- SS12 Equity Investments (1)

- R36 Market Organization and Structure

- a explain the main functions of the financial system;

- b describe classifications of assets and markets;

- c describe the major types of securities, currencies, contracts, commodities, and real assets that trade in organized markets, including their distinguishing characteristics and major subtypes;

- d describe types of financial intermediaries and services that they provide;

- e compare positions an investor can take in an asset;

- f calculate and interpret the leverage ratio, the rate of return on a margin transaction, and the security price at which the investor would receive a margin call;

- g compare execution, validity, and clearing instructions;

- h compare market orders with limit orders;

- i define primary and secondary markets and explain how secondary markets support primary markets;

- j describe how securities, contracts, and currencies are traded in quote-driven, order-driven, and brokered markets;

- k describe characteristics of a well-functioning financial system;

- l describe objectives of market regulation.

- R37 Security Market Indexes

- a describe a security market index;

- b calculate and interpret the value, price return, and total return of an index;

- c describe the choices and issues in index construction and management;

- d compare the different weighting methods used in index construction;

- e calculate and analyze the value and return of an index given its weighting method;

- f describe rebalancing and reconstitution of an index;

- g describe uses of security market indexes;

- h describe types of equity indexes;

- i describe types of fixed-income indexes;

- j describe indexes representing alternative investments;

- k compare types of security market indexes.

- R38 Market Efficiency

- a describe market efficiency and related concepts, including their importance to investment practitioners;

- b distinguish between market value and intrinsic value;

- c explain factors that affect a market’s efficiency;

- d contrast weak-form, semi-strong-form, and strong-form market efficiency;

- e explain the implications of each form of market efficiency for fundamental analysis, technical analysis, and the choice between active and passive portfolio management;

- f describe market anomalies;

- g describe behavioral finance and its potential relevance to understanding market anomalies.

- R36 Market Organization and Structure

- SS13 Equity Investments (2)

- R39 Overview of Equity Securities

- a describe characteristics of types of equity securities;

- b describe differences in voting rights and other ownership characteristics among different equity classes;

- c distinguish between public and private equity securities;

- d describe methods for investing in non-domestic equity securities;

- e compare the risk and return characteristics of different types of equity securities;

- f explain the role of equity securities in the financing of a company’s assets;

- g distinguish between the market value and book value of equity securities;

- h compare a company’s cost of equity, its (accounting) return on equity, and investors’ required rates of return.**

- R40 Introduction to Industry and Company Analysis

- a explain uses of industry analysis and the relation of industry analysis to company analysis;

- b compare methods by which companies can be grouped, current industry classification systems, and classify a company, given a description of its activities and the classification system;

- c explain the factors that affect the sensitivity of a company to the business cycle and the uses and limitations of industry and company descriptors such as “growth,” “defensive,” and “cyclical”;

- d explain how a company’s industry classification can be used to identify a potential “peer group” for equity valuation;

- e describe the elements that need to be covered in a thorough industry analysis;

- f describe the principles of strategic analysis of an industry;

- g explain the effects of barriers to entry, industry concentration, industry capacity, and market share stability on pricing power and price competition;

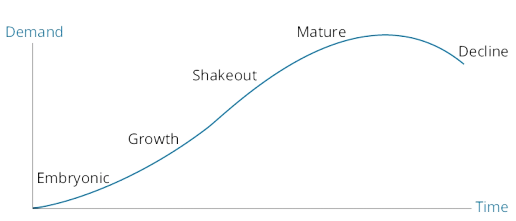

- h describe industry life cycle models, classify an industry as to life cycle stage, and describe limitations of the life-cycle concept in forecasting industry performance;

- i compare characteristics of representative industries from the various economic sectors;

- j describe macroeconomic, technological, demographic, governmental, and social influences on industry growth, profitability, and risk;

- k describe the elements that should be covered in a thorough company analysis.

- R41 Equity Valuation: Concepts and Basic Tools

- a evaluate whether a security, given its current market price and a value estimate, is overvalued, fairly valued, or undervalued by the market;

- b describe major categories of equity valuation models;

- c describe regular cash dividends, extra dividends, stock dividends, stock splits, reverse stock splits, and share repurchases;

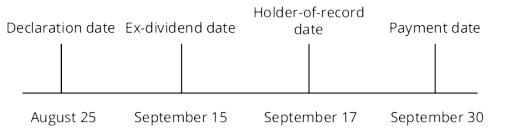

- d describe dividend payment chronology

- e explain the rationale for using present value models to value equity and describe the dividend discount and free-cash-flow-to-equity models;

- f calculate the intrinsic value of a non-callable, non-convertible preferred stock;

- g calculate and interpret the intrinsic value of an equity security based on the Gordon (constant) growth dividend discount model or a two-stage dividend discount model, as appropriate;

- h identify characteristics of companies for which the constant growth or a multistage dividend discount model is appropriate;

- i explain the rationale for using price multiples to value equity, how the price to earnings multiple relates to fundamentals, and the use of multiples based on comparables;

- j calculate and interpret the following multiples: price to earnings, price to an estimate of operating cash flow, price to sales, and price to book value;

- k describe enterprise value multiples and their use in estimating equity value;

- l describe asset-based valuation models and their use in estimating equity value;

- m explain advantages and disadvantages of each category of valuation model.

- R39 Overview of Equity Securities

SS12 Equity Investments (1)

R36 Market Organization and Structure

a explain the main functions of the financial system;

- Allow entities to save and borrow money, raise equity capital, manage risks, trade assets currently or in the future, and trade based on their estimates of asset values.

- Determine the returns (i.e., interest rates) that equate the total supply of savings with the total demand for borrowing.

equilibrium interest rate: 借贷供求平衡对应的利率,受risk, liquidity, maturity影响

- financial & real assets

- financial assets: securities (stocks and bonds), derivative contracts, *currencies

Debt securities/**Equity securities**

Public (publicly traded) securities/Private securities

Financial derivative contracts** / Physical derivative contracts **

spot markets/ forward markets

primary market/ secondary market

Money markets/ **Capital markets**

- real assets: real estate, equipment, commodities, other physical assets

- Traditional investment markets/ **Alternative markets**

traditional investment debt and security

alternative investment hedge funds, commodities, real estate, collectibles, gemstones, leases, and equipment

c describe the major types of securities, currencies, contracts, commodities, and real assets that trade in organized markets, including their distinguishing characteristics and major subtypes;

- securities** **

- Fixed-income securities

bonds are generally long term; notes are intermediate term

*commercial paper 短期debt,公司发行;*bills 政府发行;certificates of deposit* 存单,银行发行

*repurchase agreements 借方卖出资产,稍后以高价赎回;*c**onvertible debt 持有人有权将债权转换为股权

- Equity securities

Common stock;Preferred stock** ;Warrants**

- Pooled investment vehicles

The investor’s ownership interests are referred to as shares, units, depository receipts, or limited partnership interests

mutual funds

investors can purchase shares, either from the fund itself (open-end funds) or in the secondary market (closed-end funds).

exchange-traded funds (ETFs) AKA: exchange-traded notes (ETNs)

asset-backed securities (ABS)

a claim to a portion of a pool of financial assets such as mortgages, car loans, or credit card debt

Hedge funds

- currencies

currencies 中央银行发行的货币

reserve currencies 多国政府/央行都会持有的货币

dollar euro British pound Japanese yen *Swiss franc

In spot currency markets, currencies are traded for immediate delivery

- contracts

contracts agreements between two parties that require some action in the future

forward contract * *futures contracts *swap contract *option contract *insurance contract**

*credit default swaps

- commodities

Commodities trade in spot, forward, and futures markets.

*precious metals, *industrial metals, *agricultural products, *energy products, *credits for carbon reduction.

- real assets

get exposure的方式↓

*buying real assets directly

*real estate investment trust (REIT) or master limited partnership (MLP)

*holding stock of firms that have large ownership of real assets

d describe types of financial intermediaries and services that they provide;

Financial intermediaries: stand between buyers and sellers, facilitating the exchange of assets, capital, and risk

- Brokers & **Dealers**

brokers: help clients buy and sell securities by finding counterparties to trades in a cost efficient manner

block brokers: help with the placement of large trades

investment banks: help corporations sell common stock, preferred stock, and debt securities to investors. provide advice to firms, notably about mergers, acquisitions, and raising capital

dealers: facilitate trading by buying for or selling from their own inventory.

provide liquidity profit primarily from the spread

primary dealers: trade with central banks when the banks buy or sell government securities *in order to affect the money supply

- Exchanges

sometimes act as brokers by providing electronic order matching.

regulate their members and

require listed firms to provide timely financial disclosures and to promote shareholder democratization.

acquire their regulatory power through member agreement or from their governments.

—————

Alternative trading systems AKA electronic communication networks (ECNs), multilateral trading facilities (MTFs)

↑ exchange with no regulation function

- Securitizers

securitizers: pool large amounts of securities/other assets, sell interests in the pool to other investors

special purpose vehicle (SPV) AKA special purpose entity (SPE)将资产与公司BS分离,降低风险(独享声索权)

tranches different risk categories in securitized assets

- Depository Institutions

depository institutions: banks, credit unions, and savings and loans

pay interest on customer deposits

provide transaction services such as checking accounts

make loans

expertise in evaluating credit quality and managing the risk of a portfolio of loans of various types

- Insurance Companies

insurance companies: collect insurance premiums in return for providing risk reduction to the insured

moral hazard: insured may take more risks once he is protected against losses

adverse selection: those most likely to experience losses are the predominant buyers of insurance

fraud: the insured purposely causes damage or claims fictitious losses to collect on his insurance policy

- Arbitrageurs

providing liquidity to participants in the market where the asset is purchased

transferring the asset to the market where it is sold

- Clearinghouses

Escrow services (transferring cash and assets to the respective parties).契保服务

Guarantees of contract completion.

Assurance that margin traders have adequate capital.

Limits on the aggregate net order quantity (buy orders minus sell orders) of members.

counterparty risk: the risk that the other party to a transaction will not fulfill its obligation

- Custodians

holding client securities and preventing their loss due to fraud or other events that affect the broker or investment manager

e compare positions an investor can take in an asset;

long position: owns an asset, or has the right or obligation under a contract to purchase an asset

short position: borrowing an asset and selling it, obligated to replace the asset in the future (a short sale)

- short sale** Positions **

simultaneously borrows and sells securities through a broker

must return the securities at the request of the lender or when the short sale is closed out

must keep a portion of the proceeds of the short sale on deposit with the broker

covering the short position: repayment of the borrowed security or other asset

payments-in-lieu 卖空者需向资产拥有者支付卖空资产的所有期间收益(股利、利息等)

*short rebate rate 卖空者将proceeds作为抵押放在卖空账户中,经纪商从proceed中获得利息,按照short rebate rate将利息部分分配给卖空者

- Leveraged Positions** **

leveraged position: use borrowed funds to purchase an asset

buy on margin: use leverage to buy securities by borrowing from brokers

margin loan: borrowed funds are referred to as a margin loan

call money rate: interest rate paid on the margin loan

initial margin requirement

The use of leverage magnifies both the gains and losses from changes in the value of the underlying asset.

The additional risk from the use of borrowed funds is referred to as __risk from financial leverage

f calculate and interpret the leverage ratio, the rate of return on a margin transaction, and the security price at which the investor would receive a margin call;

- leverage ratio

leverage ratio: the value of the asset divided by the value of the equity position(何时成立?)

- margin transaction的收益

- 初始投资(保证金购买)

commission on purchase(股票数量commission per shre)

initial margin(股票现价股票数量*初始保证金要求)

- 期末售出收益计算

+capital gain/loss [(期末股价-期初股价)股票数量]

+dividend

-commission on purchase(股票数量commission per shre)

-commission on sales (股票数量commission per shre)

-interest paid (borrowingcall money rate)

- margin call

maintenance margin requirement:

margin call 追加保证金要求

margin call price: stock price which results in a margin call ;P**0**: initial purchase price

In a short sale, the investor must deposit initial margin equal to a percentage of the value of the shares sold short to protect the broker in case the share price increases.

g compare execution, validity, and clearing instructions;

bid price: price at which a dealer will buy a security | ask/offer price: price at which a dealer will sell a security

bid-ask spread: difference between the bid and ask prices | bid size and ask size: specific trade sizes

The quotation in the market is the highest dealer bid and lowest dealer ask from among all dealers in a particular security

make a market: traders who post bids and offers | take the market

- execution instructions /specify how to trade/

market order: instructs the broker to execute the trade immediately at the best possible price

limit order: places a minimum execution price on sell orders and a maximum execution price on buy orders

standing limit orders: limit orders waiting to execute

all-or-nothing orders: execute only if the whole order can be filled

hidden orders: only the broker or exchange knows the trade size

display size AKA iceberg orders: some of the trade is visible to the market, but the rest is not

- validity instructions /specify when the order can be filled/

day orders: expire if unfilled by the end of the trading day

good til canceled orders: last until they are filled

immediate-or-cancel AKA fill-or-kill : canceled unless they can be filled immediately

good-on-close: only filled at the end of the trading day

market-on-close: good-on-close+market order

stop orders AKA stop loss orders: not executed unless the stop price has been met

stop-sell order 价格跌到P以下,卖出

stop-buy order 价格涨到P以上,买入→结束空头仓位,止损 | 捕捉股价被低估的股票的初期上涨

stop orders reinforce market momentum

- clearing instructions /specify how to to clear and settle the trade/

h compare market orders with limit orders;

- market order: instructs the broker to execute the trade immediately at the best possible price

- limit order: places a minimum execution price on sell orders and a maximum execution price on buy orders

i define primary and secondary markets and explain how secondary markets support primary markets;

- 一级与二级市场

- Primary capital markets: the sale of newly issued securities

seasones offerings AKA: secondary issues

initial public offerings (IPOs)

indications of interest 投资意向

book building: process of gathering indications of interest询价圈购

book runner: book builder 配售经办人

accelerated book build: occurs when securities must be issued quickly

underwritten offering 承销发行: 若认购不足,投行购买未售股份;IPO后做市服务

best efforts:若认购不足,投行无义务购买未售出股份

private placement: securities are sold directly to qualified investors 定向增发

shelf registration: disclosures as in a regular offering but then issues the registered securities over time when it needs capital and when the markets are favorable 暂搁注册

dividend reinvestment plan (DRP or DRIP): 允许股东使用股利购买股票(at a slight discount)

rights offering:shareholders are given the right to buy new shares at a discount to current market price.

- Secondary financial markets: where securities trade after their initial issuance

- 二级市场如何支持一级市场

二级市场功能:provide *liquidity and *price/value information

j describe how securities, contracts, and currencies are traded in quote-driven, order-driven, and brokered markets;

call markets: the stock is only traded at specific times

continuous markets: trades occur at any time the market is open

pre-trade transparent: investors can obtain pre-trade information regarding quotes and orders

post-trade transparent: investors can obtain post-trade information regarding completed trade prices and sizes

- quote-driven markets

investors trade with dealers

dealers (market makers) who post bid and ask prices

AKA: dealer markets, price-driven markets, or over-the-counter markets

Most securities other than stocks trade in quote-driven markets.

Trading often takes place electronically

- order-driven markets

rules are used to match buyers and sellers

orders are executed using trading rules, anonymous traders

s1 order matching rules establish an order precedence hierarchy

- **price priority** highest priority are those at the highest bid (buy) and lowest ask (sell)- **secondary precedence rule** gives priority to non-hidden orders and earliest arriving orders

s2 trade pricing rules determine the price

- **uniform pricing rule** trade at uniform price that results in the highest volume of trading- **discriminatory pricing rule** uses the limit price of the order that arrived first as the trade price- derivative pricing rule

- brokered market

investors use brokers to locate a counterparty to a trade

especially valuable when the trader has a security that is unique or illiquid

large blocks of stock, real estate, and artwork

dealers typically do not carry an inventory of these assets

too few trades for these assets to trade in order-driven markets

k describe characteristics of a well-functioning financial system;

- in complete markets

*Investors can save for the future at fair rates of return.

*Creditworthy borrowers can obtain funds.

*Hedgers can manage their risks.

*Traders can obtain the currencies, commodities, and other assets they need.

- A well-functioning financial system_ _has complete markets that are:

*operationally efficient: market can perform functions at low trading costs

*informationally efficient: prices reflect all the information associated with fundamental value timely

*allocationally efficient: capital is allocated to its most productive use

l describe objectives of market regulation.

- 金融市场中的问题

Fraud and theft Insider trading Costly information Defaults

- 监管的目的

保护unsophisticated investors,建立市场信任

保持市场竞争,规范市场比较标准

防止损害其他投资者的内部交易行为

规范财务报告,降低信息成本

*维持资本市场体量

R37 Security Market Indexes

a describe a security market index;

- security market index: used to represent the performance of an asset class, security market, or segment of a market

constituent securities: individual securities in the index

b calculate and interpret the value, price return, and total return of an index;

price index: uses only the prices of the constituent securities in the return calculation

- price return: rate of return that is calculated based on a price index

- return index: includes both prices and income from the constituent securities

- total return: rate of return that is calculated based on a return index

R**P: portfolio return during the measurement period | k: total number of subperiods | R**sk portfolio return during the subperiod k

c describe the choices and issues in index construction and management;

- What is the target market the index is intended to measure?

- Which securities from the target market should be included?

- How should the securities be weighted in the index?

- How often should the index be rebalanced?

- When should the selection and weighting of securities be re-examined?

d compare the different weighting methods used in index construction;

- price-weighted index

price-weighted index: arithmetic average of the prices of the securities included in the index

等价portfolio: portfolio that has an equal number of shares in each of the constituent stocks

优:computation is simple

缺1:相同百分比变动,高价股票对指数价值影响更大

缺2:股票分割、回购、股利发放会影响股价→影响指数

例1: Dow Jones Industrial Average (DJIA)

例2: Nikkei Dow Jones Stock Average

- equal-weighted index

equal-weighted index: arithmetic average return of the index stocks for a given time period

等价portfolio: portfolio that had equal dollar amounts invested in each index stock

注:matching portfolio需要定期调整仓位,以使各成分股仓位价值相等(各股涨跌不一导致仓位变得不等)

优: 计算简单

缺: 仅以return计算均值, 资产规模小(大)的公司的权重会变得过大(小)

例1:Value Line Composite Average

例2:Financial Times Ordinary Share Index

- market capitalization-weighted index AKA value-weighted index

market capitalization-weighted index: weights based on the market capitalization of each index stock

等价portfolio:

优: not need to be adjusted when a stock splits or pays a stock dividend

缺: 个股权重会随着个股股价(下降)下降而上涨(下降) 被mispriced的股票会获得错误的权重

例: Standard and Poor’s 500 (S&P 500) Index Composite

market float: the total value of the shares that are actually available to the investing public, excludes the value of shares held by controlling stockholders

free float: market float calculation excludes shares that are not available to foreign buyers

float-adjusted market capitalization-weighted index: 将分子分母的股票数量都调整为available to invetor的number

控股股东控股程度较大的公司权重会下降

- fundamental weighting

fundamental weighting: weights based on firm fundamentals. eg. earnings, dividends, or cash flow.

优: 避免市场错误定价导致的错误权重

e calculate and analyze the value and return of an index given its weighting method;

- Price weighting** **

- Market capitalization weighting** **

- Equal weighting** **

f describe rebalancing and reconstitution of an index;

- rebalancing: primarily for equal-weighted indexes

adjusting the weights of securities in a portfolio to their target weights after price changes have affected the weights

for index calculations: rebalancing to target weights on the index securities is done on a periodic basis

考虑equal weight的等价投资组合,portfolio that had equal dollar amounts invested in each index stock

注:matching portfolio需要定期调整仓位,以使各成分股仓位价值相等(各股涨跌不一导致仓位变得不等)

- reconstitution: periodically adding and deleting securities that make up an index

新股被纳入指数→成为指数投资组合追踪目标→需求上升→股价上升

g describe uses of security market indexes;

- Reflection of market sentiment 市场情绪

- Benchmark of manager performance

- Measure of market return and risk 根据指数历史表现,计算期望与标准差(风险)

- Measure of beta and risk-adjusted return ‘CAPM’

Model portfolio for index funds 被动投资

h describe types of equity indexes;

Broad market index

衡量市场整体表现;一般包括90%以上整体市值

Wilshire 5000 Index: contains more than 6,000 equity securities

- Multi-market index

基于地理位置/发展阶段,多国市场的股票指数

Latin America indexes; emerging markets indexes; MSCI World Index

- Multi-market index with fundamental weighting

Uses market capitalization-weighting for the country indexes but then weights the country index returns in the global index by a fundamental factor (e.g., GDP)

prevents a country with previously high stock returns from being overweighted in a multi-market index

- Sector index

Measures the returns for an industry sector such as health care, financial, or consumer goods firms.

some sectors do better than others in various phases of the business cycle

- Style index

Measures the returns to market capitalization and value or growth strategies.

i describe types of fixed-income indexes;

- index types

index can based on *various sectors, *geographic regions, and *levels of country economic development.

index can based on type of *issuer or *collateral, *coupon, *maturity, *default risk, or *inflation protection.

TYPES: Broad market indexes, sector indexes, style indexes, and other specialized indexes

fixed-income特点

Commodity indexes

- issues: Weighting method ; Futures vs. actual

例:Thomson Reuters/Core Commodity CRB Index (Commodity Research Bureau Index )

例:S&P GSCI (Goldman Sachs Commodity Index)

- Real estate indexes

FTSE International produces a family of REIT indexe

- Hedge funds index

largely unregulated;upward bias

k compare types of security market indexes.

| Index | Reflects | Num. | Weighting Method | Notes |

|---|---|---|---|---|

| Dow Jones Industrial Average | Large U.S. stocks | 30 | Price | Stocks are chosen by Wall Street Journal editors |

| Nikkei Stock Average | Large Japanese stocks | 225 | Modified price | Price weighted and adjusted for high-priced shares |

| TOPIX | All stocks on the Tokyo Stock Exchange First Section | Variable | Market capitalization, adjusted for float |

Has a large number of small illiquid stocks making it hard to replicate. Contains 93% of the market cap of Japanese equities |

| MSCI All Country World Index | Stocks in 23 developed and 24 emerging markets | Variable | Market capitalization, adjusted for float |

Available in both U.S. dollars and local currency |

| S&P Developed Ex-U.S. BMI Energy Sector Index | Global energy stocks outside the United States | Variable | Market capitalization, adjusted for float |

Is the model portfolio for an ETF |

| Barclays Capital Global Aggregate Bond Index | Global investment-grade bonds | Variable | Market capitalization | Formerly compiled by Lehman Brothers |

| Markit iBoxx Euro HighYield Bond Indexes | Below investment-grade bonds | Variable | Market capitalization | Represents liquid portion of market and rebalanced monthly |

| FTSE EPRA/NAREIT Global Real Estate Index | Global real estate | Variable | Market capitalization, adjusted for float |

Represents publicly traded REITs |

| HFRX Global Hedge Fund Index | Global hedge funds | Variable | Asset weighted | Contains a variety of hedge fund strategies and is weighted based on the amount invested in each hedge fund |

| HFRX Equal Weighted Strategies EUR Index | Global hedge funds | Variable | Equal weighted | Contain same strategy funds as HFRX Global Hedge Fund Index and is equal weighted |

| Morningstar Style Indexes | U.S. stocks grouped by value/growth and mkt cap | Variable | Market capitalization, adjusted for float |

Nine categories classified by combinations of three cap categories and three value/growth categories |

R38 Market Efficiency

a describe market efficiency and related concepts, including their importance to investment practitioners;

- market efficiency

informationally efficient capital market: the current price of a security fully, quickly, and rationally reflects all available information about that security

passive investment/active investment

- importance

- 在perfect efficient market, 主动投资不会获得超额收益,反而因为费用较高回报会低于**被动投资

- 视inefficiency的程度,主动投资可能会在风险调整后获得超额收益

Only new information (information that is unexpected and changes expectations) should move prices

b distinguish between market value and intrinsic value;

market value: current price

- intrinsic value: the value that a rational investor with full knowledge about the asset’s characteristics would willingly pay

**↑**AKA fundamental value| cannot be known with certainy

c explain factors that affect a market’s efficiency;

- Number of market participants

参与者越多越高效;对外国投资者的限制

- Availability of information

信息越多越公开透明越高效;Exchange 与OTC市场;信息不对称

- Impediments to trading

交易限制越少越高效;卖空限制

- Transaction and information costs

交易/信息获取成本越小越高效;交易成本影响实际套利收益→影响市场定价

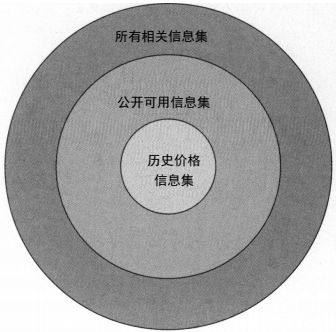

d contrast weak-form, semi-strong-form, and strong-form market efficiency;

EMH: efficient markets hypothesis

- weak-form

- current security prices fully reflect all currently available security market data.

- past price and volume (market) information will have no predictive power about the future direction of security prices because price changes will be independent from one period to the next

- In a weak-form efficient market, an investor cannot achieve positive risk-adjusted returns on average by using technical analysis. 弱型有效市场中技术分析不灵

- semi-strong-form

- security prices include all past security market information and nonmarket information available to the public 价格反映所有公开信息

- security prices rapidly adjust without bias to the arrival of all new public information

- an investor cannot achieve positive risk-adjusted returns on average by using fundamental analysis

- strong-form

- security prices includes all types of information: past security market information, public, and private (inside) information

- no group of investors has monopolistic access to information relevant to the formation of prices, and

- none should be able to consistently achieve positive abnormal returns

e explain the implications of each form of market efficiency for fundamental analysis, technical analysis, and the choice between active and passive portfolio management;

- 市场有效决定了某种分析方法是否能获得abnormal profit

- Abnormal profit AKA risk-adjusted returns: the unusual profits generated by given securities or portfolios over a specified period. The performance is different from the expected return for the investment.

The expected return is the estimated return based on an asset pricing model, using a long run historical average or multiple valuations.

abnormal profit可用于衡量市场有效性 根据某种策略是否能获得非正常收益,可确定相应的市场有效性

- Technical analysis: seeks to earn positive risk-adjusted returns by using historical price and volume (trading) data(不能在弱型有效市场中获得abnormal profit)

evidence: 发达市场:技术分析未能获得abnormal profit | 新兴市场:技术分析存在获得abnormal profit的机会

- Fundamental analysis: based on public information such as earnings, dividends, and various accounting ratios and estimates (不能在半强型有效市场获得annormal profit)

event study: examine abnormal returns before and after the release of new information that affects a firm’s intrinsic value, such as earnings announcements or dividend changes. 可用于检验市场是否半强型有效

*发达市场一般为半强型有效是场,基本面分析不能获得abnormal profit (另一方面,正是基本面分析使市场处于半强型有效)

- active and passive portfolio management

- semi-strong form efficient→被动投资更佳

- 有效市场中投资经理的作用:资产管理→匹配风险水平与预期收益

*portfolio diversification, *asset allocation, *tax management

f describe market anomalies;

market anomaly: something that would lead us to reject the hypothesis of market efficiency 市场异常

data mining AKA data snooping: investigating data until a statistically significant relation is found

- Anomalies in time-series data** **

- Calendar anomalies 日历效应

- January effect AKA turn-of-the-year effect: during the first five days of January, stock returns, especially for small firms, are significantly higher than they are the rest of the year (explaination↓)

- Calendar anomalies 日历效应

tax-loss selling: investors sell losing positions in December to realize losses for tax purposes and then repurchase stocks in January, pushing their prices up

window dressing: portfolio managers sell risky stocks in December to remove them from their year-end statements and repurchase them in January

- *Other calendar anomalies ↓

turn-of-the-month effect stock returns are higher in the days surrounding month end

day-of-the-week effect average Monday returns are negative

weekend effect positive Friday returns are followed by negative Monday returns

holiday effect pre-holiday returns are higher

- overreaction anomalies

overreaction effect: firms with poor stock returns over the previous three or five years (losers) have better subsequent returns than firms that had high stock returns over the prior period 对正面/负面好消息都反应过度

This pattern has been attributed to investor overreaction to both unexpected good news and unexpected bad news

- momentum anomalies

momentum effects: high short-term returns are followed by continued high returns

Both the overreaction and momentum effects violate the weak form of market efficiency because they provide evidence of a profitable strategy based only on market data

- Anomalies in cross-sectional data

- size effect: small-cap stocks outperform large-cap stocks

- value effect: value stocks** [lower price-to-earnings (P/E), lower market-to-book (M/B), and higher dividend yields] have outperformed growth stocks** [higher P/E, higher M/B, and lower dividend yields]. 违反半强型有效,根据公开信息获得了abnormal profit

- Other anomalies

- Closed-end investment funds: funds份额的价格和其NAV价格偏离,存在套利机会(也可能是需求紧俏)

net asset value, NAV

- Earnings announcements: 对surprise的股价调整需要一段时间完成

earnings surprise: portion of announced earnings that was not expected by the market

- Initial public offerings IPO的长期平均收益率低于平均收益,IPO存在overreact

- Economic fundamentals 基本面数据(股利收益率)和股票收益并不总consistent

- Implications

the majority of the evidence suggests that reported anomalies are not violations of market efficiency

but are due to the methodologies used in the tests of market efficiency.

both underreaction and overreaction have been found in the markets, meaning that prices are efficient on average

*Investment management based solely on anomalies has no sound economic basis

g describe behavioral finance and its potential relevance to understanding market anomalies.

- behavioral finance

behavioral finance: examines the actual decision-making processes of investors

loss aversion: investors dislike a loss more than they like a gain of an equal amount

investor overconfidence: a tendency of investors to overestimate their abilities to analyze security information and identify differences between securities’ market prices and intrinsic values.

herding: a tendency of investors to act in concert on the same side of the market, acting not on private analysis, but mimicking the investment actions of other investors. 羊群效应

information cascade: results when investors mimic the decisions of others 信息级联

If those who act first are more knowledgeable investors, others following their actions may, in fact, be part of the process of incorporating new information into securities prices and actually move market prices toward their intrinsic values, improving informational efficiency. 如果被模仿的是更富经验的投资者,那么羊群效应造成的信息级联可以提高市场有效性

- potential relevance to anomalies

*Whether widespread investor irrationality is the underlying cause of reported returns anomalies is an open question

*有效市场假说并未假设投资人理性。并无决定性证据说明投资人的不理性行为造成了anomalies

*行为金融可以用来解释市场价值为何偏离对内在价值的理性估计

SS13 Equity Investments (2)

R39 Overview of Equity Securities

a describe characteristics of types of equity securities;

- common shares

have a *residual claim (after the claims of 债权人和优选股股东) on firm assets if the firm is liquidated

*govern the corporation through voting rights

firms are under no obligation to pay dividends on common equity

common stockholders are able to vote for the board of directors, on merger decisions, and on the selection of auditors.

statutory voting: each share held is assigned one vote in the election of each member of the board of directors

cumulative voting: shareholders can allocate their votes to one or more candidates as they choose

- preference shares AKA preferred stock

*dividends are not a contractual obligation;*shares usually do not mature ;*no voting rights;

*periodic dividend payments;*maybe callable/putable

cumulative preference shares 固定股利,拖欠股利累计,且在发放普通股股利之前必须补齐

non-cumulative preference shares 固定股利,拖欠股利不累计,当期股利需在普通股股利之前发放

participating preference shares 公司业绩良好时,收到更多股利;公司清偿是可获得多余面值的份额

non-participating preference shares 股利和清偿严格按照面值与协议rate

convertible preference shares 可转换优先股

↑优:股利高于普通股;若公司表现良好,可转换为普通股;股价上升时,option价值↑;比普通股风险低(股利;倾城)

b describe differences in voting rights and other ownership characteristics among different equity classes;

- a firm may have different classes of common stock (e.g., “Class A” and “Class B” shares)

- one class may have greater voting power and seniority if the firm’s assets are liquidated.

- classes may be treated differently in dividends, stock splits, and other transactions with shareholders.

c distinguish between public and private equity securities;

Private equity

low liquidity; negotiated share price(而非市场决定); lower reporting costs;

potentially weaker corporate governance; greater ability to focus on long-term prospects

potentially greater return for investors once the firm goes public

TYPEs: venture capital; leveraged buyouts; private investment in public equity (PIPE)d describe methods for investing in non-domestic equity securities;

integrated markets: capital flows freely across borders

- Direct investing

Direct investing: buying a foreign firm’s securities in foreign markets

obstacle-1: investment and return are denominated in a foreign currency. 外国证券使用外币进行交易

obstacle-2: The foreign stock exchange may be illiquid. 流动性可能较低

obstacle-3: The reporting requirements of foreign stock exchanges may be less strict, impeding analysis. 信披要求不同

obstacle-4: Investors must be familiar with the regulations and procedures of each market in which they invest. 法规不同

- Depository receipts

depository receipts (DRs): A bank deposits shares of the foreign firm and then issues receipts representing ownership of a specific number of the foreign shares.

depository bank: acts as a custodian and manages dividends, stock splits, and other events

sponsored DR: the firm is involved with the issue provides the investor voting right**s; greater disclosure requirements

unsponsored DR : the firm is not involved with the issue the depository bank retains the voting rights

Global depository receipts (GDRs): issued outside the United States and the issuer’s home country

American depository receipts (ADRs): denominated in U.S. dollars and trade in the United States

American depository share: the security on which the ADR is based

Global registered shares: traded in different currencies on stock exchanges around the world.

basket of listed depository receipts (BLDR)**: an exchange-traded fund (ETF) that is a collection of DRs

e compare the risk and return characteristics of different types of equity securities;

return sources: *price changes, *dividend payments, *gains or losses from changes in exchange rates

————————

- Preferred stock have less risk than common stock

- Cumulative preferred shares have less risk than non-cumulative preferred shares

- Putable shares are less risky and callable shares are more risky compared to shares with neither option

Return is adjusted according to risk level

f explain the role of equity securities in the financing of a company’s assets;

权益资本的用途

purchase of long-term assets, equipment, research and development

expansion into new businesses or geographic areas.

used to buy other companies

offered to employees as incentive compensation

- 上市可以为公司提供流动性

Having publicly traded equity securities provides liquidity, which may be especially important to firms that need to meet regulatory requirements, capital adequacy ratios, and liquidity ratios.

g distinguish between the market value and book value of equity securities;

- market value of equity** **

the total value of a firm’s outstanding equity shares based on market prices

reflects the expectations of investors about the firm’s future performance

- book value of equity** **

the value of the firm’s assets on the balance sheet minus its liabilities

increases when the firm has positive net income and retained earnings that flow into the equity account.

h compare a company’s cost of equity, its (accounting) return on equity, and investors’ required rates of return.**

- accounting return on equity=**return on equity (ROE) **

ROE**t: period t 的ROE; NI**t: net income minus preferred dividends

BV不稳定时eq.1更适合;BV稳定时eq.2适合

- price-to-book ratio/**market-to-book ratio**

value stocks: firms with low price-to-book ratios

growth stocks: firms with high price-to-book ratios

- cost of equity与required rates of return

cost of equity: expected equilibrium total return (including dividends) on its shares in the market

*cost of equity can be interpreted as the minimum rate of return required by investors (in the aggregate) to compensate them for the risk of the firm’s equity shares.

At any point in time, a decrease in share price will increase the expected return on the shares and an increase in share price will decrease expected returns, other things equal. 考虑DDM中的分母

**attractive stock: _E(Return of S__i__)> minimum required rate of return on the shares, given their risk **_

Investors can have different required rates of return for a given risk, different estimates of a firm’s future cash flows, and different estimates of the risk of a firm’s equity shares.

R40 Introduction to Industry and Company Analysis

a explain uses of industry analysis and the relation of industry analysis to company analysis;

*行业分析为公司分析提供框架

通过对行业及其相关行业进行考察,透视行业内公司所处的商业环境

行业发展形势是信用分析的重要单元

performance attribution analysis中,根据portfolio中不同行业进行分组,分析industry attribution

积极管理策略中,分析师寻找被misvalued的行业,据此配置仓位

industry rotation: overweighting or underweighting industries based on the current phase of the business cycle.

b compare methods by which companies can be grouped, current industry classification systems, and classify a company, given a description of its activities and the classification system;

- group method

- products and services offered

sector: a group of similar industries

principal business activity: the largest source of sales or earnings

- sensitivity to business cycles** **

*cyclical and *non-cyclical firms

- statistical methods

groups firms that historically have had highly correlated returns.

limitations↓

Historical correlations may not be the same as future correlations.

The groupings of firms may differ over time and across countries.

The grouping of firms is sometimes non-intuitive.

The method is susceptible to statistical error

- current classification system

- commercial classifications

Global Industry Classification Standard;MSCI Barra;Russell Global Sectors ;Industry Classification Benchmark;FTSE

↑Standard & Poor’s ↑ Dow Jones

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|---|---|---|---|---|---|---|---|---|---|

| Basic materials and processing | Consumer discretionary | Consumer staples |

Energy firms | Financial services | Health care | Industrial and producer durables | Real estate | Technology | Telecommunications | Utilities |

| Building materials Metals, minerals, and mining Containers and packaging Paper and forest products *Chemicals |

Automotive Hotels and restaurants *Apparel |

Food Personal care products Tobacco Beverage |

Energy exploration Energy services Energy equipment Production *Refining |

Banking Brokerage Asset management Real estate financing *Insurance |

Pharmaceuticals Health care services Medical supplies Health care equipment Medical devices Biotech |

Heavy machinery and equipment Commercial services and supplies Transportation Defense *Aerospace |

Real estate investment trusts (REITs) Real estate services firms. |

Computers Consulting and services Electronic entertainment Internet services Communications equipment Semiconductors *Software |

wired and wireless *service providers | electric utilities water utilities *gas utilities |

- government classifications

International Standard Industrial Classification of All Economic Activities (ISIC)

Statistical Classification of Economic Activities in the European Community

Australian and New Zealand Standard Industrial Classification

North American Industry Classification System (NAICS)

- classify a company

c explain the factors that affect the sensitivity of a company to the business cycle and the uses and limitations of industry and company descriptors such as “growth,” “defensive,” and “cyclical”;

- factors

cyclical firm: earnings are highly dependent on the stage of the business cycle

Cyclical sector examples include energy, financials, technology, materials, and consumer discretionary

non-cyclical firm: produces goods and services for which demand is relatively stable over the business cycle

Non-cyclical sector examples include health care, utilities, and consumer staples

- ‘growth’,’defensive’,’cyclical’

Non-cyclical industries can be further separated into defensive (stable) or growth industries.

- some definitions

defensive industries: least affected by the stage of the business cycle

include utilities, consumer staples (such as food producers), and basic services (such as drug stores)

growth industries: demand so strong → largely unaffected by the stage of the business cycle

growth cyclical: firms with strong long-term growth potential that have revenue that is quite sensitive to economic cycles

- their limitations

‘cyclical’ industries 中经常包含不太受经济周期影响的’growth’ firms

non-cyclical industries can be affected by severe recessions

defensive industries may not always be safe investments

defensive industries may also contain some truly defensive and some growth firms

*不同国家所处经济周期阶段可能不同,所以跨国公司可能不好分类

d explain how a company’s industry classification can be used to identify a potential “peer group” for equity valuation;

peer group: a set of similar companies an analyst will use for valuation comparisons

form a peer group

使用commercial classification内容供应商定位行业内公司

公司财报中是否指出关键对手

关键对手财报中是否指出其他竞争对手

检索行业出版物中的信息

验证候选可比公司是否有相似的销售、利润贡献来源,是否处于同一市场

调整非金公司财报中财务子公司的数据

e describe the elements that need to be covered in a thorough industry analysis;

ELEMENTS↓

- 利用相关信息分析宏观变量和行业趋势的关系

- 利用不同方法、情景分析来估计行业变量

- 与其他人对行业变量的估计进行对比验证,找出不一致的根源

- 计算不同行业的相对估值

- 对比行业估值在长期/短期/经济周期的不同阶段的波动性(对long-term inv& short-term industry rotation有用)

- Analyze industry prospects based on strategic groups.

- 对行业的生命周期进行判断 embryonic, growth, shakeout, mature, declining.

- Position the industry on the experience curve. The curve declines because of increases in productivity and economies of scale, especially in industries with high fixed costs.

- 市场区域、宏观经济、政府、社会、技术发展对行业的影响

- 探明决定行业竞争的影响因素

strategic groups: groups of firms that are distinct from the rest of the industry due to the delivery _or _complexity _of _their products or barriers to entry.

e.g. full-service hotels are a distinct market segment within the hotel industry.

life-cycle stage

experience curve**: shows the cost per unit relative to output.

f describe the principles of strategic analysis of an industry;

economic profits: return on invested capital minus its cost

pricing power: elasticity of demand for the firm’s products

strategic analysis: examines how an industry’s competitive environment influences a firm’s strategy

- Michael Porter’s Five Forces

i Rivalry among existing competitors ⭐

ii Threat of entry⭐

iii Threat of substitutes

iv Power of buyers

v Power of suppliers

two key factors ‘**Rivalry among existing competitors ‘&’Threat of entry**’

Higher barriers to entry reduce competition.

Greater concentration reduces competition, market fragmentation increases competition

Unused capacity in an industry, especially if prolonged, results in intense price competition

Stability in market share reduces competition

More price sensitivity in customer buying decisions results in greater competition

Greater maturity of an industry results in slowing growth

g explain the effects of barriers to entry, industry concentration, industry capacity, and market share stability on pricing power and price competition;

- Barriers to Entry** **

High barriers to entry do not necessarily mean firm pricing power is high.

Other things equal,壁垒越高→新公司难以进入→降低行业内竞争

高退出壁垒、商品同质化会导致行业内公司之间的价格竞争加剧

- Industry Concentration** **

High industry concentration does not guarantee pricing power

与竞争对手的市场份额差距越大→竞争越小→pricing power越大

产品越同质化→pricing power越小;产品差异化越大→pricing power越大

*资本密集→行业进出壁垒→若产能过剩,价格竞争激烈

- Industry Capacity** **

Undercapacity(当前价位,需求超过供给)→higher pricing power→higher return on capital

Overcapacity(当前价位,需求小于供给 )→lower pricing power→lower return on capital

Capacity is fixed in the short run and variable in the long run.

producer可能过于乐观,提升过多产能,造成产能过剩(经济周期的扩张阶段)

有形产能/无形产能

有形且用途单一的产能 liquidity value可能较低,且难以切换生产线

- Market Share Stability** **

highly variable market share→highly competitive industry→little pricing power

stability的影响因素 ↓

barriers to entry, new products, innovations, switching costs

switching costs: 消费者选择另一公司产品时产生的成本

h describe industry life cycle models, classify an industry as to life cycle stage, and describe limitations of the life-cycle concept in forecasting industry performance;

- Industry life cycle

Stages of the Industry Life Cycle

| embryonic | growth | shakeout | mature | decline |

|---|---|---|---|---|

| Slow growth High prices Large investment required High risk of failure |

Rapid growth Limited competitive pressures Falling prices Increasing profitability |

Growth has slowed Intense competition Increasing industry overcapacity Declining profitability Increased cost cutting Increased failures |

Slow growth Consolidation High barriers to entry Stable pricing *Superior firms gain market share |

Negative growth Declining prices *Consolidation |

- applications

investigate whether a firm is “acting its age”

growth firms:应将利润进行再投资,以保持并进一步提升竞争力。提升产品性能,客户忠诚度,规模经济效应

mature firms:主要支付股利,因为现金流强劲但增长机会很少

analyst should be concerned about firms that do not act their stage, such as a mature firm that is investing in low-return projects for the sake of increasing firm size__

- limitations

Life-cycle analysis is likely most useful during stable periods, not during periods of upheaval when conditions are changing rapidly.

有些stage长短不一,有些stage可能被跳过

产品可能因为法规、技术发展等原因迅速退出市场

*行业内有些公司可能有比较优势

i compare characteristics of representative industries from the various economic sectors;

j describe macroeconomic, technological, demographic, governmental, and social influences on industry growth, profitability, and risk;

- macroeconomic** influences**

cyclical trends__

Interest rates _affect financing costs for firms and individuals, as well as financial institution profitability

_Credit availability affects consumer and business expenditures and funding.

Inflation _affects costs, prices, interest rates, and business and consumer confidence

_structural (longer-term) trends

More education→increase workers’ productivity and real wages→increase their demand for consumer goods

- technological** influences**

technology can change an industry dramatically through the introduction of new or improved products.

- demographic influences

age distribution and population size, other changes in the composition of the population.

- governmental** influences**

Governments have an important & widespread effect on businesses, (taxes, regulation, license,…)

- social influences

how people work, play, spend their money, and conduct their lives

k describe the elements that should be covered in a thorough company analysis.

- basic definition

company analysis: analyzing the firm’s financial condition, products and services, and competitive strategy

competitive strategy: how a firm responds to the opportunities and threats of the external environment

cost leadership (low-cost) strategy offer lowest prices, generate enough volume to make a superior return

predatory pricing: firm hopes to drive out competitors and later increase prices.

product or service differentiation strategy: firm’s products should be distinctive in terms of type, quality, or delivery

spreadsheet modeling performed with error that can compound over time

- elements

- Firm overview, including information on operations, governance, and strengths and weaknesses.

- Industry characteristics.

- Product demand.

- Product costs.

- Pricing environment.

- Financial ratios, with comparisons to other firms and over time.

- Projected financial statements and firm valuation.

R41 Equity Valuation: Concepts and Basic Tools

a evaluate whether a security, given its current market price and a value estimate, is overvalued, fairly valued, or undervalued by the market;

intrinsic value /fundamental value: rational value investors would place on the asset given full knowledge of the asset’s characteristics

| market price **> **value estimate | overvalued |

|---|---|

| maket price **= **value estimate | fair valued |

| market price **< **value estimate | undervalued |

market price与value estimate的偏离越多,越倾向于take position(交易成本角度;假设检验角度)

model 的validity/sensitivity,input的accessability/precision,影响是否take position

market misprice的原因是什么?价格回归到value estimate的时间尺度是多久?

b describe major categories of equity valuation models;

- discounted cash flow models AKA present value models

- dividend discount models: the present value of cash distributed to shareholders

- free cash flow to equity models: the present value of cash available to shareholders after the firm meets its necessary capital expenditures and working capital expenses

- multiplier models AKA market multiple models

- ratio of** stock price to fundamentals**: used to determine if a stock is fairly valued

earnings, sales, book value, or cash flow per share

- ratio of** enterprise value to fundamentals**

earnings before interest, taxes, depreciation, and amortization (EBITDA) or revenue

enterprise value: market value of all a firm’s outstanding securities minus cash and short-term investments.

asset-based models** **

intrinsic value of common stock **= total asset value - liabilities -** preferred stock

assets and liabilities are typically adjusted to __fair valuesc describe regular cash dividends, extra dividends, stock dividends, stock splits, reverse stock splits, and share repurchases;

- Dividends** **

cash dividends: payments made to shareholders in cash

regular dividends: pays out a portion of profits on a consistent schedule

special dividends : the firm to make a one-time cash payment to shareholders

↑AKA extra dividends, irregular dividends

stock dividends: dividends paid out in new shares of stock rather than cash.

↑more shares outstanding, but each one will be worth less

- Stock splits

stock splits: divide each existing share into multiple shares, creating more shares.

no change in the owner’s wealth

Reverse stock splits the opposite of stock splits

- share repurchase

share repurchase: company buys outstanding shares of its own common stock

an alternative to cash dividends as a way of distributing cash to shareholders

have the same effect on shareholders’ wealth as cash dividends of the same size

*用来抵消雇员股票期权行权带来的流通股数量增加

d describe dividend payment chronology

- declaration date: 股利宣布日,董事会宣布发放股利的日期

- ex-dividend date: 除息日,在这一天,股票将不再含有股利,卖者仍可享受股利. 股价会在除息日下跌

- holder-of-record date AKA record date: 股权登记日,宣布的股利只分配给这一天拥有公司股票的股东

- payment date: payment is made

e explain the rationale for using present value models to value equity and describe the dividend discount and free-cash-flow-to-equity models;

- rational for present value model

intrinsic value of stock is the present value of future cash flows

- dividend discount model

- general form

V**0: current stock value; D**t: dividend at time t; k**e**: required rate of return on common equity

- One-year holding period DDM

持有一年就卖掉,收入=PV当年股利+PV年末股价

terminal value: expected price of the stock at the end of the year

Multiple-year holding period DDM

The most general form of the DDM uses an infinite holding period because a corporation has an indefinite life. ↓类似永续债券

In an infinite-period DDM model, the PV of a**ll expected future dividends is calculated and no explicit terminal value_ **for the stock_

- free-cash-flow-to-**equity **model

represents the potential amount of cash that could be paid out to common shareholders

reflects the firm’s capacity to pay dividends.

*useful for firms that do not currently pay dividends. 可用于分析现在不发放股利的公司

general form

FCFE的计算

↑ ↓都可以

net borrowing: the increase in debt during the period (i.e., amount borrowed minus amount repaid)

↑assumed to be available to shareholders

- required return for equity k的计算

f calculate the intrinsic value of a non-callable, non-convertible preferred stock;

不含权优先股类似于永续年金

<br />这里注意:对应的情况是从下一年开始发放股利

g calculate and interpret the intrinsic value of an equity security based on the Gordon (constant) growth dividend discount model or a two-stage dividend discount model, as appropriate;

- Gordon (constant) growth DDM

- Gordon growth model AKA constant growth model: 股利年增长率为常数

V**0: PV of the expected future dividends;| D**t: period t‘s dividend;| k**e: cost of equity;| g**c: constant annual growth rate of dividends

- assumptions of the Gordon growth model

dividends are the appropriate measure of shareholder wealth.

**g**c, k**e** are constant

k*e must be greater than g**c. 否则结果为负值

- how to determine g**c**

historical growth in dividends for the firm.

median industry dividend growth rate.

sustainable growth rate.

sustainable growth rate : the rate at which equity, earnings, and dividends can continue to grow indefinitely assuming that ROE __is constan_t, the dividend payout ratio is constant, and no new equity_ is sold

*retention rate: 1-dividend payout ratio

- two-stage DDM

- multistage dividend discount model:** **

适合短期内呈现高增长(不可持续)的公司

↑

- two-stage DDM

- 非永续增长阶段的股利计算

计算此阶段内的股利现值

- 永续增长阶段的股价计算

h identify characteristics of companies for which the constant growth or a multistage dividend discount model is appropriate;

- Gordon growth model: stable and mature, non-cyclical, dividend-paying firms

- multistage growth model: dividend-paying firms with dividends that are expected to grow rapidly, slowly, or erratically over some period, followed by constant dividend growth

*three stages model: growth, transition, and maturity

When a firm does not pay dividends, estimates of dividend payments some years in the future are highly speculative.

FEFE or multiplier MODEL 可能更合适

i explain the rationale for using price multiples to value equity, how the price to earnings multiple relates to fundamentals, and the use of multiples based on comparables;

- rationale for using price multiples

price multiple: compare a stock’s price multiple to a benchmark value based on an index, industry group of firms, or a peer group of firms within an industry

TYPES: *price-to-earnings; *price-to-cash flow; *price-to-sales; *price-to-book value ratios

优1:easily calculated

优2:can be used in time series and cross-sectional comparisons

优3:useful for predicting stock returns: low multiples associated with higher future returns

缺:reflect only the past because historical (trailing) data are often used in the denominator

↑ 改进: 利用fundamental的预测值计算price multiples

price to earning

multiples based on comparables

price multiples based on comparables: 根据market price计算price multiples,进行公司之间的比较

price multiples based on fundamentals: 根据valuation model(计算出来的price)计算price multiples

j calculate and interpret the following multiples: price to earnings, price to an estimate of operating cash flow, price to sales, and price to book value;

calculating multiples | MULTIPLES | FORMULA | NOTE | | —- | —- | —- | | Price-earnings (P/E) ratio |

| | | Price-sales (P/S) ratio |

| | | Price-book value (P/B) ratio |

| | | Price-cash flow (P/CF) ratio |

| CF may be defined as operating cash flow or free cash |

modified version

justified P/E: P/E based on fundamentals

D**/E**=expected dividend payout ratio; k=required rate of return on the stock; g=expected constant growth rate of dividends

leading P/E ratio: based on expected earnings next period

trailing P/E ratio: based actual earnings for the previous period

dividend displacement of earnings: while higher dividends will increase firm value, a lower growth rate will decrease firm value

law of one price: two comparable assets should have approximately the same multiple (price multiple version)

k describe enterprise value multiples and their use in estimating equity value;

- EV的定义

Enterprise value (EV) measures total company value

可视为收购公司的成本| 适合用来比较资本结构差异较大公司之间的价值差异

普通股市价+优先股市价+(短期+长期)debt市价-现金与短期投资

注:在计算债务价值时,可讲short-term debt的book value作为market value

- EV multiples

Because the numerator represents total company value, it should be compared to earnings of both **debt and equity **owners

常用multiple:

;

EBITDA中包含非现金项目

operating income 可能小于零,此时multiple无意义

l describe asset-based valuation models and their use in estimating equity value;

asset-based models

use in estimating equity value

- 问题↓

*资产市场价值通常较难获得,一般通过对BS进行分析, ‘估计’资产和负债的’价值’

*无形资产、表外资产、雇员talent、客户关系难以度量

- Asset-based model valuations are most reliable when

*firm has primarily tangible short-term assets, assets with ready market values

↑ (e.g., financial or natural resource firms)

*firm will cease to operate and is being liquidated

m explain advantages and disadvantages of each category of valuation model.

- discounted cash flow models

优1: 折现概念有理论基础

优2: widely accepted in the analyst community

缺1: inputs must be estimated

缺2: value estimates are very sensitive to input values

- price multiples

- comparable valuation using price multiples

优1: some price multiples are useful for predicting stock returns

优2: widely used by analysts

优3: readily available

优4: can be used in time series and cross-sectional comparisons

优5: EV/EBITDA可用于比较资本结构不同的公司

缺1: lagging price multiples reflect the past.

缺2: 规模不同、产品不同、发展趋势不同的公司的price multiple可能不具有可比性

缺3: cyclical firms的price multiple可能受当期经济状况影响较大

缺4: A stock may appear overvalued by the comparable method but undervalued by a fundamental method or vice versa

缺5: 不同会计方法导致price multiple不可比

缺6: 分母为负值时price multiple无意义(earning为负时的P/E ratio)

- price multiple valuations based on fundamentals

优1: based on theoretically sound valuation models

优2: correspond to widely accepted value metrics

缺1: very sensitive to the inputs (especiallythe k-g denominator)

- asset-based models** **

优1: provide floor values

优2: 短期有形资产占主/资产市价方便获取/*公司清算 时,最有效

优3: increasingly useful for valuing public firms that report fair values

缺1: 市场价格难以准确获取

缺2: 市价和账面价值经常存在差异

缺3: 公司无形资产等占比较高时模型不可靠

缺4: 恶性通膨时难以获得可靠价格

![[F] Equity Investments - 图14](/uploads/projects/jianzhou@enxqsv/0a3176b1a660cdb1424034eceeeab101.jpeg)