parterships

- commodities

physical commodities;

commodities derivatives;

equity of commodity producing firms;

derivatives contracts (track a specific commodities index)

- infrastructure (long-lived assets that provide public services)

roads; airports; utility grids (economic infrastructure assets)

schools; hospitals (social infrastructure assets)

- other (tangible/intangible collectible assets)

fine wines; stamps; automobiles; antique furniture; art; patents

b describe hedge funds, private equity, real estate, commodities, infrastructure, and other alternative investments, including, as applicable, strategies, subcategories, potential benefits and risks, fee structures, and due diligence; (combined with e)

1. hedge funds

- applicable

- 收益目标statement: absolute basis (e.g.10%);relative basis (e.g., returns 5% above a specific benchmark return)

- 一般通过prime brokers 交易

- Hedge funds are less regulated than traditional investments.

- lockup period: a time after initial investment during which __withdrawals are NOT allowed__

- notice period: the amount of time a fund has after receiving a redemption request to fulfill the request

- Additional fees may be charged at redemption

- fund-of-funds: an investment company that invests in hedge funds (方便中小投资者;分散化收益;多层收费)

- strategies

- Event-driven strategies

利用公司重组/收购等的机会,投资common equity, preferred equity, or debt of a specific corporation. [long/short position]

- Merger arbitrage 买入被收购方股票;卖空收购方股票- Distressed/restructuring 分析面临融资困境公司的security,根据价格价值偏离进行长短操作- Activist shareholder 收购某公司大量股份,积极利用股东地位提升公司价值- Special situations 对发行/回购股票、剥离部门、变卖资产、分配资本的公司进行投资

- Relative value strategies

对估值和价格偏离的证券进行长短头寸投资,在价格回归时实现收益

- Convertible arbitrage fixed income 可转债和普通股之间的价格差异

- Asset-backed fixed income 不同MBS/ABS之间的价格差异

- General fixed income 不同固收证券之间的价格差异

- Volatility 期权波动性和市场预期之间的差异

- Multi-strategy 跨市场跨资产策略

- Macro strategies

(根据全球经济趋势,对股债货币和大宗商品进行投资,with long/short position)

- Equity hedge fund strategies

对公开市场上的权益资产和衍生品进行投资

- Market neutral 通过技术/基本面分析,买空卖空mispriced equity

- Fundamental growth 基本面分析,投资潜在高增长的公司

- Fundamental value 基本面公分析,投资价格被低估的公司

- Quantitative directional 技术分析

- Short bias 持有大量(估价过高的公司)短头寸,maybe少量长头寸,但净头寸是短

- potential benefits & risks:

Less-than-perfect correlation with global equity returns may offer some diversification benefits, but correlations tend to increase during periods of financial crisis.

- due diligence

Investment strategy;Investment process.;Source of competitive advantages.;Historical returns.

Valuation and returns calculation methods.;Longevity.;Amount of assets under management.

Management style.;Key person risk.;Reputation.;Growth plans.;Systems for risk management.__Appropriateness of benchmarks.

- valuation

traded securities: market values

most conservative to use the prices at which a position could be closed: bid prices for long positions and ask prices for short positions

Some funds use the average of the bid and ask prices instead.

non-traded securities: model (estimated) values

In the case of illiquid securities, quoted market prices may be reduced for the degree of illiquidity, based on position size compared to the total value of such securities outstanding and their average trading volume. Some funds calculate a ‘trading NAV’ using such adjustments for illiquidity.

2. private equity

- applicable

主要投资对象

- private companies

- public companies they intend to take private (leveraged buyout funds)

- early stage companies (venture capital funds).

- distressed investment funds

- developmental capital funds.

A private equity fund may also charge fees for arranging buyouts, fees for a deal that does not happen, or fees for handling asset divestitures after a buyout.

- strategies

- Leveraged buyouts **(LBOs)**:the fund’s purchase of the portfolio company is funded primarily by debt

↑ most common type of private equity fund investment.

- **management buyouts ****(MBOs)**: the existing management team is involved in the purchase

- **management buy-ins ****(MBIs)**: an external management team will replace the existing management team

- Developmental capital or **minority equity investing** refers to the provision of capital for business growth or restructuring. The firms financed may be public or private.

In the case of public companies, such financing is referred to as **private investment in public equities**(PIPEs).

- Venture capital **(VC) funds** invest in companies in the early stages of their development.

- portfolio companies: companies in which a venture capital fund is invested

Venture capital fund managers are closely involved in the development of portfolio companies

- **Categorization of venture capital investments**

Formative stage investments made during a firm’s earliest period

/Angel investing investments made very early in a firm’s life__

/Seed stage investments made for product development, marketing, and market research

/Early stage investments made to fund initial commercial production and sales__

Later stage company already has production and sales and is operating as a commercial entity.

Mezzanine-stage financing capital provided to prepare the firm for an IPO__

- Private Equity Structure and Fees

private equity funds are typically structured as limited partnerships.

Committed capital: amount of capital provided to the fund by investors.

The committed capital amount is typically __NOT all invested immediately but is “drawn down” (invested) as securities are identified and added to the portfolio.

Committed capital is usually drawn down over three to five years, but the drawdown period is at the discretion of the fund manager.

Management fees typically 1% to 3% of committed capital, rather than investd capital

Incentive fees typically 20% of profits, but these fees are not earned until after the fund has returned investors’ initial capital.

clawback **provision** requires the manager to return any periodic incentive fees to investors that would result in investors receiving less than 80% of the profits generated by portfolio investments as a whole 若期间的激励费用使得投资者最后得到的净收益少于总收益的80%,投资经理需返还相应的激励费

- Private Equity Exit Strategies

- Trade sale: Sell a portfolio company to a competitor or another strategic buyer. 同行买卖

- IPO: Sell all or some shares of a portfolio company to the public

- Recapitalization: The company issues debt to fund a dividend distribution to equity holders (the fund).

This is not an exit, in that the fund still controls the company, but is often a step toward an exit.__ 资本重组

- Secondary sale: Sell a portfolio company to another private equity firm or a group of investors. 二次销售

- Write-off/liquidation: Reassess and adjust to take losses from an unsuccessful outcome.

- Private Equity Potential Benefits and Risks

- PE的平均收益超过traditional investment(from over 20 yrs evidence)

- portfolio diversification benefit (correlation coefficient<1)

- 风险高于股票(standard deviation 更大)

- Bias: survivorship bias and backfill bias

- 估值更新不及时,也有downward biased的风险

- Evidence suggests that choosing skilled fund managers is important

- Private Equity Due Diligence

Because of the high leverage typically used for private equity funds, investors should consider how interest rates and the availability of capital may affect any required refinancing of portfolio company debt.

The operating and financial experience of the manager, the valuation methods used, the incentive fee structures, and drawdown procedures are all important areas to investigate prior to investing.

- Private Equity Company Valuation

- Market/comparables approach

Market or private transaction values of similar companies may be used to estimate multiples of EBITDA, net income, or revenue to use in estimating the portfolio company’s value.

- Discounted cash flow approach

DDM falls into this category, as does calculating the present value of free cash flow to the firm or free cash flow to equity.

- Asset-based approach

Either the liquidation values or fair market values of assets can be used. ~~

3. real estate

- applicable

rents; capital gains (potential)

- strategies

how to get exposure

- Residential property

- Commercial property

- Loans

with residential or commercial property as collateral—mortgages (‘whole loans’), construction loans.

- Real estate investment trusts (REITs)

- subcategories

Residential property

Commercial property

Timberland (木材销售;地价变化)

Farmland (农产品销售;地价变化)

- potential benefits, risks, due diligence

benefits: diversification benefits; potential inflation hedge

appraisal index: based on periodic estimates of property values

repeat sales index: based on price changes for properties that have sold multiple times

REIT indices: based on the actual trading prices of REIT shares, similar to equity indices.

Distressed properties investing has additional risk factors compared to investing in properties with sound financials and stable operating histories

Real estate development has additional risk factors including regulatory issues such as zoning, permitting, and environmental considerations or remediation, and economic changes and financing decisions over the development period.

- valuation

comparable sales approach

bases valuation on recent sales of similar properties (need adjustments).__

income approach

calculating the present value of expected future cash flows from property ownership or by dividing the net operating income (NOI) for a property by a capitalization (cap) rate.

cost approach

estimates the replacement cost of a property. The cost of land and the cost of rebuilding at current construction costs are added to estimate replacement cost

Value estimates for real estate investment trusts can be income based or asset based

4. commodities 大宗商品

- General

- derivatives** **are MOST commonly used instruments to gain exposure to commodity prices

- Returns are based on price changes (not on income streams)

- Futures, forwards, options, and _swaps _are all available forms of commodity derivatives.

- subcategories/strategies

derivatives: futures, forwards, options, swaps

Exchange-traded funds (commodity ETFs) 交易所交易基金

Equities that are directly linked to a commodity

Managed futures funds 积极管理

Individual managed accounts 定制服务,for高净值客户/机构投资者

Specialized funds in specific commodity sectors 追踪特定大宗商品的投资

- potential benefits & risks

Spot prices for commodities are a function of supply and demand.

收益低于股债;相关性较低⋙分散化收益;对冲通膨风险

- valuation

convenience yield: the value of having the physical commodity for use over the period of the futures contract

contango: If there is little or no convenience yield, futures prices > spot prices 期货溢价

backwardation: When the convenience yield is high, futures prices < spot prices 现货溢价

*Three sources of commodities futures returns:

- Roll yield: The yield due to a difference between the spot price and futures price, or a difference between two futures prices with different expiration dates.

- Collateral yield: The interest earned on collateral required to enter into a futures contract.

- Change in spot prices: The total price return is a combination of the change in spot prices and the convergence of futures prices to spot prices over the term of the futures contract.

5. infrastructure 基础设施

- strategies; subcategories

transportation : roads, airports, ports, and railways

utility : gas distribution facilities, electric generation and distribution facilities, and waste disposal and treatment facilities

communications: broadcast assets and cable systems

social: prisons, schools, and health care facilities

brownfield investments

assets that are _already constructed ; stable cash flow; relatively high yields; little growth potential

greenfield investment

assets that are __to be constructed more uncertainty; relative low yields; with growth potential

to gain exposure

- constructing the assets→selling/leasing to the government or by directly operating the assets.

- purchasing existing assets from the government to lease back to the government or operate directly

- public-private partnership 公私合营

- potential benefits & risks

diversification benefits; low liquidity; regulatory risk…

6. other alternative investments

- Storage costs may be significant, especially with art and wine

- Specialized knowledge is required

- Markets for many collectibles are illiquid, and gains result only from increases in the prices of these assets.

c describe potential benefits of alternative investments in the context of portfolio management;

投资组合关心的问题:

portfolio risk

low correlation with (traditional investment)→diversification benefit (但相关系数的变化范围很大)

potrtfolio return

return measures are less reliable (for alternative investment)

return increase may be explained by increase in specific risk

high returns may be explained by inefficiencies in valuation

relationship between the two

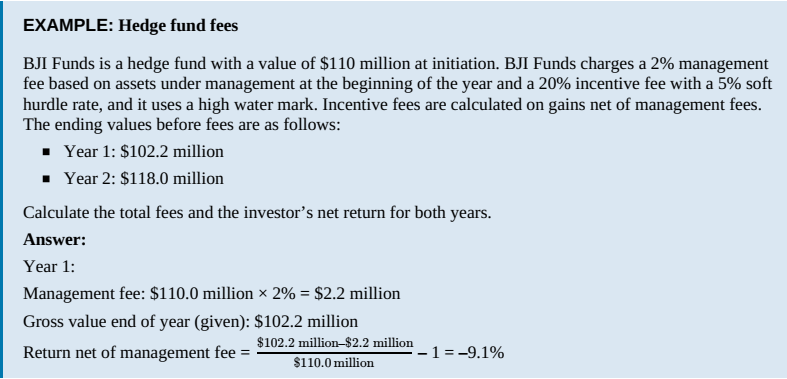

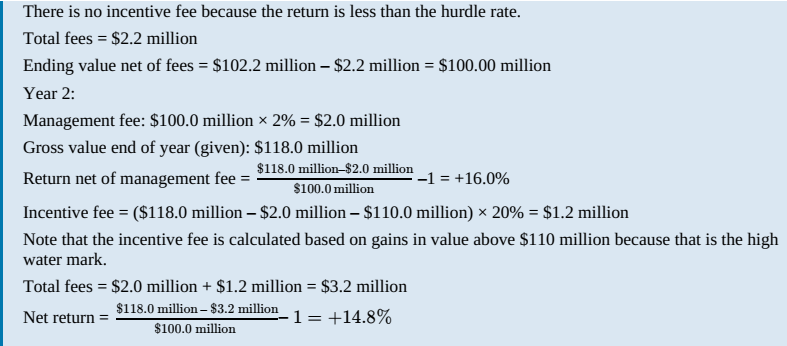

skewness and positive excess kurtosis (fat tails)d describe, calculate, and interpret management and incentive fees and net-of fees returns to hedge funds;

total fee: management fee + incentive fee

most common: ‘2 and 20‘ or ‘2 plus 20%’ 2% of the value of the assets under management plus an incentive fee of 20% of profits

Profits can be

(1) any gains in value

(2) any gains in value in excess of the management fee

(3) gains in excess of a hurdle rate

hurdle rate: a percentage(e.g., 4%) or a rate plus a premium (e.g., LIBOR + 2%).

hard hurdle rate: incentive fees are earned only on returns in excess of the benchmark.

soft hurdle rate: incentive fees are paid on all profits, but only if the hurdle rate is met.

high water mark: incentive fee is not paid on gains that just offset prior losses.

(用组合最高值计算激励金,避免重复收费)

Investors in funds of funds incur additional fees from the managers of the funds of funds.

A common fee structure from funds of funds is “1 and 10.” A 1% management fee and a 10% incentive fee are charged in addition to any fees charged by the individual hedge funds within the fund-of-funds structure

e describe issues in valuing and calculating returns on hedge funds, private equity, real estate, commodities, and infrastructure;

f describe risk management of alternative investments.

Standard deviation of returns may be a misleading measure

Use of derivatives introduces operational, financial, counterparty, and liquidity risk.

Risk of management underperformance

Hedge funds and private equity funds are much less transparent than traditional investments

Many alternative investments are illiquid.

Indices of historical returns and standard deviations may not be good indicators of future returns and volatility

Correlations vary across periods and are affected by events

Due Diligence (six categories)

- Organization

- Portfolio management

- Operations and controls

- Risk management

- Legal review

- Fund terms