1、Proceedings

- The CFA Institute Board of Governors maintains oversight and responsibility for the Professional Conduct Program (PCP), which, in junction with Disciplinary Review Committee (DRC), is responsible for enforcement of the Code and Standards.

- Self-disclosure on annual Professional Conduct Statements of involvement in civil litigation or a criminal investigation, or that the member or candidate is the subject of a written complaint.

- Written complaints about professional conduct received by the Professional Conduct staff.

- Evidence of misconduct by a member or candidate that the Professional Conduct staff received through public sources, such as a media article or broadcast.

- A report by a CFA exam proctor(监考人员)of a possible violation during the examination.

- Once an inquiry is initiated, Professional Conduct staff may requests (in writing) an explanation from the subject member or candidate and may:

- interview the subject member or candidate

- interview the complainant or other third parties

- collect documents and records relevant to the investigation

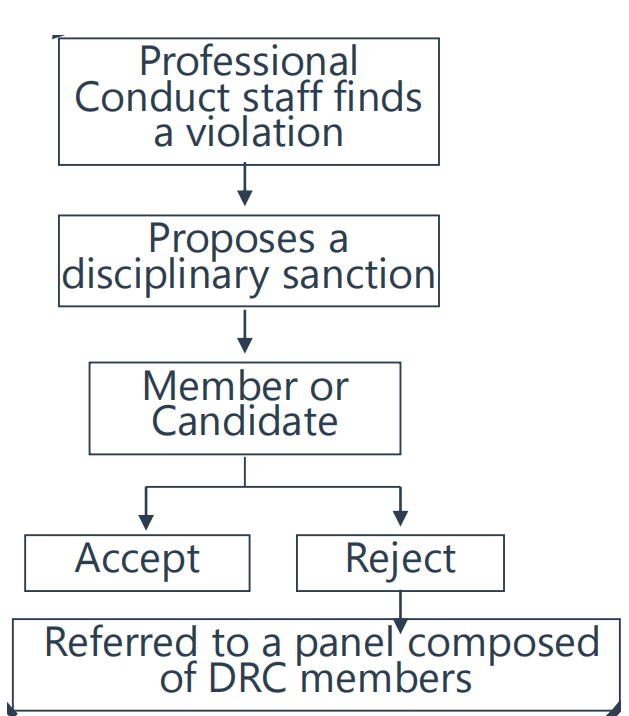

- The Professional Conduct staff may decide:

- that no disciplinary sanctions are appropriate

- to issue a cautionary(警告的; 告诫的; 劝告的)letter

- to discipline the member or candidate

2、The panel

- If the member or candidate does not accept the charges and proposed sanction, the matter is referred to a panel composed of DRC (Discipline Review Committee) members.

- panel:

- n. 面板; (门、墙等上面的)嵌板,镶板,方格板块; 控制板,仪表盘; (车身的)金属板,板金; (衣服上的)镶条,嵌条,饰片; 专家咨询组

- vt. 镶板(用木或玻璃板等镶嵌或装饰

- panel:

- Panels review materials and presentations from Professional Conduct staff and from the member or candidate.

- The panel’s task is to determine whether a violation of the Code and Standards or testing policies occurred and, if so, what sanction should be imposed.

Sanctions imposed by CFA Institute may have significant consequences; they include public censure(严厉斥责,谴责; 责难), suspension of membership and use of the CFA designation, and revocation of the CFA charter. Candidates enrolled in the CFA Program who have violated the Code and Standards or testing policies may be suspended or prohibited from further participation in the CFA Program.

AMC

- The Asset Manager Code (AMC) of Professional Conduct, which is designed, in part, to help asset managers comply with the regulations mandating codes of ethics for investment advisers.

- AMC was drafted specifically for firms.

Code and Standards

Members of CFA Institute (“Members and Candidates”) must:

- Act with integrity, competence, diligence, respect, and in an ethical manner with the public, clients, prospective clients, employers, employees, colleagues in the investment profession, and other participants in the global capital markets.

- Place the integrity of the investment profession and the interests of clients above their own personal interests.

- Use reasonable care and exercise independent professional judgment when conducting investment analysis, making investment recommendations, taking investment actions, and engaging in other professional activities.

- Practice and encourage others to practice in a professional and ethical manner that will reflect credit on themselves and the profession.

- Promote the integrity and viability(生存能力; 生命力; 活力; 寿命; 耐用性; 服务期限; 可行性)of the global capital markets for the ultimate benefit of society.

- Maintain and improve their professional competence and strive to maintain and improve the competence of other investment professionals.