- SS10 Corporate Finance (1)

- R31 Introduction to Corporate Governance and OtherESG Considerations

- a describe corporate governance;

- b describe a company’s stakeholder groups and compare interests of stakeholder groups;

- c describe principal–agent and other relationships in corporate governance and the conflicts that may arise in these relationships;

- d describe stakeholder management;

- e describe mechanisms to manage stakeholder relationships and mitigate associated risks;

- f describe functions and responsibilities of a company’s board of directors and its committees;

- g describe market and non-market factors that can affect stakeholder relationships and corporate governance;

- h identify potential risks of poor corporate governance and stakeholder management and identify benefits from effective corporate governance and stakeholder management;

- i describe factors relevant to the analysis of corporate governance and stakeholder management;

- j describe environmental and social considerations in investment analysis;

- k describe how environmental, social, and governance factors may be used in investment analysis.

- R32 Capital Budgeting

- a describe the capital budgeting process and distinguish among the various categories of capital projects;

- b describe the basic principles of capital budgeting;

- c explain how the evaluation and selection of capital projects is affected by mutually exclusive projects, project sequencing, and capital rationing;

- d calculate and interpret net present value (NPV), internal rate of return (IRR), payback period, discounted payback period, and profitability index (PI) of a single capital project;

- e explain the NPV profile, compare the NPV and IRR methods when evaluating independent and mutually exclusive projects, and describe the problems associated with each of the evaluation methods;

- f contrast the NPV decision rule to the IRR decision rule and identify problems associated with the IRR rule;

- g describe expected relations among an investment’s NPV, company value, and share price.

- R33 Cost of Capital

- a calculate and interpret the weighted average cost of capital (WACC) of a company;

- b describe how taxes affect the cost of capital from different capital sources;

- c describe the use of target capital structure in estimating WACC and how target capital structure weights may be determined;

- d explain how the marginal cost of capital and the investment opportunity schedule are used to determine the optimal capital budget;

- e explain the marginal cost of capital’s role in determining the net present value of a project;

- f calculate and interpret the cost of debt capital using the yield-to-maturity approach and the debt-rating approach;

- g calculate and interpret the cost of noncallable, nonconvertible preferred stock;

- h calculate and interpret the cost of equity capital using the capital asset pricing model approach, the dividend discount model approach, and the bond-yield plus risk-premium approach;

- i calculate and interpret the beta and cost of capital for a project;

- j describe uses of country risk premiums in estimating the cost of equity;

- k describe the marginal cost of capital schedule, explain why it may be upwardsloping with respect to additional capital, and calculate and interpret its break-points;

- l explain and demonstrate the correct treatment of flotation costs.

- R31 Introduction to Corporate Governance and OtherESG Considerations

- SS11 Corporate Finance (2)

- R34 Measures of Leverage

- a define and explain leverage, business risk, sales risk, operating risk, and financial risk and classify a risk;

- b calculate and interpret the degree of operating leverage, the degree of financial leverage, and the degree of total leverage;

- c analyze the effect of financial leverage on a company’s net income and return on equity;

- d calculate the breakeven quantity of sales and determine the company’s net income at various sales levels;

- e calculate and interpret the operating breakeven quantity of sales.

- R35 Working Capital Management

- a describe primary and secondary sources of liquidity and factors that influence a company’s liquidity position;

- b compare a company’s liquidity measures with those of peer companies;

- c evaluate working capital effectiveness of a company based on its operating and cash conversion cycles and compare the company’s effectiveness with that of peer companies;

- d describe how different types of cash flows affect a company’s net daily cash position;

- e calculate and interpret comparable yields on various securities, compare portfolio returns against a standard benchmark, and evaluate a company’s short-term investment policy guidelines;

- f evaluate a company’s management of accounts receivable, inventory, and accounts payable over time and compared to peer companies;

- g evaluate the choices of short-term funding available to a company and recommend a financing method.

- R34 Measures of Leverage

SS10 Corporate Finance (1)

R31 Introduction to Corporate Governance and OtherESG Considerations

a describe corporate governance;

corporate governance:

the system of internal controls and procedures by which individual companies are managed. It provides a framework that defines the rights, roles and responsibilities of various groups. within an organization.

At its core, corporate governance is the arrangement of checks, balances, and incentives a company needs in order to minimize and manage the conflicting interests between insiders and external shareowners

shareholder theory

- the primary focus of a system of corporate governance is the interests of the firm’s shareholders (maximize equity)

- primarily concerned with the conflict of interest between the firm’s managers and its owners (shareholders).

stakeholder theory

- considers conflicts among the several groups that have an interest in the activities and performance of the firm.

include shareholders, employees, suppliers, and customers, among others.

b describe a company’s stakeholder groups and compare interests of stakeholder groups;

Shareholders

have a residual interest in the corporation

have voting rights for the election of the board of directors and for other important corporate matters

have an interest in the ongoing profitability and growth of the firm

board of directors

responsibility to protect the interests of shareholders

to hire, fire

set the compensation of the firm’s senior managers

set the strategic direction of the firm

to monitor financial performance and other aspects

one-tier board structure: both company executives and non-executive board members serve on a single board of directors

two-tier structure: supervisory board (non-executive board members) _oversees a management board (_company executives__).

- Senior managers

- compensation (remuneration) composition

*salary__,

*bonus based on some measure of company performance

*perquisites (e.g., expense accounts, use of company planes, special retirement benefits, vacation time off) 补贴性消费

- interests

continued employment

maximizing the total value of their compensation

- Employees** **

- interest

the sustainability and success of the firm

their rate of pay

opportunities for career/advancement

working conditions

- Creditors

not have a vote in firm management and not __participate in firm growth beyond receiving their promised interest and principal payments.

The interests of creditors are protected to varying degrees by covenants in their debt agreements with the firm

- Suppliers

- interest

preserving an ongoing relationship with the firm

the profitability of their trade with the firm

the growth and ongoing stability of the firm

the firm’s solvency and ongoing financial strength (信用销售)

c describe principal–agent and other relationships in corporate governance and the conflicts that may arise in these relationships;

- principal-agent conflict:

an agent is hired to act in the interest of the principal, but an agent’s interests may not coincide exactly with those of the principal

- conflict of interest the may arise

- between shareholders and managers or directors

information asymmetry: managers have more and better information about the functioning of the firm and its strategic direction

例:管理层基于自身利益选择的风险策略不符合股东的最大利益;管理层损害股东利益图利自己(高消费等)

- between groups of shareholders

例:大股东与小股东;同股不同权;兼并收购过程中少数股东的权益;related party transactions(图利大股东的关联交易)

- between creditors and shareholders

例:发行新债;增发股利

- between shareholders and other stakeholders

例:通过降低产品质量降低成本(顾客利益);采取避税策略(政府利益)

d describe stakeholder management;

Stakeholder management: management of company relations with stakeholders and is based on having a good understanding of stakeholder interests and maintaining effective communication with stakeholders.

- 非股东

Four base infrastructures

*legal** infrastructure: the laws relevant to and the legal recourse of stakeholders when their rights are violated

*contractual** infrastructure: the contracts between the company and its stakeholders that spell out the rights and responsibilities of the company and the stakeholders.

*organizational** infrastructure: a company’s corporate governance procedures (internal systems and practices)

*governmental** infrastructure: the regulations to which companies are subject.

- 股东

annual general meeting

extraordinary general meetings

vote by proxy: assigns right to vote to another who will attend the meeting(多为董事、高管或投资顾问)

ordinary resolutions 审计投票;董事选举(简单多数)

special resolutions 兼并、接管、修改公司章程等(绝对多数,2/3或3/4)

- board member elections

majority voting: the candidate with the most votes for each single board position is elected

cumulative voting: shareholders can cast all their votes (shares times number of board position elections) for a single board candidate or divide them among board candidates. (greater minority shareholder representation)

Minority shareholders may have special rights by law when the company is acquired by another company.

e describe mechanisms to manage stakeholder relationships and mitigate associated risks;

f describe functions and responsibilities of a company’s board of directors and its committees;

- Board structure

A company may have any number of directors _on its board.

Companies often have directors with expertise in specific areas of the firm’s business(risk management, finance, or industry strategy).

one-tier board: a single board of directors that includes both internal and external directors

two-tier board: _supervisory board (non-executive__ board members) _oversees a _management board (company executives).

independent directors: Non-executive directors who have no other relationship with the company

Currently, the general practice is for all board member elections to be held at the same meeting and each election to be for multiple years

staggered board: elections for some board positions are held each year (less used) 分期分级董事会制度

- Board responsibilities

- 高管任免与管理

*selecting senior management/ *setting their compensation and bonus structure/

*evaluating their performance/ *replacing them as needed/

Planning for continuity of management and the succession of the CEO and other senior managers.

- 战略制定与监督

setting the strategic direction for the company

making sure that management implements the strategy approved by the board.

- 审议大额投融资

approving capital structure changes; significant acquisitions; *large investment expenditures

- 公司业绩评议

*reviewing company performance

*implementing any necessary corrective steps.

- 内部控制与风险管理

Establishing, monitoring, and overseeing the firm’s *internal controls and *risk management system.

- 公司会计

Ensuring the quality of the firm’s *financial reporting and *internal audit, *oversight of the external auditors.

- Board committees

- audit committee

Oversight of the financial reporting function and implementation of accounting policies.

Effectiveness of the company’s internal controls and the internal audit function.

Recommending an external auditor and its compensation.

Proposing remedies based on their review of internal and external audits.

- governance committee

Oversight of the company’s corporate governance code.

Implementing the company’s code of ethics and policies regarding conflicts of interest.

Monitoring changes in relevant laws and regulations.

Ensuring that the company is in compliance with all applicable laws and regulations, as well as with the company’s governance policies.

- nominations committee

proposes qualified candidates for election to the board.

manages the search process

align the board’s composition with the company’s corporate governance policies

- compensation committee/remuneration committee

recommends to the board the amounts and types of compensation paid to directors and senior managers.

oversight of employee benefit plans and evaluation of senior managers

- risk committee

informs the board about appropriate risk policy and risk tolerance of the organization

oversees the enterprise-wide risk management processes of the organization

- investment committee

reviews and reports to the board on management proposals for

*large acquisitions or projects, *sale or other disposal of company assets or segments,

*performance of acquired assets, *other large capital expenditures.

g describe market and non-market factors that can affect stakeholder relationships and corporate governance;

- 股东行为

Activist shareholders: pressure companies for changes(in which they hold a significant number of shares) , often changes they believe will increase shareholder value.

proxy fight: seek the proxies of shareholders to vote in favor of their alternative proposals and policies.

tender offer: 要约收购

hostile takeover: a takeover not supported by the company’s management

- 法规体系

common-law system: judges’ rulings become law in some instances

⬆ Shareholders’ and creditors’ interests are considered to be better protected IN common law system

civil law system: judges are bound to rule based only on specifically enacted laws

The rights of creditors are more clearlydefined than those of shareholders

- 媒体沟通

……

Growth of firms that advise funds on proxy voting and rate companies’ corporate governance

h identify potential risks of poor corporate governance and stakeholder management and identify benefits from effective corporate governance and stakeholder management;

- Risks of poor governance and stakeholder management** **

*weak control systems, *poor decision making, *legal risk, *reputational risk, *default risk.

- Benefits of effective governance and stakeholder management

*improve operational efficiency and performance, *reduce default risk,

*reduce the cost of debt, *improve financial performance, *increase firm value.

i describe factors relevant to the analysis of corporate governance and stakeholder management;

- Company ownership and voting structure

dual class structure: one class of shares:several votes per share | another class of shares: one vote per share

- Composition of a company’s board

- Management incentives and remuneration

- Composition of shareholders

- Relative strength of shareholders’ rights

-

j describe environmental and social considerations in investment analysis;

ESG investing: the use of environmental, social, and governance factors in making investment decisions

AKA: sustainable investing/ responsible investing/ socially responsible investing

_ Choosing to construct a portfolio based on an environmental, social, or governance concern at the expense of investor returns would violate the manager’s fiduciary duty

k describe how environmental, social, and governance factors may be used in investment analysis.

*negative screening: excluding specific companies or industries from consideration for the portfolio based on their practices regarding human rights, environmental concerns, or corruption.

*positive screening: identify companies that have positive ESG practices.

relative/best-in-class: seeks to identify companies within each industry group with the best ESG practices

*full integration: inclusion of ESG factors or ESG scores in traditional fundamental analysis 将ESG因素纳入基本面分析

*thematic investing: investing in sectors or companies in an attempt to promote specific ESG-related goals

*engagement/active ownership investing: using ownership of company shares or other securities as a platform to promote improved ESG practices

*green finance: producing economic growth in a more sustainable way by reducing emissions and better managing natural resource use

*green bonds: bonds for which the funds raised are used for projects with a positive environmental impact.

*overlay/portfolio tilt strategies: used by fund and portfolio managers to manage the ESG characteristics of their overall portfolios

*risk factor/risk premium investing: treat ESG factors as an additional source of systematic factor risk 将ESG视为收益率的一部分,整合进分析R32 Capital Budgeting

a describe the capital budgeting process and distinguish among the various categories of capital projects;

capital budgeting process: process of identifying and evaluating capital projects

capital projects: projects where the cash flow to the firm will be received over a period longer than a year

four administrative steps:

Step 1: Idea generation

Step 2: Analyzing project proposals

Step 3: Create the firm-wide capital budget

Step 4: Monitoring decisions and conducting a post-audit

Categories

Replacement projects to maintain

*是够继续经营 *运营策略否改变. normally made without detailed analysis.

Replacement projects for cost reduction

*是否更换过时但仍可用的设备. need a fairly detailed analysis

- Expansion projects

*涉及未来需求增长预测等复杂决策. A very detailed analysis is required.

- New product or market development

*涉及新产品开发成本、效果、需求等众多不确定性. require a detailed analysis

- Mandatory projects

*政府部门/保险公司要求,一般涉及生命财产和环境健康 *收入一般较少,但可能对其他项目的进展有帮助

- Other projects. 不宜用资本预算方法进行决策的项目

pet project of senior management (e.g., corporate perks) or a high-risk endeavor that is difficult to analyze with typical capital budgeting assessment methods (e.g., research and development projects).

b describe the basic principles of capital budgeting;

- Decisions are based on cash flows, not accounting income

incremental cash flows: changes in cash flows that will occur if the project is undertaken (增量现金流量)

sunk costs: costs that cannot be avoided(即使项目不通过). should not be included in analysis (不**考虑沉没成本)

_externalities_: the effects the acceptance of a project may have on other firm cash flows. (考虑外部性)

cannibalization (a kind of negative externalities) 利润侵蚀效应

_conventional cash flow pattern: the sign on the cash flows changes only once

unconventional cash flow pattern**:_ more than one sign change

- Cash flows are based on opportunity costs

opportunity costs: cash flows that a firm will lose by undertaking the project under analysis. (机会成本)

The timing of cash flows is important **考虑**资金的时间价值

Cash flows are analyzed on an after-tax basis 考虑税后现金流

Financing costs are reflected in the project’s required rate of return**. **融资成本体现在项目的必要回报率中

c explain how the evaluation and selection of capital projects is affected by mutually exclusive projects, project sequencing, and capital rationing;

- independent projects 项目彼此不相关,可以仅凭自身的盈利性进行评价

- mutually exclusive 多选一的项目选择过程

- project sequencing 投资一个项目为未来投资其他项目提供机会

- unlimited funds 资本来源无限,可以接受任何回报期望超过资本成本的项目,仅在理想情况下成立

- capital rationing: 项目多,资本少,必须挑选回报最有优势的项目

d calculate and interpret net present value (NPV), internal rate of return (IRR), payback period, discounted payback period, and profitability index (PI) of a single capital project;

- NPV

net present value (NPV): the sum of the present values of all the expected incremental cash flows if a project is undertaken

CF**: intial investment outlay

CF**: after-tax cash flow at time t

k: required rate of return for project

independent projects: NPV>0 →accept; NPV<0→reject

计算器计算NPV实例↓

| Year | 0 | 1 | 2 | 3 |

|---|---|---|---|---|

| Cash Flow | -100 | 25 | 50 | 75 |

| k=9% |

| Keystrokes | Explanation | Display |

|---|---|---|

| [CF] [2nd] [CLR WORK] | Clear memory registers | CF0 = 0.0000 |

| 100 [+/-] [ENTER] | Initial cash outlay | CF0 = –100.0000 |

| [↓] 25 [ENTER] | Period 1 cash flow | C01 = 25.0000 |

| [↓] | Frequency of cash flow 1 | F01 = 1.0000 |

| [↓] 50 [ENTER] | Period 2 cash flow | C02 = 50.0000 |

| [↓] | Frequency of cash flow 2 | F02 = 1.0000 |

| [↓] 75 [ENTER] | Period 3 cash flow | C03 = 75.0000 |

| [↓] | Frequency of cash flow 3 | F03 = 1.0000 |

| [NPV] 9 [ENTER] | 9% discount rate | I = 9.0000 |

| [↓] [CPT] | Calculate NPV | NPV = 22.9335 |

- IRR

internal rate of return (IRR): the discount rate that makes the present value of the expected incremental after-tax cash inflows just equal to the initial cost of the project. 使PV(inflows)=PV(outflows)的折现率

IRR decision rule:

- determine the required rate of return for a given project

- If IRR > required rate of return→ACCEPT

If IRR < required rate of return→REJECT

即IRR>0,则NPV>0

- hurdle rate: minimum IRR that a firm requires internally for a project

- payback period

payback period (PBP): number of years it takes to recover the initial cost of an investment

<br />优: a good measure of project liquidity(先确定最大回收期,再根据NPV/IRR进行项目决策)<br />缺1: time value of money NOT CONSIDERED 回收期不考虑资金的时间价值<br />缺2: cash flows beyond the payback period NOT CONSIDERED 回收期法不考虑资金回收完成后的现金流

- discounted payback period

discounted payback period: uses the present values of the project’s estimated cash flows

still does not consider any cash flows beyond the payback period

- profitability index (PI)

profitability index (PI): the present value of a project’s future cash flows divided by the initial cash outlay

decision rule

if PI>1.0, accept the project

if PI<1.0, reject the project

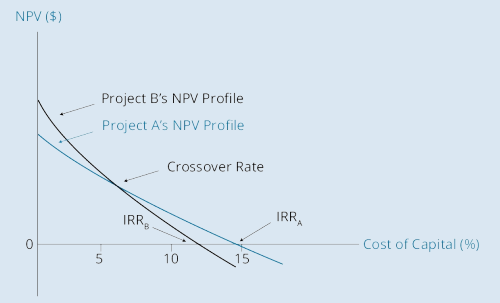

e explain the NPV profile, compare the NPV and IRR methods when evaluating independent and mutually exclusive projects, and describe the problems associated with each of the evaluation methods;

- NPV profile

NPV profile : a graph that shows a project’s NPV for different discount rates

一个项目在不同折现率(x轴)情况下的NPV(y轴)

crossover rate:rate at which the NPVs are equal 两个NPV曲线交点代表两项目NPV相同时对应的折现率,一般情况下,在交点两侧项目NPV的大小情况相反

- NPV & IRR

- NPV

优: a direct measure of the expected increase in the value of the firm.

_

缺: not include any consideration of the size of the project

- IRR _

优1: measures profitability as a percentage, showing the return on each dollar invested

优2: provides information on the margin of safety

优3: tell how much below the IRR (estimated return) the actual project return could fall, in percentage terms, before the project becomes uneconomic (has a negative NPV) _

缺1: possible rankings of mutually exclusive projects different from NPV analysis

缺2: the possibility that a project has multiple IRRs or no IRR

f contrast the NPV decision rule to the IRR decision rule and identify problems associated with the IRR rule;

- NPV is the only acceptable criterion when ranking projects

- IRR的问题:

rankinig; project size

multiple IRR and no IRR (with unconventional cashflows)

g describe expected relations among an investment’s NPV, company value, and share price.

In theory, a positive NPV project should cause a proportionate increase in a company’s stock price.

(理论途径:计算NPV→权益增长→股价增长)

In reality, the impact of a project on the company’s stock price is more complicated

(NPV期望人人不同;项目的相关性带来的实物期权可能导致股价变化幅度超过或不及NPV)

R33 Cost of Capital

a calculate and interpret the weighted average cost of capital (WACC) of a company;

How a company raises capital and how it budgets or invests it are considered independently** **

weighted average cost of capital (WACC): the cost of financing firm assets (AKA: marginal cost of capital, MCC)

the proper rate to discount the CF of a capital budgeting project

w**x: percentage of x in the capital structure. x=d(debt), ps(perferred stocks),ce(common equity)

k**: the rate at which the firm can issue new debt.

t: marginal tax rate

k**(1-t): after-tax cost of debt

k**: the cost of perferred stock

k**: the cost of common equity.

b describe how taxes affect the cost of capital from different capital sources;

the interest paid on corporate debt is tax deductible. the cost of debt, kd is adjusted, for the firm’s marginal tax rate, t.

Because there is typically no tax deduction allowed for payments to common or preferred stockholders, there is no equivalent deduction to k**ps or kce **

c describe the use of target capital structure in estimating WACC and how target capital structure weights may be determined;

- use in estimating WACC

target capital structure: the proportions (based on market values) of debt, preferred stock, and equity that the firm expects to achieve over time

- how to determined

*use the stated target capital structure provided by firm management

*simply use the firm’s current capital structure (based on market values)

*incorporate noticeable trend (if there is) into the estimate of the firm’s target capital structure.

* use the industry average capital structure as the target capital structure for a firm under analysis.

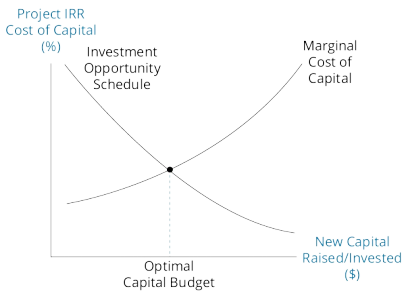

d explain how the marginal cost of capital and the investment opportunity schedule are used to determine the optimal capital budget;

- 基本概念

marginal cost of capital the cost of raising additional capital

marginal cost of capital curve: marginal cost of capital increase as larger amounts. 边际融资成本随r融资量上升而上升

investment opportunity schedule: 按照IRR的高低,由左至右排列,连成一条线

sequencing: 最优项目(max IRR)匹配最低融资成本(capital amount is small)可以为权益提供最大增长(project size?)

- 最优融资量的确定

optimal capital budget: 两条曲线的交点,此时边际融资成本等于边际项目的IRR,是价值创造最大点(接受左侧的项目)

e explain the marginal cost of capital’s role in determining the net present value of a project;

- WACC可直接用于对项目风险水平和公司风险水平一致的公司

- 项目风险水平则需要根据风险水平对在WACC的基础上进行调整

- 利用WACC进行项目预算的隐含假设:公司资本结构在项目生命周期内不变

f calculate and interpret the cost of debt capital using the yield-to-maturity approach and the debt-rating approach;

- YTM approach

kd is the market interest rate (YTM) on new (marginal) debt (注:not the coupon rate on the firm’s existing debt)

-

g calculate and interpret the cost of noncallable, nonconvertible preferred stock;

k**: cost of preferred stock;D**: preferred dividends(下一年初开始发);P: market price of preferred

根据永续年金的TVM公式变换而得h calculate and interpret the cost of equity capital using the capital asset pricing model approach, the dividend discount model approach, and the bond-yield plus risk-premium approach;

cost of equity capital (kce): the required rate of return on the firm’s common stock

capital asset pricing model (CAPM)

Step 1: 估计无风险利率 R**f. 一般为与项目生命周期一致期限的无风险债券的收益率

Step 2: 估计股票β

Step 3: 估计市场的回报率期望 E(Rmkt)**

Step 4: 利用CAPM公式计算股权融资成本↓

dividend discount model (DDM)

DDM模型

<br />**P****0****-**0时刻的股价;**D****1**-1时刻发放的股利;**k****ce****-**普通股的必要回报率;**g**-公司的期望增长率<br />确定g的方法<br />(1) 使用分析师提供的g<br />(2) 公式确定可持续增长率↓<br />

After rearranging↓(用来确定股权融资成本)

<br />股价、股利已知,用公式计算g,最后求kce

bond-yield plus risk-premium

add a risk premium (3 to 5 percentagepoints) to the market yield on the firm’s long-term debt

i calculate and interpret the beta and cost of capital for a project;

关于Beta的基本概念

project’s beta: measure of project’s systematic or market risk

pure-play method: begin with the beta of a company or group of companies that are purely __engaged in a business similar to that of the project and are therefore comparable to the project

公司(股权)beta的影响因素:业务风险+资本结构风险(债务融资增加了风险)

Beta的计算

unlevered asset beta

D/E: comparable company’s debt-to-equity ratio;t: marginal tax rateproject beta

logic: 通过pure paly股票表现估计股权贝塔→对股权贝塔进行去杠杆得到资产贝塔(移除债务风险)→将pureplay资产贝塔根据本项目的融资结构将β扩大至project贝塔

对放大因子的考量:单位股权代表的总资产量(也就是杠杆?)

Beta的问题**

*Beta根据历史数据估计,受time length和frequency的影响较大

*计算结果对反映市场回报率的index选择较为敏感

*Beta有向1回归的趋势,有时需要进行调整

*对资产规模小的公司的Beta估计需要上调以反映小公司的风险

j describe uses of country risk premiums in estimating the cost of equity;

- 基本概念

country risk premium: reflect the increased risk associated with investing in a developing country

sovereign yield spread: the difference in yields between the developing country’s government bonds (denominated in the developed market’s currency) and Treasury bonds of a similar maturity 主权利差

计算

CRP-country risk premium,客观上增加了贝塔的放大值k describe the marginal cost of capital schedule, explain why it may be upwardsloping with respect to additional capital, and calculate and interpret its break-points;

基本概念

marginal cost of capital (MCC): the cost of raising an additional dollar of capital

marginal cost of capital schedule: the WACC for different amounts of financing

- 为什么MCC schedule 曲线向上倾斜

different sources of financing become more expensive as the firm raises more capital, the MCC schedule typically has an upward slope.

- break-points

break points: any time the cost of one of the components of the company’s WACC changes

使WACC中任一cost改变的点

分子:对应组分融资成本变动的融资量

分母:资本结构中该组分的权重

l explain and demonstrate the correct treatment of flotation costs.

- floatation costs: fees charged by investment bankers when a company raises external equity capital 发行成本

发行成本为t=0时刻(不用折现)的一次性资本支出, 直接从原NPV中减掉

SS11 Corporate Finance (2)

R34 Measures of Leverage

a define and explain leverage, business risk, sales risk, operating risk, and financial risk and classify a risk;

leverage: the amount of fixed costs a firm has

- business risk: risk associated with a firm’s operating income (运营收入与成本的不确定性)

sales risk: uncertainty about the firm’s sales

operating risk: additional uncertainty about operating earnings caused by fixed operating costs

- financial risk: fixed cost (debt) financing 债务融资带来的风险

b calculate and interpret the degree of operating leverage, the degree of financial leverage, and the degree of total leverage;

- degree of operating leverage **(DOL)**

- 定义

degree of operating leverage (DOL): the % change in operating income (EBIT) that results from a given % change in sales

计算

<br />**Q**: quantity of units sold; **P**: price per unit; **V**: variable cost per unit; **F**: fixed cost<br /> <br />**S**: sales; **T****VC**: total variable costs; **F**: fixed cost /(simply把Q乘进去)<br />注:the degree of operating leverage for a company depends on the level of sales,**sales level↑, DOL↓**

- degree of financial leverage **(DFL)**

- 定义

degree of financial leverage (DFL): the ratio of the percentage change in net income (or EPS) to the % change in EBIT** **(net income 与 EPS成比例,故百分比变动相同)

计算

- degree of total leverage **(DTL) **

- 定义

degree of total leverage (DTL): the sensitivity of EPS to change in sales

计算

<br /> <br />

c analyze the effect of financial leverage on a company’s net income and return on equity;

- financial leverage decreases net income (fixed interest cost)

- financial leverage increases (1) the level of ROE; (2) the rate of change for ROE

- financial leverage increases (1) the risk of default; (2) the potential return for equity holders

d calculate the breakeven quantity of sales and determine the company’s net income at various sales levels;

- breakeven quantity of sales

breakeven quantity of sales: the quantity of sales for which revenues equal total costs

contribution margin: the difference between price and variable cost per unit

net income

Q为net income为0的点,leverage越大,Q越大

leverage上升,固定成本上升,变动成本下降,contribute margin上升,销量增加/减少带来的影响被放大e calculate and interpret the operating breakeven quantity of sales.

calculation

operating breakeven quantity of sales fixed costs中只考虑operating costs

- interpretation

R35 Working Capital Management

a describe primary and secondary sources of liquidity and factors that influence a company’s liquidity position;

- sources of liquidity

primary sources of liquidity 通过日常经营获得的流动性

selling goods and services

collecting receivables

short-term funding (trade credit, lines of credit)

effective cash flow management of a firm’s collection and payments

secondary sources of liquidity 通过变卖资产、债务重组等获得的流动性

liquidating short-term or long-lived assets

negotiating debt agreements

*filing for bankruptcy and reorganizing

- influence factor

drags on liquidity: delay or reduce cash inflows, or increase borrowing costs.

uncollected receivables and bad debts,

obsolete inventory (打折出售,且销售时间会更长)

tight short-term credit due to economic conditions.

pulls on liquidity: accelerate cash outflows

paying vendors sooner than is optimal

*changes in credit terms that require repayment of outstanding balances.

b compare a company’s liquidity measures with those of peer companies;

current ratio

quick ratio/ acid-test ratio 除去存货

<br />**----------------------------------**

receivables turnover

number of days of receivables (AKA: average days’ sales outstanding)

<br />**------------------------------------**

inventory turnover

number of days of inventory (AKA: average inventory processing period)

<br />-------------------------------------

payables turnover ratio

number of days of payables (AKA: payables payment period)

c evaluate working capital effectiveness of a company based on its operating and cash conversion cycles and compare the company’s effectiveness with that of peer companies;

operating cycle: the average number of days that it takes to turn raw materials into cash proceeds from sales

cash conversion cycle: the length of time it takes to turn the firm’s cash investment in inventory back into cash.

AKA: net operating cycle

d describe how different types of cash flows affect a company’s net daily cash position;

- daily cash position: uninvested cash balances, available to make routine purchases and pay expenses when due避免negative position,同时避免过多现金

- typical cash inflows

*cash from sales and collections of receivables; *cash received from subsidiaries;

*dividends, interest, and principal received from investments in securities; *tax refunds; *borrowing.

- typical cash outflows

*payments to employees and vendors; *cash transferred to subsidiaries; *payments of interest and principal on debt;

*investments in securities; *taxes paid; dividends paid

e calculate and interpret comparable yields on various securities, compare portfolio returns against a standard benchmark, and evaluate a company’s short-term investment policy guidelines;

短期证券类型:

*U.S. Treasury bills. *Short-term federal agency securities. *Bank certificates of deposit. *Banker’s acceptances.*Time deposits. *Repurchase agreements. *Commercial paper. *Money market mutual funds. *Adjustable-rate preferred stock.

- Yields** **

有yield字眼就需要年化,年化标准有差异(360or365)

percentage **discount **from face value

↑ discount相对于face value,故分母为face valuediscount**-basis yield (bank discount yield or BDY) **

↑ discount相对于face value,故分母为face value

总结:有discount 分母都用face valuemoney market yield

days: days to maturity; price: purchase price of the security 从投资角度,收益率计算要基于期初投资(price)bond equivalent yield

↑ 投资角度,用price ↑ 这里的年化基准是365天

- 现金管理中的投资policy

目标:获得market return,且低风险(流动性、违约)

↓

选择:high credit quality+ short maturities

better have an investment policy statement (IPS)

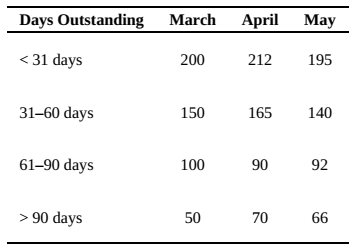

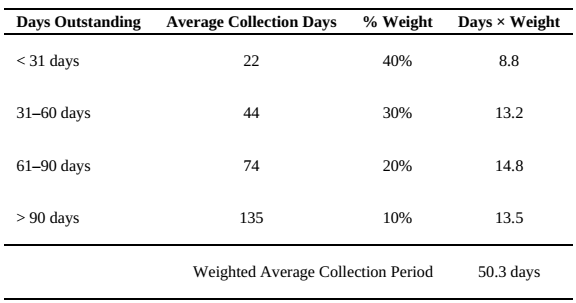

f evaluate a company’s management of accounts receivable, inventory, and accounts payable over time and compared to peer companies;

- accounts receivable management

- aging schedule 账龄表

行:某一账龄范围内的应收总额随时间变化 (time series)

列:某一时间点各个账龄范围内的营收总额 (cross section)

weighted average collection period: the average days outstanding per dollar of receivables.

<br />

- inventory

- 存货过少→缺货造成销售损失;存货过多→占用资本(机会成本)

- 存货周转天数升高+存货周转率下降→存货过多

- 存货过多的问题:greater losses from obsolete items; 产品可能过时

- 不同行业存货评价标准不同

- accounts payable

过早支付→机会成本大;过晚支付→损害伙伴关系/享受的信用政策收窄

- trade credit

trade credit: ‘2/10 net 60‘ 10天内支付享受2%discount,最迟60天内支付 相当于在折扣期外把钱“借”给了buyer

折扣期外支付的隐含融资成本↓:

days pad of trade credit=number of days after the end of the discount period

- number of days of payables

应付周转天数较长的可能原因:(1)为利用低成本的贸易信贷 (2)买方议价能力大

An extension of days’ payables may serve as an early warning of deteriorating short-term liquidity

g evaluate the choices of short-term funding available to a company and recommend a financing method.

- 银1-lines of credit 信贷额度

*uncommitted line of credit 给予授信,特定情况可能取消

** committed (regular) line of credit 一段时期(少于一年)内的授信承诺 AKA: overfraft line of credit

*revolving line of credit 循环信用额度(大于一年)

信用等级较低的公司在寻求银行借款时需要抵押(固定资产/存货/应收)

blanket lien**: a claim to all current and future firm assets as collateral in case the primary collateral is insufficient and the borrowing firm defaults. 总括留置权,公司违约+抵押价值不够时,银行对公司资产的留置权

- 银2-banker’s acceptances 银行承兑汇票

banker’s acceptances: A banker’s acceptance is a guarantee from the bank of the firm that has ordered the goods stating that a payment will be made upon receipt of the goods

- 银3-factoring 应收账款保理

factoring: actual sale of receivables at a discount from their face values 应收的买方自己收集账款

- 非银-commercial paper 商业票据

commercial paper: short-term debt securites issued by creditworthy firm. 利率可稍微小于银行贷款