- SS04 Economics (1)

- R12 Topics in Demand and Supply Analysis

- a calculate and interpret price, income, and cross-price elasticities of demand and describe factors that affect each measure;

- b compare substitution and income effects;

- c distinguish between normal goods and inferior goods;

- d describe the phenomenon of diminishing marginal returns;

- e determine and interpret breakeven and shutdown points of production;

- f describe how economies of scale and diseconomies of scale affect costs.

- R13 The Firm and Market Structures

- a describe characteristics of perfect competition, monopolistic competition, oligopoly, and pure monopoly;

- b explain relationships between price, marginal revenue, marginal cost, economic profit, and the elasticity of demand under each market structure;

- c describe a firm’s supply function under each market structure;

- d describe and determine the optimal price and output for firms under each market structure;

- e explain factors affecting long-run equilibrium under each market structure;

- f describe pricing strategy under each market structure;

- g describe the use and limitations of concentration measures in identifying market structure;

- h identify the type of market structure within which a firm operates.

- R14 Aggregate Output, Prices, and Economic Growth

- a calculate and explain gross domestic product (GDP) using expenditure and income approaches;

- b compare the sum-of-value-added and value-of-final-output methods of calculating GDP;

- c compare nominal and real GDP and calculate and interpret the GDP deflator;

- d compare GDP, national income, personal income, and personal disposable income;

- e explain the fundamental relationship among saving, investment, the fiscal balance, and the trade balance;

- f explain the IS and LM curves and how they combine to generate the aggregate demand curve;

- g explain the aggregate supply curve in the short run and long run;

- h explain causes of movements along and shifts in aggregate demand and supply curves;

- i describe how fluctuations in aggregate demand and aggregate supply cause short-run changes in the economy and the business cycle;

- j distinguish between the following types of macroeconomic equilibria: long-run full employment, short-run recessionary gap, short-run inflationary gap, and short-run stagflation;

- k explain how a short-run macroeconomic equilibrium may occur at a level above or below full employment;

- l analyze the effect of combined changes in aggregate supply and demand on the economy;

- m describe sources, measurement, and sustainability of economic growth;

- n describe the production function approach to analyzing the sources of economic growth;

- o distinguish between input growth and growth of total factor productivity as components of economic growth.

- R15 Understanding Business Cycles

- a describe the business cycle and its phases;

- b describe how resource use, housing sector activity, and external trade sector activity vary as an economy moves through the business cycle;

- c describe theories of the business cycle;

- d describe types of unemployment and compare measures of unemployment;

- e explain inflation, hyperinflation, disinflation, and deflation;

- f explain the construction of indexes used to measure inflation;

- g compare inflation measures, including their uses and limitations;

- h distinguish between cost-push and demand-pull inflation;

- i interpret a set of economic indicators and describe their uses and limitations.

- R12 Topics in Demand and Supply Analysis

- SS05 Economics (2)

- R16 Monetary and Fiscal Policy

- a compare monetary and fiscal policy;

- b describe functions and definitions of money;

- c explain the money creation process;

- d describe theories of the demand for and supply of money;

- e describe the Fisher effect;

- f describe roles and objectives of central banks;

- g contrast the costs of expected and unexpected inflation;

- h describe tools used to implement monetary policy;

- i describe the monetary transmission mechanism;

- j describe qualities of effective central banks;

- k explain the relationships between monetary policy and economic growth, inflation, interest, and exchange rates;

- l contrast the use of inflation, interest rate, and exchange rate targeting by central banks;

- m determine whether a monetary policy is expansionary or contractionary;

- n describe limitations of monetary policy;

- o describe roles and objectives of fiscal policy;

- p describe tools of fiscal policy, including their advantages and disadvantages;

- q describe the arguments about whether the size of a national debt relative to GDP matters;

- r explain the implementation of fiscal policy and difficulties of implementation;

- s determine whether a fiscal policy is expansionary or contractionary;

- t explain the interaction of monetary and fiscal policy.

- R17 International Trade and Capital Flows

- a compare gross domestic product and gross national product;**

- b describe benefits and costs of international trade;

- c distinguish between comparative advantage and absolute advantage;

- d compare the Ricardian and Heckscher–Ohlin models of trade and the source(s) of comparative advantage in each model;

- e compare types of trade and capital restrictions and their economic implications;

- f explain motivations for and advantages of trading blocs, common markets, and economic unions;

- g describe common objectives of capital restrictions imposed by governments;

- h describe the balance of payments accounts including their components;

- i explain how decisions by consumers, firms, and governments affect the balance of payments;

- j describe functions and objectives of the international organizations that facilitate trade, including the World Bank, the International Monetary Fund, and the World Trade Organization.

- R18 Currency Exchange Rates

- a define an exchange rate and distinguish between nominal and real exchange rates and spot and forward exchange rates;

- b describe functions of and participants in the foreign exchange market;

- c calculate and interpret the percentage change in a currency relative to another currency;

- d calculate and interpret currency cross-rates;

- e convert forward quotations expressed on a points basis or in percentage terms into an outright forward quotation;

- f explain the arbitrage relationship between spot rates, forward rates, and interest rates;

- g calculate and interpret a forward discount or premium;

- h calculate and interpret the forward rate consistent with the spot rate and the interest rate in each currency;

- i describe exchange rate regimes;

- j explain the effects of exchange rates on countries’ international trade and capital flows.

- R16 Monetary and Fiscal Policy

SS04 Economics (1)

R12 Topics in Demand and Supply Analysis

a calculate and interpret price, income, and cross-price elasticities of demand and describe factors that affect each measure;

- own-price elasticity of demand

own-price elasticity: a measure of the responsiveness of the quantity demanded to a change in price

elasticity>1, elastic

elasticity<1, inelastic

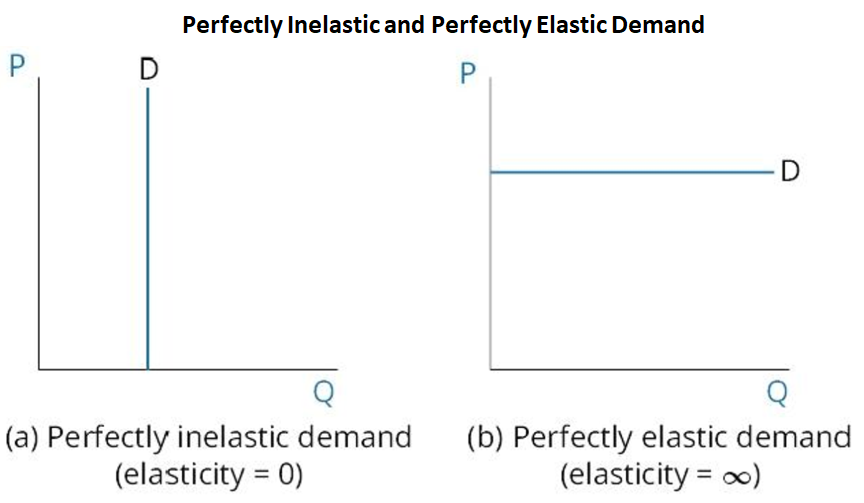

perfectly Inelastic: 价格怎么变,需求都不变 perfectly Elastic Demand: 价格稍微变,需求就没了

influence factor

quality and availability of substitute 替代性越强,价格弹性越大

portion of income spent on a good 支出占比越大,价格弹性越大

*time 时间越长 弹性越大

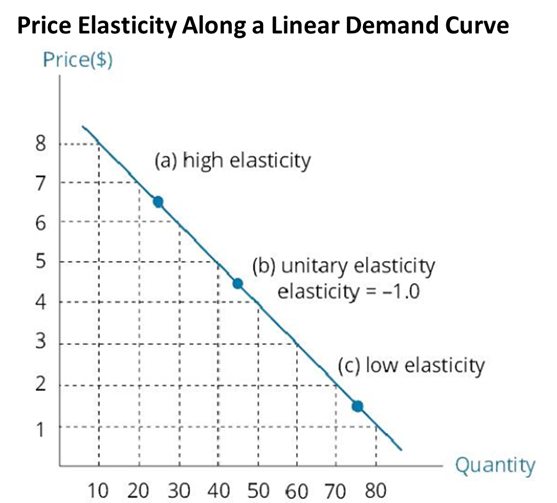

考虑公式,价格弹性不是需求曲线的斜率。(因为和价格与需求的大小有关)

unit or unitary elasticity: 价格弹性=-1。单位价格弹性下,总销售收入最大

- income elasticities of demand

income elasticities of demand: sensitivity of quantity demanded to a change in income

normal goods: income⬆ ⋙ quantity demanded⬆

inferior goods: income⬆ ⋙ quantity demanded⬇

- cross-price elasticities of demand

corss-price elasticities of demand: ratio of the % change in the quantity demanded for a goods to the % change in the price of a related food

交叉价格弹性大于零⋙good substitute

交叉价格弹性小于零⋙complements

| price elasticity of demand | |

|---|---|

| income elasticity of demand | |

| corss price elasticity of demand |

b compare substitution and income effects;

substitution effect: total expenditure on the consumer’s original bundle of goods falls when the price of Good X falls

income effect:

| substitution effect | income effect | Consumption of Good X |

|---|---|---|

| + | + | ⬆ |

| ++ | - | ⬆ |

| + | — | ⬇ |

c distinguish between normal goods and inferior goods;

a specific good may be an inferior good for some ranges of income and a normal good for other ranges of income

giffen goods: inderior good, negative income effect outweights the positive subsitution, price⬇, demand⬇

veblen good: higher price makes the good more desirable. 更高价格带来更多utility

d describe the phenomenon of diminishing marginal returns;

factor of production: resources a firm uses to generate output

land: where the business facilities are located

labor: all workers from unskilled labors to top management

capital: aka physical capital or plant and equipment. manufacturing facilities, equipment, and machinery

materials: inputs into the productive process (raw materials, manufactured inputs)

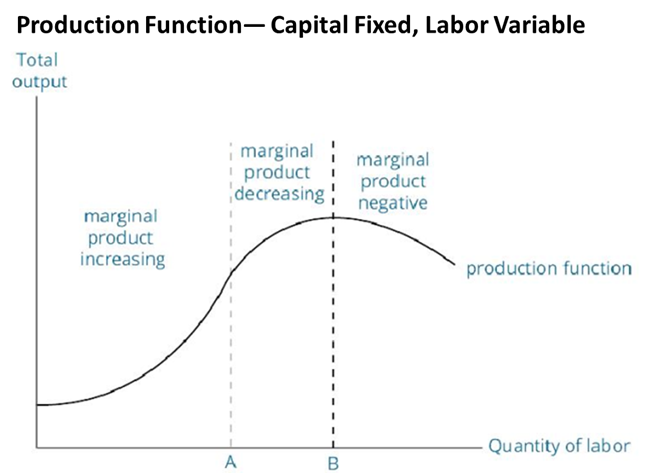

production function:

point of diminishing marginal productivity, aka. diminishing marginal returns: 超过该点,边际产出随劳动力上升而下降

three stages

marginal product increasing

marginal product decreasing

marginal product negative

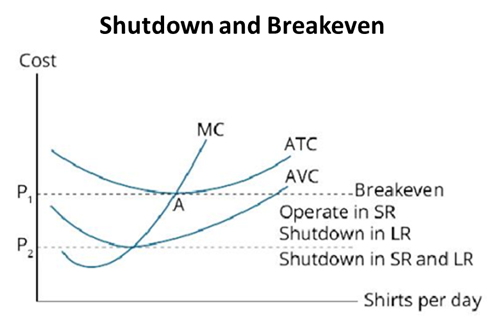

e determine and interpret breakeven and shutdown points of production;

short run: time period over which some factors of production are fixed

long run: all factors of production are variable

f describe how economies of scale and diseconomies of scale affect costs.

R13 The Firm and Market Structures

a describe characteristics of perfect competition, monopolistic competition, oligopoly, and pure monopoly;

b explain relationships between price, marginal revenue, marginal cost, economic profit, and the elasticity of demand under each market structure;

c describe a firm’s supply function under each market structure;

d describe and determine the optimal price and output for firms under each market structure;

e explain factors affecting long-run equilibrium under each market structure;

f describe pricing strategy under each market structure;

g describe the use and limitations of concentration measures in identifying market structure;

h identify the type of market structure within which a firm operates.

R14 Aggregate Output, Prices, and Economic Growth

a calculate and explain gross domestic product (GDP) using expenditure and income approaches;

gross domestic product (GDP): the total market value of the goods and services produced in a country within a certain time period

The values used in calculating GDP are market values of final goods and services—that is,goods and services that will not be resold or used in the production of other goods and services.

expenditure approach: GDP is calculated by summing the amounts spent on goods and services produced during the period.

income approach: GDP is calculated by summing the amounts earned by households and companies during the period (wage income, interest income, and business profits)

b compare the sum-of-value-added and value-of-final-output methods of calculating GDP;

value-of-final-output method=expenditure approach

sum-of-value-added method: GDP is calculated by summing the additions to value created at each stage of production and distribution.

| Stage of Production | Sales Value ($) | Value Added ($) |

|---|---|---|

| Raw materials/components | $100 | $100 |

| Manufacturing | $350 | $250 |

| Retail | $400 | $50 |

| Sum of value added | $400 |

c compare nominal and real GDP and calculate and interpret the GDP deflator;

- nominal GDP

nominal GDP: the total value of all goods and services produced by an economy, valued at current market prices.

- real GDP

real GDP: measures the output of the economy using prices from a base year

- GDP deflator

GDP deflator:

- per-capita real GDP** **

per-capita real GDP: real GDP divided by population, often used as a measure of the economic well-being of a country’s residents.

d compare GDP, national income, personal income, and personal disposable income;

expenditure approach: the major components of real GDP are consumption, investment, government spending, and net exports

C=consumption spending; I=business investment; G=government purchases; X=exports; M=imports

G**=government consumption; G**=government investment

income approach: equation for GDP, or gross domestic income (GDI):

capital consumption allowance (CCA): measures the depreciation (i.e., wear) of physical capital from the production of goods and services over a period

statistical discrepancy: an adjustment for the difference between GDP measured under the income approach and the expenditure approach because they use different data

national income: the sum of the income received by all factors of production that go into the creation of final output

personal income: easure of the pretax income received by households and is one determinant of consumer purchasing power and consumption

household disposable income/personal disposable income: personal income after taxes

e explain the fundamental relationship among saving, investment, the fiscal balance, and the trade balance;

C=consumption spending; S=household and business savings; T=net taxes(taxes paid minus payments received)

total income equals total expenditures

(G-T)=fiscal balance; (X-M)=trade balance

| G-T | X-M | ||

|---|---|---|---|

| <0 | >0 | <0 | >0 |

| gov. budget deficit | gov. budget surplus | trade deficit | trade surplus |

a government deficit (G – T > 0) must be financed by some combination of a trade deficit (X – M < 0) or an excess of private saving over private investment (S – I > 0).

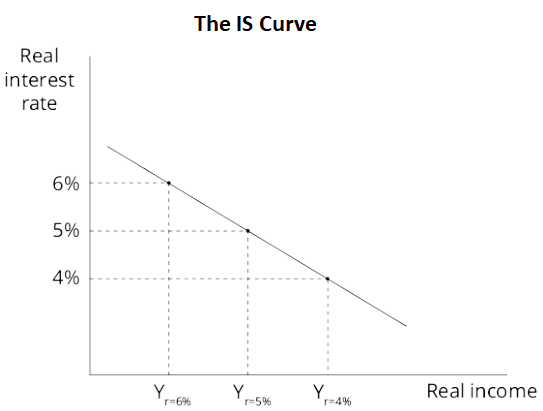

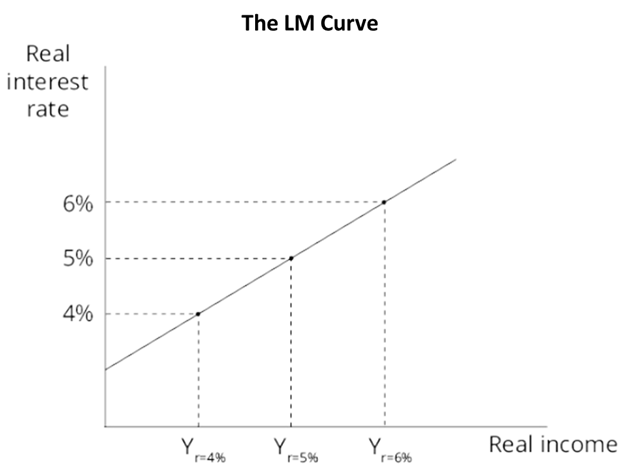

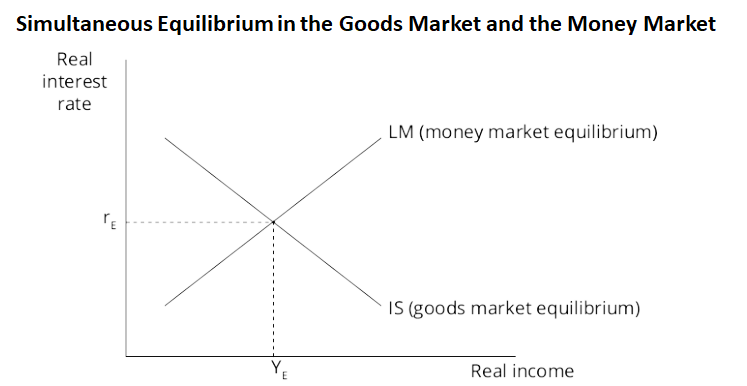

f explain the IS and LM curves and how they combine to generate the aggregate demand curve;

the factors that determine each of the components of GDP

- Consumption is a function of disposable income.

An increase in personal income or a decrease in taxes will increase both consumption and saving.

Additional disposable income will be consumed or saved.

marginal propensity to consume (MPC) proportion of additional income spent on consumption

marginal propensity to save (MPS) proportion of additional income saved

MPC + MPS must equal 100%.

- Investment is a function of expected profitability and the cost of financing.

Expected profitability depends on the overall level of economic output.

Financing costs are reflected in real interest rates, (≈ nominal interest rates minus the expected inflation rate).

- Government purchases may be viewed as independent of economic activity to a degree, but tax revenue to the government, and therefore the fiscal balance, is clearly a function of economic output.

- Net exports are a function of domestic disposable incomes (which affect imports), foreign disposable incomes (which affect exports), and relative prices of goods in foreign and domestic markets.

IS curve (income-savings): illustrates the negative relationship between real interest rates and real income for equilibrium in the goods market.

Points on the IS curve are the combinations of real interest rates and income consistent with equilibrium in the

goods market (i.e., those combinations of real interest rates and income for which planned expenditures equal income).

低利率⋙储蓄⬇, 投资⬆, (S-I)⬇⋙融资成本⬇⋙NPV⬆

a decrease in interest rates decreases S – I, so that (S – I) < (G – T) + (X – M). In order to satisfy this fundamental relationship, income must increase. Greater income can restore equilibrium in the goods market by increasing savings (which increases S – I), increasing tax receipts (which decreases G – T), and increasing imports (which decreases X – M)

LM curve (liquidity-money): illustrates the positive relationship between real interest rates and income consistent with equilibrium in the money market.

real interest rates⬆ ⋙ 个人先进持有 ⬇, so for a given real money supply (M/P constant), equilibrium in the money market requires that an increase in real interest rates be accompanied by an increase in income.

g explain the aggregate supply curve in the short run and long run;

h explain causes of movements along and shifts in aggregate demand and supply curves;

i describe how fluctuations in aggregate demand and aggregate supply cause short-run changes in the economy and the business cycle;

j distinguish between the following types of macroeconomic equilibria: long-run full employment, short-run recessionary gap, short-run inflationary gap, and short-run stagflation;

k explain how a short-run macroeconomic equilibrium may occur at a level above or below full employment;

l analyze the effect of combined changes in aggregate supply and demand on the economy;

m describe sources, measurement, and sustainability of economic growth;

n describe the production function approach to analyzing the sources of economic growth;

o distinguish between input growth and growth of total factor productivity as components of economic growth.

R15 Understanding Business Cycles

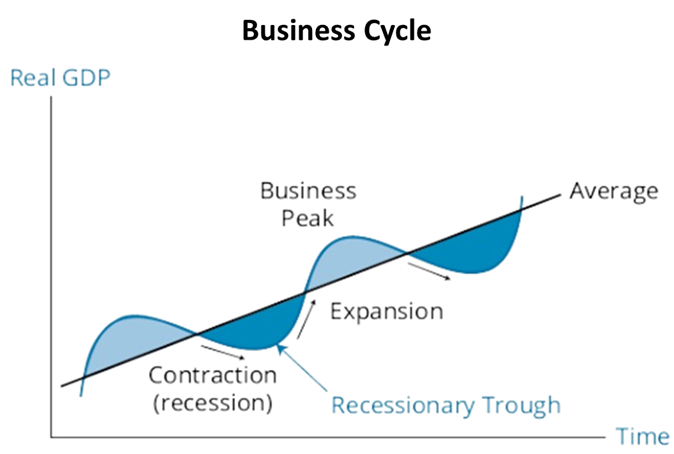

a describe the business cycle and its phases;

business cycle: fluctuations in economic activity

Real GDP and the rate of unemployment are the key variables used to determine the current phase of the cycle.

| real GDP | ||

|---|---|---|

| expansion | 增长 | growth in most sectors of the economy increasing employment, consumer spending, and business investment *as an expansion approaches its peak, the rates of increase in spending, investment, and employment slow but remains positive, while inflation accelerates |

| peak | 止涨转跌 | |

| contraction recession |

下跌 | declines in most sectors inflation typically decreasing When the contraction reaches a trough and the economy begins a new expansion or recovery, economic growth becomes positive again and inflation is typically moderate, but employment growth may not start to increase until the expansion has taken hold convincingly. |

| trough | 止跌转涨 |

b describe how resource use, housing sector activity, and external trade sector activity vary as an economy moves through the business cycle;

Resource Use Fluctuation

Housing Sector Activity

虽然总体占比不大,但受商业周期影响明显,对整体经济产生了影响

Mortgage rates:

interest rate⬇⋙home buying and construction⬆

Housing costs relative to income

When incomes are cyclically high (low) relative to home costs, including mortgage financing costs ⋙ home buying and construction tend to increase (decrease).

Housing activity can decrease even when incomes are rising late in a cycle if home prices are rising faster than incomes, leading to decreases in purchase and construction activity in the housing sector.

Speculative activity

As we saw in the housing sector in 2007 and 2008 in many economies, rising home prices can lead to purchases based on expectations of further gains. Higher prices led to more construction and eventually excess building. This resulted in falling prices that decreased or eliminated speculative demand and led to dramatic decreases in housing activity overall.

Demographic factors

The proportion of the population in the 25- to 40-year-old segment is positively related to activity in the housing sector because these are the ages of greatest household formation.

In China, a strong population shift from rural areas to cities as manufacturing activity has grown has required large increases in construction of new housing to accommodate those needs.

- External Trade Sector Activity

The most important factors determining the level of a country’s imports and exports are __domestic GDP growth, GDP growth of trading partners, and __currency exchange rates.

domestic GDP⬆ ⋙ purchases of foreign goods (imports)⬆

foreign incomes ⬆⋙ sales to foreigners (exports) ⬆

| business cycle | characteristics |

|---|---|

| Trough | *GDP growth rate changes from negative to positive. *High unemployment rate, increasing use of overtime and temporary workers. *Spending on consumer durable goods and housing may increase. *Moderate or decreasing inflation rate. |

| Expansion | *GDP growth rate increases. *Unemployment rate decreases as hiring accelerates. *Investment increases in producers’ equipment and home construction. *Inflation rate may increase. *Imports increase as domestic income growth accelerates. |

| Peak | *GDP growth rate decreases. *Unemployment rate decreases but hiring slows. *Consumer spending and business investment grow at slower rates. *Inflation rate increases. |

| Contraction / Recession |

*GDP growth rate is negative. *Hours worked decrease, unemployment rate increases. *Consumer spending, home construction, and business investment decrease. *Inflation rate decreases with a lag. *Imports decrease as domestic income growth slows. |

c describe theories of the business cycle;

Neoclassical school: shifts in both aggregate demand and aggregate supply are primarily driven by changes in technology over time.

d describe types of unemployment and compare measures of unemployment;

Frictional unemployment: results from the time lag necessary to match employees who seek work with employers needing their skills. always there.

Structural unemployment: long-run changes in the economy that eliminate some jobs while generating others for which unemployed workers are not qualified.

Cyclical unemployment: caused by changes in the general level of economic activity.

unemployed: not working, actively searching for work

unemployment rate: the percentage of people in the labor force who are unemployed

labor force: includes all people who are either employed or unemployed

underemployed: A person who is employed part time but would prefer to work full time or is employed at a low-paying job despite being qualified for a significantly higher-paying one

participation ratio a.k.a. activity ratio or labor force participation rate: the percentage of the working-age population who are either employed or actively seeking employment

discouraged workers: available for work but are neither employed nor actively seeking employment.

productivity: output per hour worked

e explain inflation, hyperinflation, disinflation, and deflation;

f explain the construction of indexes used to measure inflation;

g compare inflation measures, including their uses and limitations;

h distinguish between cost-push and demand-pull inflation;

i interpret a set of economic indicators and describe their uses and limitations.

SS05 Economics (2)

R16 Monetary and Fiscal Policy

a compare monetary and fiscal policy;

- monetary policy

monetary policy: central bank’s actions that affect the quantity of money and credit in an economy in order to influence economic activity

expansionary/accommodative/easy: central bank is increasing the quantity of money and credit in an economy

contractionary/restrictive/tight: central bank is reducing the quantity of money and credit in an economy

- fiscal policy

fiscal policy: a government’s use of spending and taxation to influence economic activity.

budget surplus: government tax revenues > expenditures

budget deficit: government tax revenues < expenditures

b describe functions and definitions of money;

- definition

money: a generally accepted medium of exchange

- functions

- medium of exchange or means of payment

- unit of account

- store of value

narrow money: the amount of notes (currency) & coins in circulation in an economy + balances in checkable bank deposits

broad money: narrow money plus any amount available in _liquid _assets, which can be used to make purchases

c explain the money creation process;

- 一些概念

promissory notes: contains a written promise by one party ( issuer) to pay another party a definite sum of money, either on demand or at a specified future date.

fractional reserve banking: bank holds a proportion of deposits in reserve

excess reserves: cash not needed for reserves

money multiplier

- Money and the Price Level** **

quantity theory of money: quantity of money is some proportion of the total spending in an economy

implies the quantity equation of exchange: MV=PY

Price multiplied by real output is total spending so that velocity is the average number of times per year each unit of money is used to buy goods or services. The equation of exchange must hold with velocity defined in this way.

Assuming that velocity and real output remain constant, money supply⬆⋙proportionate increase in price level.

money neutrality: real variables (real GDP and velocity) are not affected by monetary variables (money supply and prices)

d describe theories of the demand for and supply of money;

e describe the Fisher effect;

fisher effect: the nominal interest rate is simply the sum of the real interest rate and expected inflation

R=nominal interest rate; R=real interest rate; E[I]=expected inflation

The idea behind the Fisher effect is that

*real rates are relatively stable, *changes in interest *rates are driven by changes in expected inflation.

This is consistent with money neutrality.

此外,可添加一个预期的不确定性带来的风险项

RP=risk premium for uncertainty

f describe roles and objectives of central banks;

- roles of central banks

- Sole supplier of currency

legal tender

fiat money: money not backed by any tangible value 法定货币

- Banker to the government and other banks

- Regulator and supervisor of payments system

- Lender of last resort

- Holder of gold and foreign exchange reserves

- Conductor of monetary policy

- objective of a central bank** **

- primary objective

🚩control inflation 保持物价稳定

menu costs: cost to businesses of constantly having to change their prices (under high inflation)

shoe leather costs: costs to individuals of making frequent trips to the bank (最小化现金持有)

- other objective

Stability in exchange rates with foreign currencies.汇率稳定

Full employment.充分就业

Sustainable positive economic growth.可持续的经济增长

Moderate long-term interest rates.适宜的长期利率

pegging choose a target level for the exchange rate of their currency with that of another country (U.S. dollar) 汇率钉住

本币升值⋙卖出本币换美元⋙本币贬值(回归到target level)

g contrast the costs of expected and unexpected inflation;

At any point in time, economic agents have an expected rate of future inflation in the aggregate.

The costs of inflation that is equal to the expected rate are different from the costs of inflation that differs

from expectations, with the costs imposed on an economy of unanticipated inflation greater than those of perfectly anticipated inflation

| perfectly anticipated | |

|---|---|

h describe tools used to implement monetary policy;

i describe the monetary transmission mechanism;

j describe qualities of effective central banks;

k explain the relationships between monetary policy and economic growth, inflation, interest, and exchange rates;

l contrast the use of inflation, interest rate, and exchange rate targeting by central banks;

m determine whether a monetary policy is expansionary or contractionary;

n describe limitations of monetary policy;

o describe roles and objectives of fiscal policy;

p describe tools of fiscal policy, including their advantages and disadvantages;

q describe the arguments about whether the size of a national debt relative to GDP matters;

r explain the implementation of fiscal policy and difficulties of implementation;

s determine whether a fiscal policy is expansionary or contractionary;

t explain the interaction of monetary and fiscal policy.

| Monetary Policy | Fiscal Policy | Interest Rates | Output | Private Sector Spending | Public Sector Spending |

|---|---|---|---|---|---|

| Tight | Tight | higher | lower | lower | lower |

| Easy | Easy | lower | higher | higher | higher |

| Tight | Easy | higher | higher | lower | higher |

| Easy | Tight | lower | varies | higher | lower |

R17 International Trade and Capital Flows

definitions

Imports: Goods and services that firms, individuals, and governments purchase from producers in other countries.

Exports: Goods and services that firms, individuals, and governments from other countries purchase from domestic producers.

Autarky/closed economy: A country that does not trade with other countries.

Free trade: A government places no restrictions or charges on import and export activity.

Trade protection: A government places restrictions, limits, or charges on exports or imports.

World price: The price of a good or service in world markets for those to whom trade is not restricted.

Domestic price: The price of a good or service in the domestic country, which may be equal to the world price if free trade is permitted or different from the world price when the domestic country restricts trade.

Net exports: The value of a country’s exports minus the value of its imports over some period.

Trade surplus: Net exports are positive; the value of the goods and services a country exports are greater than the value of the goods and services it imports.

Trade deficit: Net exports are negative; the value of the goods and services a country exports is less than the value of the goods and services it imports.

Terms of trade: The ratio of an index of the prices of a country’s exports to an index of the prices of its imports expressed relative to a base value of 100

Foreign direct investment: Ownership of productive resources (land, factories, natural resources) in a foreign country

Multinational corporation: A firm that has made foreign direct investment in one or more foreign countries, operating production facilities and subsidiary companies in foreign countries.

a compare gross domestic product and gross national product;**

| GDP | Gross Domestic Product: total value of goods & services produced within a country’s borders over a period |

|---|---|

| GNP | Gross National Product: total value of goods & services produced by the labor and capital of a country’s citizens. |

| 区别 | *| non-citizen incomes of foreigners working within a country GDP, |* income of citizens who work in other countries, *|** income of foreign capital invested within a country, GDP, |* **income of capital supplied by its citizens to foreign countries. |

| GDP is more closely related to economic activity within a country and so to its employment and growth |

b describe benefits and costs of international trade;

The benefit to the importing countries has been lower-cost goods, from textiles to electronics. The benefits to the Chinese economy have been in increasing employment, increasing wages for workers, and the profits from its export products.

The costs of trade are primarily borne by those in domestic industries that compete with imported goods.

| importing countries | exporting countries | |

|---|---|---|

| benefit | lower-cost goods | increasing employment, increasing wages for workers, profits from its export products |

| costs | domestic industries that compete with imported goods |

c distinguish between comparative advantage and absolute advantage;

absolute advantage: can produce the good A at a lower resource cost than another country

comparative advantage: lower opportunity cost in the production of that good A

production possibility frontier: 生产可能性边界

斜率可被看做是机会成本

d compare the Ricardian and Heckscher–Ohlin models of trade and the source(s) of comparative advantage in each model;

ricardian model of trade: 仅考虑labor这一个生产要素

The source of differences in production costs in Ricardo’s model is differences in labor productivity due to differences in technology

| Ricardian model of trade | Heckscher-Ohlin model | |

|---|---|---|

| factor | labor | capital; labor |

| source of difference | differences in labor productivity due to differences in technology | differences in the relative amounts of each factor the countries possess |

e compare types of trade and capital restrictions and their economic implications;

| 合理原因 | infant industry: 保护幼小产业 national security: 保护国内涉及到国家安全的产业 |

| 存疑原因 | Protecting domestic jobs. 保护国内就业 Protecting domestic industries 保护国内产业 |

| 其他原因 | retaliation for foreign trade restrictions; government collection of tariffs (like taxes on imported goods); countering the effects of government subsidies paid to foreign producers; preventing foreign exports at less than their cost of production (dumping). |

Types of trade restrictions include:

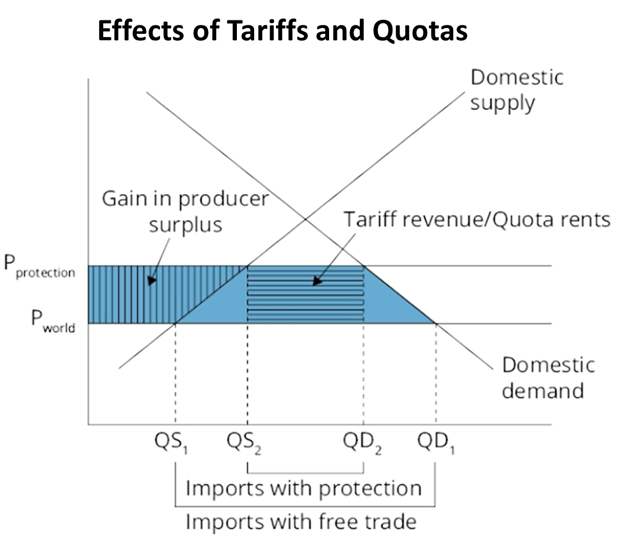

Tariffs: Taxes on imported good collected by the government.

tariff⋙quantity imported⬇ domestic price⬆, quantity supplied domestically⬆

Quotas: Limits on the amount of imports allowed over some period

uantity of a good imported⬇, domestic price⬆

quota rents: In the case of a quota, if the domestic government collects the full value of the import licenses, the result is the same as for a tariff. If the domestic government does not charge for the import licenses, this amount is a gain to those foreign exporters who receive the import licenses under the quota

deadweight loss: the amount of lost welfare from the imposition of the quota or tariff

Export subsidies: Government payments to firms that export goods

Minimum domestic content: Requirement that some percentage of product content must be from the domestic country.

Voluntary export restraint: A country voluntarily restricts the amount of a good that can be exported, often in the hope of avoiding tariffs or quotas imposed by their trading partners

Reduce imports.

Increase price.

Decrease consumer surplus.

Increase domestic quantity supplied.

Increase producer surplus.

f explain motivations for and advantages of trading blocs, common markets, and economic unions;

| Free Trade Areas | |

|---|---|

| 1. All barriers to import and export of goods &services among the countries are removed. e.g. North American Free Trade Agreement (NAFTA) |

|

| Customs Union | |

| 1. All barriers to import and export of goods &services among the countries are removed. 2. All countries adopt a common set of trade restrictions with non-members. |

|

| Common Market | |

| 1. All barriers to import and export of goods &services among the countries are removed. 2. All countries adopt a common set of trade restrictions with non-members. 3. All barriers to the movement of labor and capital goods among member countries are removed. |

|

| Economic Union | |

| 1. All barriers to import and export of goods &services among the countries are removed. 2. All countries adopt a common set of trade restrictions with non-members. 3. All barriers to the movement of labor and capital goods among member countries are removed. 4. Member countries establish common institutions and economic policy for the union. e.g. European Union (EU) |

|

| Monetary Union | |

| 1. All barriers to import and export of goods &services among the countries are removed. 2. All countries adopt a common set of trade restrictions with non-members. 3. All barriers to the movement of labor and capital goods among member countries are removed. 4. Member countries establish common institutions and economic policy for the union. 5. Member countries adopt a single currency e.g. euro zone |

g describe common objectives of capital restrictions imposed by governments;

Reduce the volatility of domestic asset prices

Maintain fixed exchange rates

Keep domestic interest rates low

Protect strategic industries

h describe the balance of payments accounts including their components;

According to the U.S. Federal Reserve, BOP [balance of payments] includes **

| current account mainly measures the flows of goods and services; |

|---|

| Merchandise and services Merchandise: all raw materials and manufactured goods bought, sold, or given away Services: tourism, transportation, and business and engineering services, as well as fees from patents and copyrights on new technology, software, books, and movies. Income receipts foreign income from dividends on stock holdings and interest on debt securities. Unilateral transfers one-way transfers of assets, e.g. money received from those working abroad and direct foreign aid. In the case of foreign aid and gifts, the capital account of the donor nation is debited. |

| capital account capital transfers the acquisition and disposal of non-produced, non-financial assets |

| Capital transfers debt forgiveness goods and financial assets that migrants bring in/out the transfer of title to fixed assets and of funds linked to the purchase or sale of fixed assets, gift and inheritance taxes, death duties, and uninsured damage to fixed assets. *Sales and purchases of non-financial assets that are not produced assets, include rights to natural resources and intangible assets, such as patents, copyrights, trademarks, franchises, and leases |

| financial account records investment flows |

| Government-owned assets abroad include gold, foreign currencies, foreign securities, reserve position in the International Monetary Fund, credits and other long-term assets, direct foreign investment, and claims against foreign banks. Foreign-owned assets in the country foreign official assets and other foreign assets in the domestic country. These assets include domestic government and corporate securities, direct investment in the domestic country, domestic country currency, and domestic liabilities to foreigners reported by domestic banks. |

current account (trade) deficit: imports value > exports value

current account surplus: imports value < exports value

i explain how decisions by consumers, firms, and governments affect the balance of payments;

Lower levels of private saving, larger government deficits, and high rates of domestic investment all tend to result in or increase a current account deficit.

j describe functions and objectives of the international organizations that facilitate trade, including the World Bank, the International Monetary Fund, and the World Trade Organization.

| org. name | International Monetary Fund, IMF |

|---|---|

| main goals | promoting international monetary cooperation; facilitating the expansion and balanced growth of international trade; promoting exchange stability assisting in the establishment of a multilateral system of payments; making resources available (with adequate safeguards) to members experiencing balance of payments difficulties. |

| org. name | World Bank, WB |

| vital source of financial and technical assistance to developing countries around the world. fight poverty with passion and professionalism for lasting results and to help people help themselves and their environment by providing resources, sharing knowledge, building capacity and forging partnerships in the public and private sectors. made up of two unique development institutions owned by 187 member countries: the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA). provide low-interest loans, interest-free credits and grants to developing countries for a wide array of purposes that include investments in education, health, public administration, infrastructure, financial and private sector development, agriculture and environmental and natural resource management. |

|

| org. name | World Trade Organization, WTO |

| ensure that trade flows as smoothly, predictably and freely as possible. |

R18 Currency Exchange Rates

a define an exchange rate and distinguish between nominal and real exchange rates and spot and forward exchange rates;

exchange rate: the price or cost of units of one currency in terms of another.

base currency:

price currency:

direct quote: price currency/base currency

indirect quote

nominal exchange rate

real exchange rate

spot exchange rate: the currency exchange rate for immediate delivery

forward exchange rate: a currency exchange rate for an exchange to be done in the future

b describe functions of and participants in the foreign exchange market;

c calculate and interpret the percentage change in a currency relative to another currency;

d calculate and interpret currency cross-rates;

cross rate: the exchange rate between two currencies implied by their exchange rates with a common third currency

e convert forward quotations expressed on a points basis or in percentage terms into an outright forward quotation;

Points in a foreign currency quotation are in units of the last digit of the quotation.

f explain the arbitrage relationship between spot rates, forward rates, and interest rates;

g calculate and interpret a forward discount or premium;

To calculate a forward premium or forward discount for Currency B using exchange rates quoted as units of Currency A per unit of Currency B, use the following formula:

h calculate and interpret the forward rate consistent with the spot rate and the interest rate in each currency;

i describe exchange rate regimes;

| Countries That Do Not Have Their Own Currency** ** | |

|---|---|

| formal dollarization | |

| Def. | A country can use the currency of another country |

| Feature | *无法执行货币政策 |

| monetary union | |

| Def. | several countries use a common currency |

| Feature | 成员国无法在国内执行独立的货币政策 联盟制定统一的货币政策 |

| Countries That Have Their Own Currency | |

| currency board arrangement | |

| Def. | explicit commitment to exchange domestic currency for a specified foreign currency at a FX rate |

| Feature | monetary authority gives up the ability to conduct independent monetary policy imports the inflation rate of the outside currency, *there may be some latitude to affect interest rates over the short term. |

| conventional fixed peg arrangement | |

| Def. | a country pegs its currency within margins of ±1% versus another currency or a basket that includes the currencies of its major trading or financial partners. |

| Feature | monetary authority peg的方法 直接: *purchasing or selling foreign currencies in the FX markets 间接: *changes in interest rate policy, *regulation of foreign exchange transactions, *convincing people to constrain FX activity. 比美元化、货币联盟、货币局制度灵活. |

| pegged exchange rates within horizontal bands or a target zone | |

| Def. | permitted fluctuations are wider (e.g., ±2%) |

| Feature | more policy discretion compared to a conventional peg |

| crawling peg | |

| Def. | exchange rate is adjusted periodically, typically to adjust for higher inflation versus the currency used in the peg. a.k.a passive crawling peg |

| Feature | active crawling peg=a series of exchange rate adjustments over time is announced and implemented. An active crawling peg can influence inflation expectations, adding some predictability to domestic inflation. |

| management of exchange rates within crawling bands |

|

| Def. | the width of the bands that identify permissible exchange rates is increased over time. |

| Feature | can be used to transition from a fixed peg to a floating rate (货币信用不足时,向浮动利率的过渡) degree of monetary policy flexibility increases with the width of the bands. |

| managed floating exchange rates | |

| Def. | monetary authority attempts to influence the exchange rate in response to specific indicators |

| Feature | *indicators: the balance of payments, inflation rates, or employment without any specific target exchange rate or predetermined exchange rate path. Intervention may be direct or indirect. Such management of exchange rates may induce trading partners to respond in ways that reduce stability |

| independently floating | |

| Def. | exchange rate is market-determined |

| Feature | FX market intervention仅被用于避免汇率短期剧烈波动,而非维持target level |

j explain the effects of exchange rates on countries’ international trade and capital flows.

trade deficit (X – M< 0)⋙ total savings (private savings + government savings) is less than domestic investment in physical capital.⋙additional amount to fund domestic investment must come from foreigners⋙there is a surplus in the capital account to offset the deficit in the trade account.

Another thing we can see from this identity is that any government deficit not funded by an excess of domestic saving over domestic investment is consistent with a trade deficit (imports > exports) which is offset by an inflow of foreign capital (a surplus in the capital account).

- elasticities approach

elasticities approach: 👀 the impact of exchange rate changes on the total value of imports & exports

shortcoming: only considers the microeconomic relationship between exchange rates and trade balances. ignores capital flows

[imports exceed its exports] 本币⬇⋙imports more expensive, export less expensive⋙进口⬇,出口⬆⋙trade deficit⬇

NOT the quantity of imports and exports, BUT the total **expenditures on imports&exports that must change in order to affect the trade deficit.

Marshall-Lerner condition: the condition under which a depreciation of the domestic currency will decrease a trade deficit

W**=proportion of total trade that is exports; W**M=proportion of total trade that is imports;

ε**=absolute value of price elasticity of demand for exports; ε**=absolute value of price elasticity of demand for imports

classic Marshall-Lerner condition: W=WM⋙ ε + ε > 1

进/出口商品的价格弹性越大,货币贬值降低贸易赤字的能力就越强

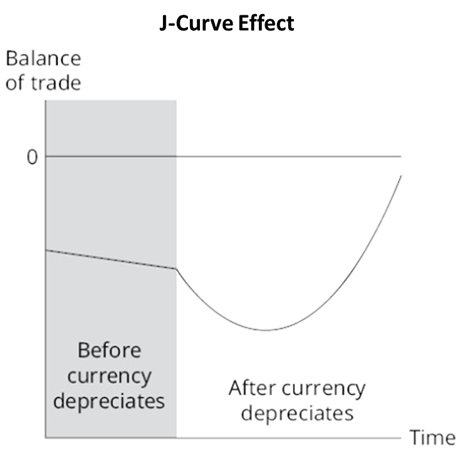

The J-Curve: short-term increase in the deficit followed by a decrease when the Marshall-Lerner condition is met

因为商品交付和支付完成之间存在延时

- absorption approach

absorption approach: analyzing the effect of a change in exchange rates focuses on capital flows.

Y = domestic production of goods & services or national income; BT = balance of trade

E=domestic absorption of goods and services, which is total expenditure

Under the absorption approach, national income must increase relative to national expenditure in order to decrease a trade deficit.

This can also be viewed as a requirement that national saving must increase relative to domestic investment in order to decrease a trade deficit.