A:Loyalty, prudence and care

- Members and Candidates have a duty of loyalty to their clients and must act with reasonable care and exercise prudent judgment.

Must act for the benefit of their clients and place their clients’ interests before their employer’s or their own interests.

(1)Guidance

Exercise prudence, care, skill, and diligence.

- Fiduciary (acting for the benefit of another party) requires higher duty to other business duty.

- A fiduciary is someone who acts for the benefit of someone else.

- In a position of trust, fiduciaries owe undivided loyalty to their clients and must place clients’ interests before their own.

- Prudent man rule:A fiduciary must direct and operate the client’s assets according to a higher standard of loyalty and extra care than the standard to which most people are held.

- Any pooling of funds must be managed in strict accordance to the trust documents.

- Fiduciary:[fɪˈdjuːʃəri] adj. 信托的; 信用的; (尤指)受委托的,受信托的; 基于信用的; n. (尤指财产)受信托人(或公司)

- Prudence requires caution and discretion.

- The exercise of prudence requires acting with care, skill, and diligence in the circumstances that a reasonable person acts in a like capacity and familiar with such matters would use.

- In managing a client’s portfolio, prudence requires following the investment parameters set by the client and balancing risk and return.

- Acting with care requires a prudent and judicious(明智的; 有见地的; 明断的)manner in avoiding harm to clients.

- Standard 3-A, is not a substitute for legal or regulatory obligations.

The duty required in fiduciary relationships exceeds what is acceptable in many other business relationships because a fiduciary is in an enhanced position of trust.

(a)Understanding the Application of Loyalty,Prudence and Care

Although fiduciary duty often encompasses the principles of loyalty, prudence and care, Standard 3-A does not render all members and candidates fiduciaries.

- The responsibilities of members and candidates for fulfilling their obligations under this standard depend greatly on the nature of their professional responsibilities and the relationships they have with clients.

两个特别提出的岗位:

- Trade execution:a trade execution professional must prudently work in the client’s interest when completing requested trades. Acting in the client’s best interest requires these professionals to use their skills and diligence to execute trades in the most favorable terms.

- Blended environment where they execute client trades and offer advice on a limited set of investment options.

- The extent of the advisory arrangement and limitations should be outlined in the agreement with the client at the outset(开始; 开端 ; 起始)of the relationship. For instance, members and candidates should inform clients that the advice provided will be limited to the propriety products of the firm and not include other products available on the market.

- Recommend the allowable products that are consistent with the client’s objectives and risk tolerances.

- 不管是不是资产管理的岗位,所有的从业人员都必须要以客户利益为先。

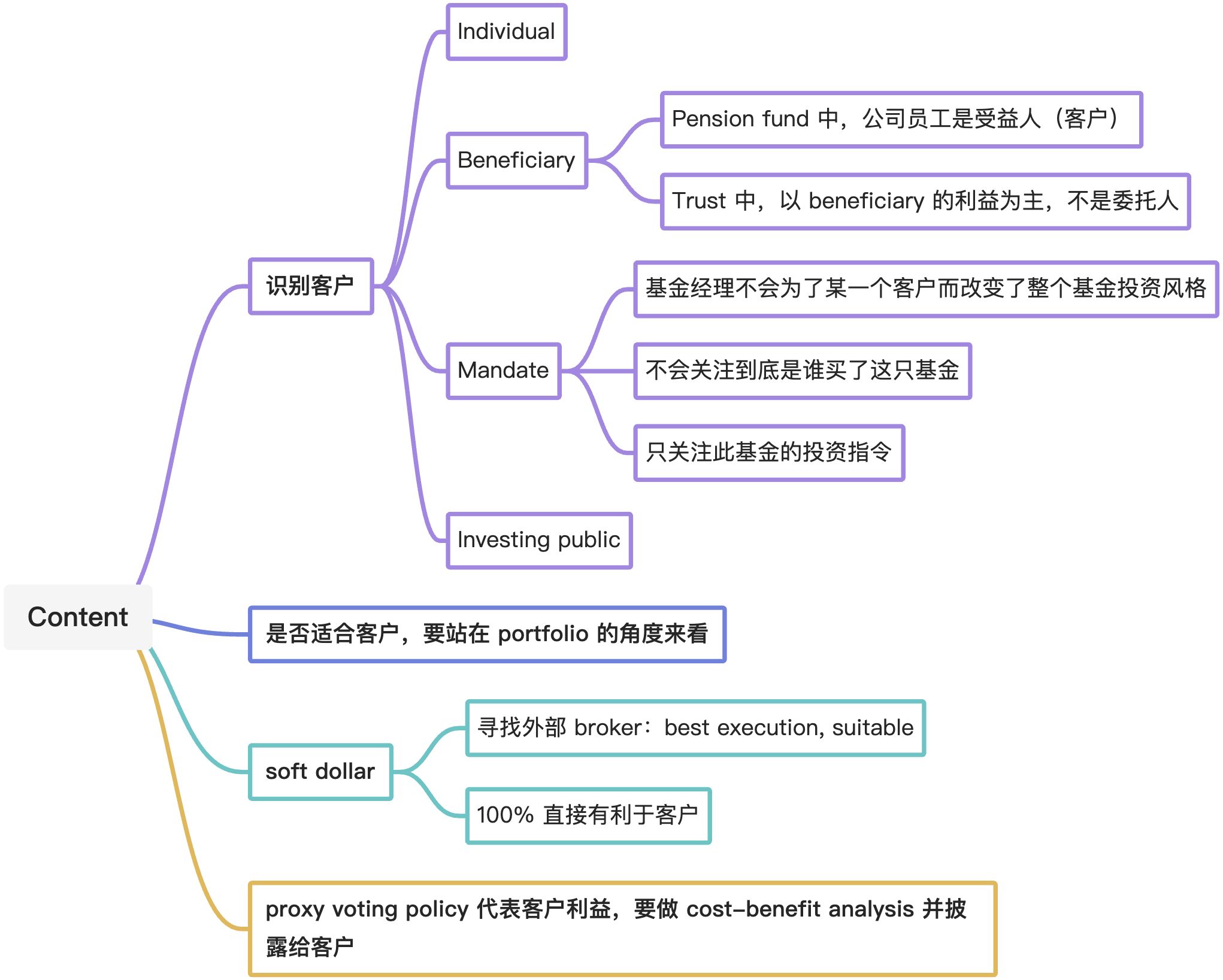

(b)Identifying the Actual Investment Client

Determine the identity of the “client” to whom the duty of loyalty is owed.

4 types of clients

- Individual

- In the context of an investment manager managing the personal assets of an individual, the client is easily identified.

- Beneficiary

- When the manager is responsible for the portfolios of pension plans or trusts, the client is the beneficiaries of the plan or trust. The duty of loyalty is owed to the ultimate beneficiaries.

- Mandate

- Members and candidates managing a fund to an index or an expected mandate owe the duty of loyalty, prudence, and care to the stated mandate.

- Investing public

- Individual

Members must put their obligation to clients first in all dealings and follow any guidelines set out by their clients for the management of their assets. Investment decisions must be judged in the context of the total portfolio rather than by individual investments within the portfolio.(必须把客户的利益放在最高位,要严格按照客户的要求进行投资,并站在整个组合的角度进行投资)

- The duty of loyalty, prudence, and care to client is especially important because the investment manager typically possesses greater knowledge in investment than the client does. This disparity places the individual client in a vulnerable position; the client must trust the manager.

- The manager in these situations should ensure that the client’s objectives and expectations of the account are realistic and suitable to their circumstances and that the risks involved are appropriate.

- In most circumstances, recommended investment strategies should relate to the long-term objectives and circumstances of the client

- Particular care must be taken to detect whether the goals of the investment manager or the firm in placing business, selling products, and executing security transactions potentially conflict with the best interests and objectives of the client.

Must follow any guidelines set by their clients for asset management.

(d)【IMP】Soft Commission Policies

An investment manager often has discretion over the selection of brokers executing transactions. Conflicts arise when an investment manager uses client brokerage to purchase research services(”soft dollars” or “soft commissions”).

- brokerage:经纪业务; 经纪人佣金(或回扣)

- Whenever using client brokerage to purchase goods or services that do not benefit the client, should disclose to clients the methods or policies followed in addressing the potential conflict.

- A member or candidate who pays a higher commission than he or she would normally pay to purchase goods or services, without corresponding benefit to the very client, violates 3-A.(购买服务的开销不合理的偏高了,有损客户利益)

Directed brokerage:A client will direct a manager to use the brokerage to purchase goods or services for the client. Because brokerage commission is an asset of the client and is used to benefit that client, not the manager, such a practice does not violate any duty of loyalty.

- Obligated to seek “best execution” and “best price”, and assured that the goods or services purchased from the brokerage will benefit the account beneficiaries.

- “Best execution” refers to a trading process that seeks to maximize the value of the client’s portfolio within the client’s stated investment objectives and constraints.

- Should disclose to the client and obtain written consent that the client may not get best execution from the directed brokerage if he insist on trading through that broker.

(e)Proxy Voting Policies

Voting proxies in an informed and responsible manner.

- Proxies have economic value to a client. Must ensure properly safeguard and maximize this value.

- An investment manager who fails to vote, casts a vote without considering the impact of the question, or votes blindly with management on non-routine governance issues may violate 3-A.

- A cost-benefit analysis may show that voting all proxies may not benefit the client, so voting proxies may not be necessary in all instances.

Regular account information.

- Members and candidates with control of client assets should submit to each client, at least quarterly, an itemized statement showing:

- the funds and securities in custody plus all debits, credits, and transactions that occurred during the period.

- custody:保管; (尤指在候审时的)拘留; 羁押; 监护; 监护权; 拘押; 保管权

- debit:n. 借方; 借记; 借项; 收方; vt. 记入(账户)的借方; 借记

- should disclose to the client where the assets are to be maintained, where or when they are moved

- should separate the client’s assets from any other party’s assets, including the member’s or candidate’s own assets.

- the funds and securities in custody plus all debits, credits, and transactions that occurred during the period.

- Members and candidates with control of client assets should submit to each client, at least quarterly, an itemized statement showing:

- Client approval

- If uncertain about the appropriate action to a client, should ask what he or she would expect or demand if he were the client.

- If in doubt, should disclose questionable matter in writing to the client and obtain client approval.

- When taking investment actions, must consider the appropriateness and suitability of the investment relative to:

- the client’s needs and circumstances

- the investment’s basic characteristics

- the basic characteristics of the total portfolio.

- Diversify

- Should diversify investments to reduce the risk of loss, unless diversification is not consistent with plan guidelines or is contrary to the account objectives.

Vote proxies

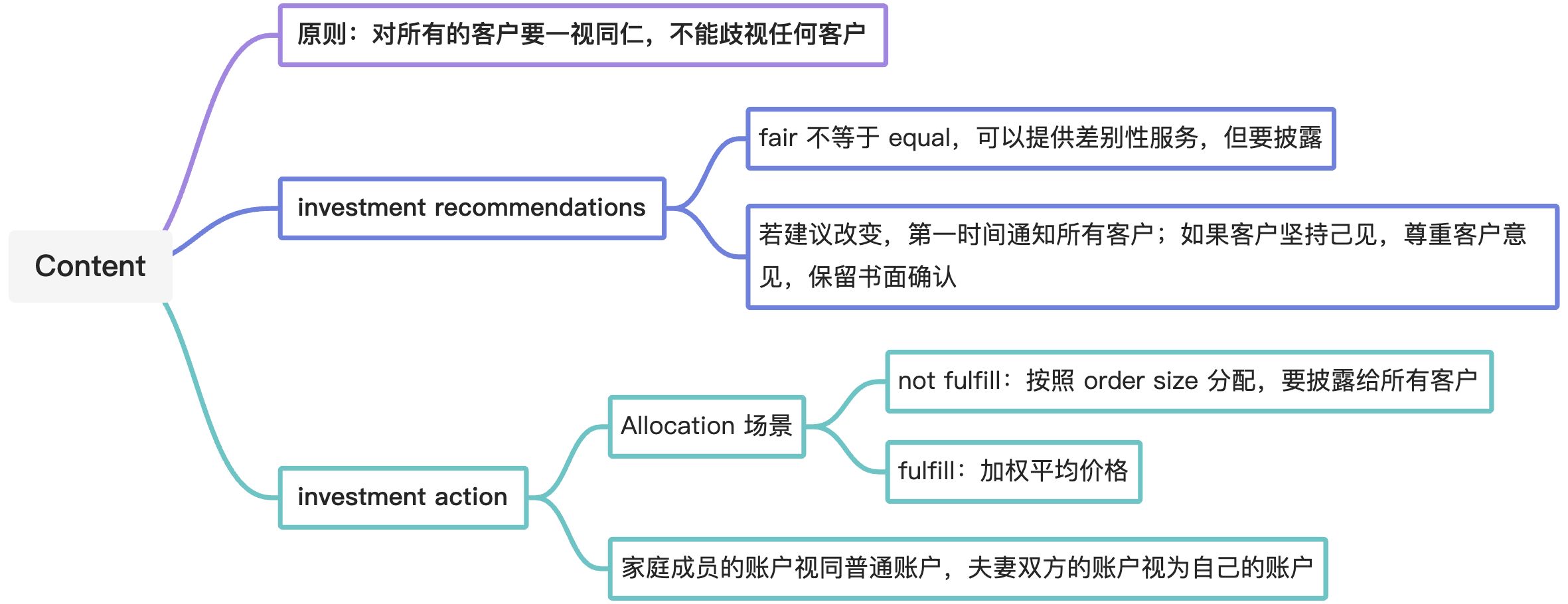

Must deal fairly and objectively with all clients when

Fairly ≠ equally

- Fairly:Not to discriminate against any clients when disseminating recommendations or taking investment action.

- Equally:Not required to treat all clients exactly the same, e.g. reach all clients exactly the same time, by e-mail or telephone.

- Premium level service is okay, if not disadvantage or negatively affect other clients. Should be disclosed to clients and available to everyone (should not be selective).

- 公平不等于平等,允许根据不同的收费标准向客户提供不同的服务,但必须向客户披露这种差别。(对于重要的事实,无论客户等级,一视同仁,不可使一般客户收到伤害)

Trade:equitable system, pro rata on order size, not on account size.

(a)Investment Recommendation

Ensure that information is disseminated in a manner that all clients have a fair opportunity to act on every recommendation.

- should encourage their firms to design an equitable(公平的; 公正的; 公平合理的)system to prevent selective or discriminatory disclosure

- should inform clients about what kind of communications they will receive.

Material changes in prior recommendations should be communicated to all current clients; particular care should be taken that the information reaches those clients who have acted on or been affected by the earlier advice.

Treat all clients fairly in light of investment objectives and circumstances.

- When making investments in new offerings or in secondary financings, should distribute the issues to all customers who are suitable for the investment and consistent with the policies of allocating blocks of stock.

- If the issue is oversubscribed(供不应求的,未能达到需求量的), should be prorated to all subscribers.

- should be taken on a round-lot basis to avoid odd-lot distributions.

- if the issue is oversubscribed, should forgo any sales to themselves or immediate families in order to free up additional shares for clients.

- prorate:按比例; 分摊; 按比例分配; 分派

- odd-lot:零星交易;零星散股;零担货物

- If the investment professional’s family-member accounts are managed similarly to the accounts of other clients of the firm, these accounts should not be excluded from buying such shares.

- Must make every effort to treat all individual and institutional clients in a fair and impartial(公正的; 不偏不倚的; 中立的) manner.

- Disclose to clients and prospective clients the documented allocation procedures in place and how the procedures would affect them.

Should not take advantage of their position to the detriment of clients.

(2)Recommended Procedures for compliance

Develop firm policies

- an investment advisor who is a sole proprietor(所有人; 业主) and handles only discretionary accounts might not disseminate recommendations to the public, but should have formal written procedures to ensure that all clients receive fair investment action

- Consider the following points when establishing compliance procedures:

- Limit the number of people who are privy to the fact that a recommendation is going to be disseminated

- privy:[ˈprɪvi] adj. 准许知情; 可参与秘事; n. (户外)厕所,茅房

- Shorten the time frame between decision and dissemination

- Publish guideline for pre-dissemination behavior

- Simultaneous dissemination

- Maintain a list of clients and their holdings

- Develop and document trading allocation procedures

- Limit the number of people who are privy to the fact that a recommendation is going to be disseminated

- Disclose trade allocation procedures

- Establish systematic account review procedures to detect whether trading in one account is being used to benefit a favored client

- Disclose the level of services available

- Shorten the time frame between decision and dissemination

- If a detailed recommendation is still in preparation, should publish a short summary including the conclusion in advance.

- In large firms with extensive review process, the long passage of time is not within the control of the analyst. Should communicate to customers and firm personnel by an update on “flash”report

- If a detailed recommendation is still in preparation, should publish a short summary including the conclusion in advance.

- Simultaneous dissemination

- Should not give favored clients info when such action may disadvantage other clients.

- Discuss with some clients after email dissemination, okay.

- Develop and document trade allocation procedures:develop a guiding principles that ensure

- fairness to advisory clients, both in priority of execution of orders and in the allocation of the price in execution of block orders or trades

- timeliness(合时) and efficiency in the execution of orders

- accuracy of the records as to trade orders and client account positions.

- Disclose trade allocation procedures

- Trade allocation procedures must be fair and equitable(公平的; 公正的; 公平合理的).

- Disclosure of inequitable allocation methods does not relieve the member or candidate of this obligation.

Should develop or encourage their firm to develop written allocation procedures, with particular attention to procedures for block trades and new issues.

- Document orders and time stamped

- FIFO basis

- Develop a policy to calculate execution prices and “partial fills” in a block trade for efficiency

- same commission, same price

- pro rata on basis of order size

- obtain advance indications of interest, allocate securities by client (not portfolio manager), and provide a method for calculating allocations when allocating for new issues. Why?

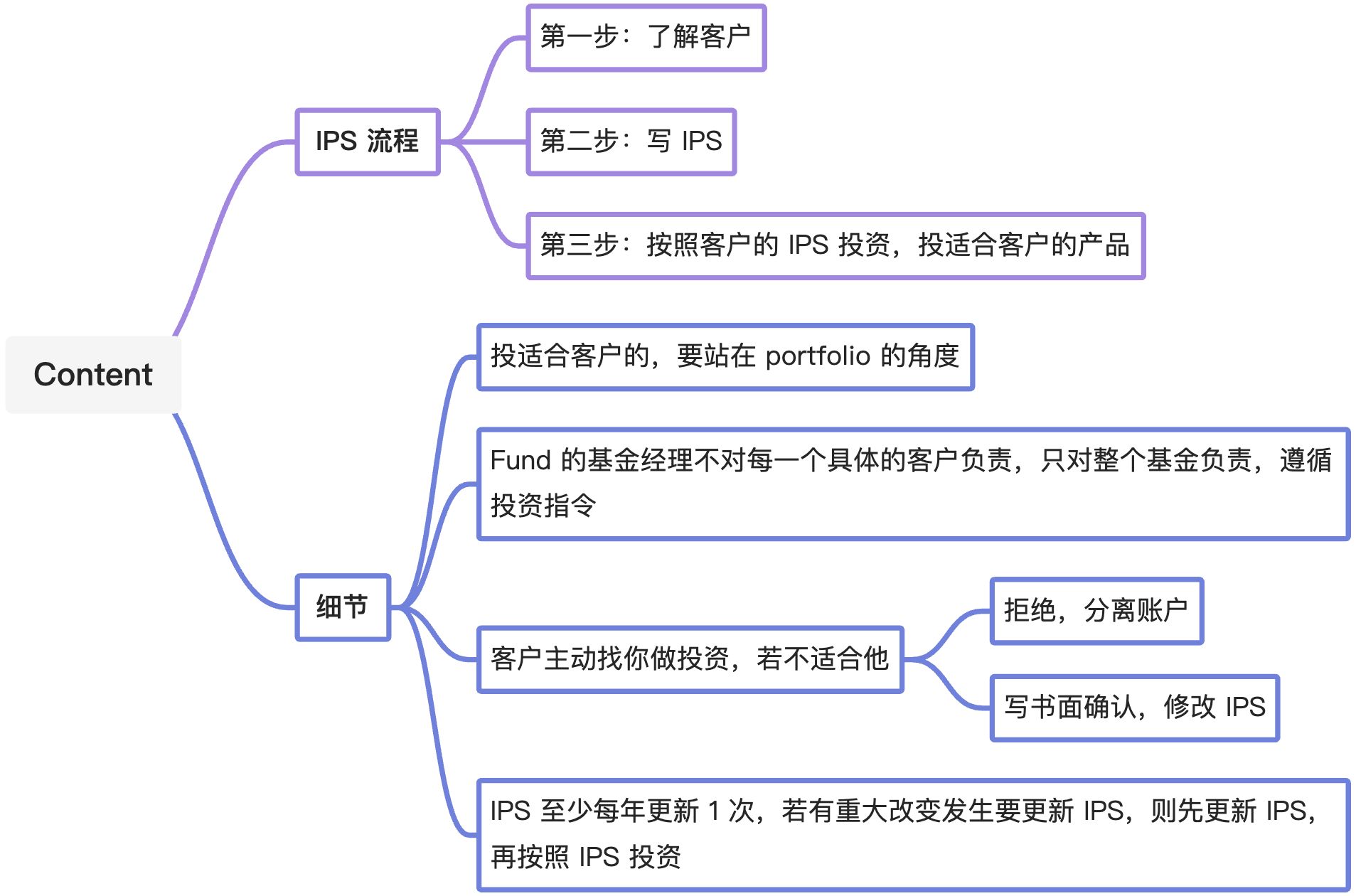

When in an advisory relationship with a client, must:

- Make a reasonable inquiry into a client or prospective client’s investment experience, risk and return objectives, and financial constraints prior to making any investment recommendation or taking investment action, must reassess and update regularly.

- Determine that an investment is suitable to the client’s financial situation and consistent with written objectives, mandates, and constraints before making an investment recommendation or taking investment action.

- Judge the suitability in the context of the client’s total portfolio.

When responsible for managing a portfolio to a specific mandate, strategy, or style, must only make investment recommendations or take investment actions that are consistent with the stated objectives and constraints of the portfolio.

(1)Guidance

Developing an Investment Policy

- In an advisory relationship, must gather client information at the inception of the relationship.

- Information includes the client’s financial circumstances, personal data (such as age and occupation) that are relevant to investment decisions, attitudes toward risk, and objectives in investing.

- Information should be incorporated into a written investment policy statement (IPS) that addresses the client’s risk tolerance, return requirements, and all investment constraints

- In an advisory relationship, must gather client information at the inception of the relationship.

- Understanding the Client’s Risk Profile

- One of the most important factors to be considered in matching appropriateness and suitability of an investment with a client’s needs and circumstances is measuring that client’s tolerance for risk.

- Updating an Investment Policy

- Updating the IPS should be repeated at least annually and also prior to material changes to any specific investment recommendations.

- The Need for Diversification

- An investment with high relative risk may be suitable in the context of the entire portfolio or when the client’s stated objectives contemplate(考虑; 沉思; 思忖; 深思熟虑; 思量; 端详; 苦思冥想; 考虑接受) speculative or risky investments.

- The manager may be responsible for only a portion of the client’s total portfolio, or the client may not have provided a full financial picture.

- Members and candidates can be responsible for assessing the suitability of an investment only on the basis of the information and criteria actually provided by the client.

- Managing to an Index or Mandate

- Responsibility is to invest in a manner consistent with the stated mandate.

- Those who manage pooled assets to a specific mandate are not responsible for any individual investor.

- Only those who have advisory relationship are responsible for individual clients.

Addressing Unsolicited Trade Requests

- Unsolicited trades request(未经请求的交易请求) that a member or candidate knows are unsuitable for a client.

- Unsolicited:自发的; 未经要求的; 自我推荐的; 未被要求的

- The member or candidate should refrain from making the trade until he or she discusses the concerns with the client.

- An unsolicited request may be expected to have only a minimum impact on the entire portfolio because the size of the requested trade is small or the trade would result in a limited change to the portfolio’s risk profile.

- necessary client approval for executing unsuitable trades.

- At a minimum, the client should acknowledge the discussion and accept the conditions that make the recommendation unsuitable.

- Unsolicited request expected to have a material impact on the portfolio, the member or candidate should use this opportunity to update the investment policy statement.

- Some clients that decline to modify their policy statements while insisting an unsolicited trade be made.

- members or candidates will need to evaluate the effectiveness of their services to the client and ultimately determine whether they should continue the advisory arrangement with the client.

- Some firms may allow for the trade to be executed in a new unmanaged account.

(2)Recommended Procedures for compliance

- Unsolicited trades request(未经请求的交易请求) that a member or candidate knows are unsuitable for a client.

Regular updates.

- Objectives and constraints should be maintained and reviewed periodically to reflect any changes in the client’s circumstances.

- Changes in either factor may result in a fundamental change in asset allocation.

- Should reqularly compare constraints with capital market expectations to arrive at an appropriate asset allocation.

- Annual review is reasonable unless business or other reasons, such as a major change in market conditions, dictate more frequent review.

- Should document attempts to carry out review if circumstances prevent it.

- Objectives and constraints should be maintained and reviewed periodically to reflect any changes in the client’s circumstances.

Suitability test policies.

- Should require the investment professional to look beyond the potential return of the investment and include the following:

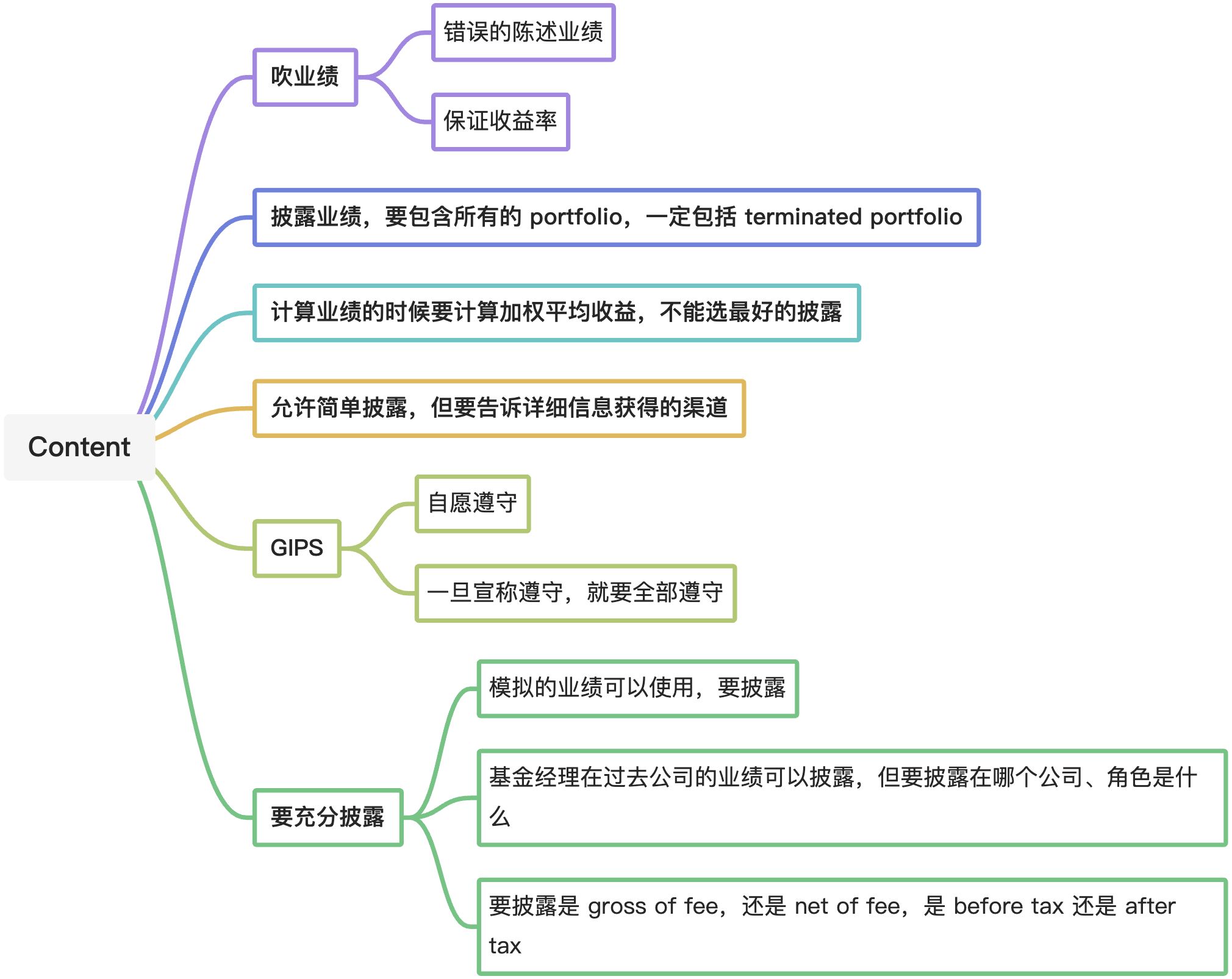

When communicating investment performance information, must make reasonable efforts to make sure that it is fair, accurate, and complete.

(1)Guidance

Not misrepresent past performance or reasonably expected performance

- Not state or imply to obtain what was achieved in the past

- 不得暗示将获得与历史投资业绩相同的成绩

- Should include terminated portfolio as part of performance history.

- Shold measure performance of weighted rate of return rather than a single performance.

If the presentation is brief, must

Apply GIPS standards

- For members and candidates who are showing the performance history of the assets they manage, compliance with the GIPS standards is the best method to meet their obligations under Standard 3-D.

- Should encourage firms to comply with the GIPS standards.(推荐采用 GIPS 的业绩表述标准,并非强制)

Compliance without applying GIPS standards. Can also meet obligations under Standard 3-D by:

- considering the knowledge and sophistication of the audience to whom a performance presentation is addressed

- presenting the performance of the weighted composite of similar portfolios rather than using a single representative account

- including terminated accounts as part of performance history with a clear indication of when the accounts were terminated

- including disclosures that fully explain the performance results being reported.

- Simulated performance using models?

- Performance record from prior entity?

- Is performance gross of fees (investment management fee), net of fees, or after tax?

- maintaining the data and records used to calculate the performance being presented.

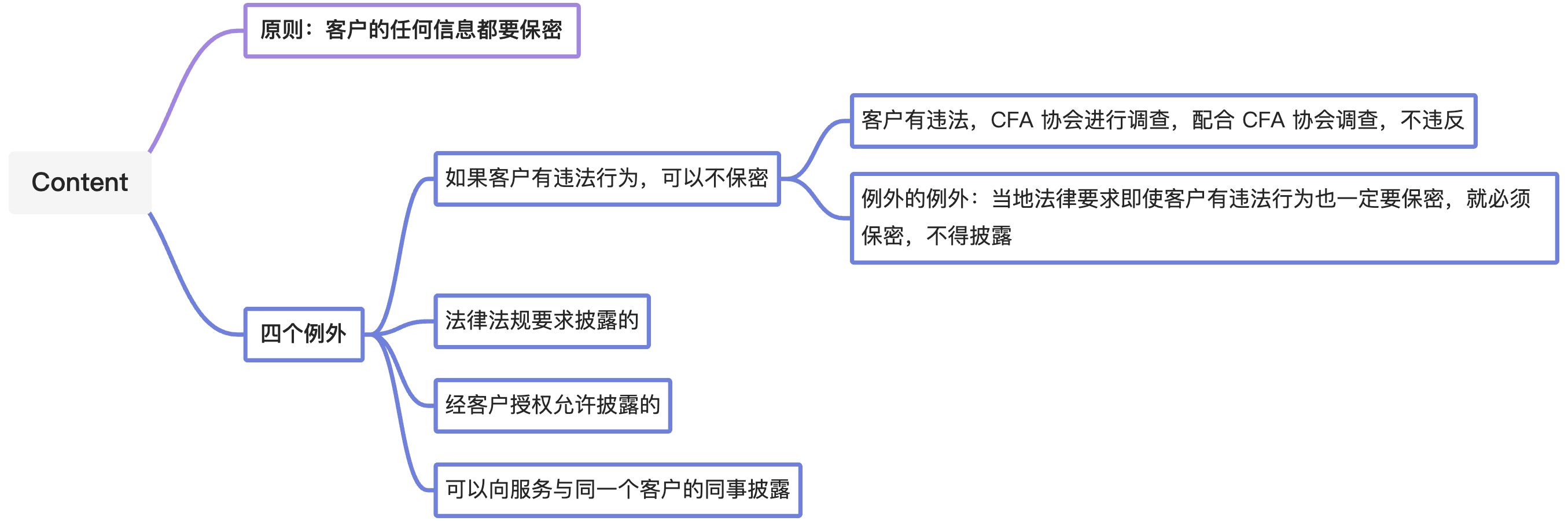

E:Preservation of confidentiality

Must keep information about current, former, and prospective clients confidential unless:

As a general matter, must comply with applicable law.

- If applicable law requires disclosure of client information in certain circumstances, members and candidates must comply with the law.

- If applicable law requires maintaining confidentiality, even if the information concerns illegal activities on the part of the client, should not disclose.(当地法规规定了不得披露,即使有违法行为,也不得披露)

- When in doubt, should consult with compliance personnel or legal counsel before disclosing confidential information about clients.

- If applicable law requires disclosure of client information in certain circumstances, members and candidates must comply with the law.

- Requirements of 3-E are not intended to prevent from cooperating with an investigation by the CFA Institute Professional Conduct Program (PCP).(鼓励配合 CFA 协会对会员的监督)

Disclose to authorized fellow employees is not violate(向服务于同一个客户的同事披露不违反该条款)

(2)Recommended Procedures for compliance

The simplest, most conservative and effective way to comply with 3-E is to avoid disclosing any information received from a client except to authorized fellow employees who are also working for the client.

- In some instances, may want to disclose information from clients that is outside the scope of the confidential relationship and does not involve illegal activities(如:卖房子). Before making such a disclosure, should ask the following:

- In what context was the information disclosed? If disclosed, is the information relevant to the work?

- Is the information background material that, if disclosed, will enable better service to the client?

- Communication with clients

- Technological changes are constantly enhancing the methods that are used to communicate with clients and prospective clients.

- Members and candidates should make reasonable efforts to ensure that firm-supported communication methods and compliance procedures follow practices designed for preventing accidental distribution of confidential information.