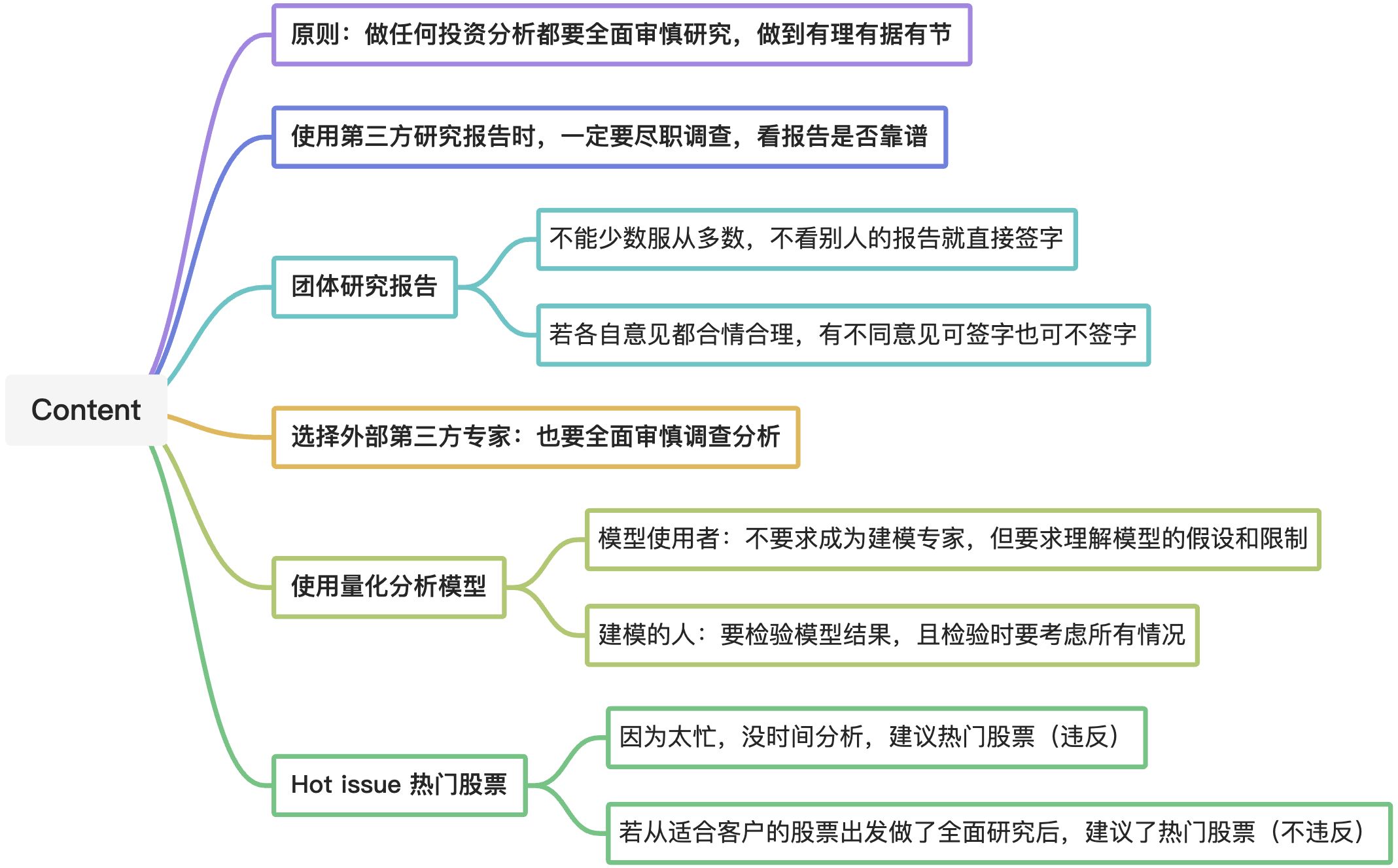

A:Diligence and reasonable basis

- Members and Candidates must:

- Exercise diligence, independence, and thoroughness in analyzing investments, making investment recommendations, and taking investment actions.

- Have a reasonable and adequate basis, supported by appropriate research and investigation, for any investment analysis, recommendation, or action.

- The requirements for research conclusions vary in relation to the role in investment decision-making process, but must make reasonable efforts to cover all pertinent(直接相关的,有关的; 恰当的; 相宜的) issues when arriving at a recommendation.

Provide supporting information to clients —> enhance transparency

(1)Defining Diligence and Reasonable Basis

In providing investment service, often use a variety of resources(company reports, third-party research, and results from quantitative models).

- Some attributes to consider:

- Global, regional, and country macroeconomic conditions

- current stage of the industry’s business cycle,

- company’s operating and financial history

- mutual fund’s fee structure and management history

- output and potential limitations of quantitative models

- quality of the assets included in a securitization

- appropriateness of selected peer-group comparisons

Can base decisions only on the information available at the time the decision is made. The steps taken in developing a diligent and reasonable recommendation should minimize unexpected downside events.

(2)Using Secondary or Third-Party Research

Criteria in forming an opinion on whether research is sound include:

- assumptions used

- rigor of the analysis performed

- date/timeliness of the research

- evaluation of objectivity and independence of recommendations

- If rely on secondary or third-party research, must make reasonable and diligent efforts to determine whether it is sound. If suspect the soundness, must not rely on that information.

- May rely on others in the firm to determine soundness and use the information in good faith assuming the due diligence process was deemed adequate.

- The sources of the information and data will influence the level of the review a member or candidate must undertake.

- Information and data taken from internet sources, such as personal blogs, independent research aggregation websites, or social media websites, likely require a greater level of review than information from more established research organizations.

- Should verify that the firm has a policy about the timely and consistent review of approved research providers to ensure the quality of the research.

If such policy not in place, should encourage development and adoption.

(3)Using Quantitatively Oriented Research

Need to have an understanding of the parameters used in the model or quantitative research.

Although not required to be experts in technical aspects of the models, must understand the assumptions and limitations inherent in any model and how the results were used in the decision-making process.

(4)Developing Quantitatively Oriented Research

Individuals who create new quantitative models and services must exhibit a higher level of diligence in reviewing new products than the individuals who ultimately use the analytical output.

- Members and candidates involved in the development and oversight of quantitatively oriented models, methods, and algorithms must understand the technical aspects of the products they provide to clients.

- A thorough testing of the model and resulting analysis should be completed prior to product distribution.

- Need to consider the time horizon of data input in financial models.

- In development of a recommendation, may need to test the models by using volatility and performance expectations that represent scenarios outside the observable databases.

In reviewing computer models or the resulting output, pay attention to the assumptions and rigor(僵硬; 寒战; 艰辛) of the analysis to ensure that the model incorporates negative market events.

(5)Selecting External Advisers and Subadvisers

Why adopt external advisers and subadvisers?

- The progression of financial instruments and allocation techniques leads to the use of specialized managers to invest in specific asset classes that complement the firm’s in-house expertise.

Need to ensure that the firm has standardized criteria for reviewing external advisers. Such criteria would include, but would not be limited to, the following:

The conclusions or recommendations of the group report represent the consensus of the group, but may not necessarily be the views of the member or candidate, even though his name is included on the report.

- If not reflect his or her conclusion, must dissociate from the group research?

- If the consensus opinion has a reasonable and adequate basis and is independent and objective, need not decline to be identified with the report, even if it does not reflect his opinion.

Always recommend “hot” issue indicates NO reasonable basis.

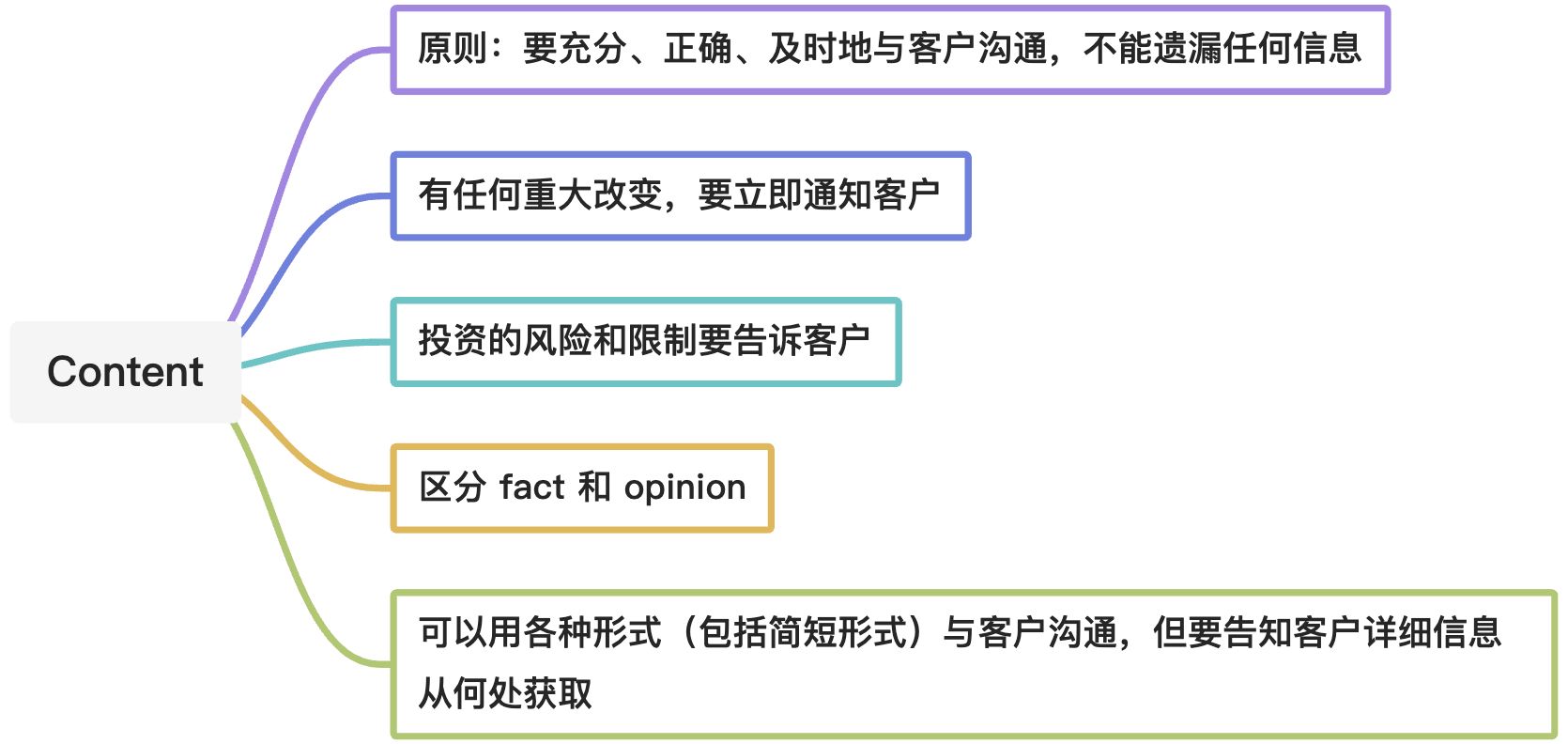

B:Communication with clients

Members and Candidates must:

- Disclose to clients and prospective clients the basic format and general principles of the investment processes used to analyze investments, select securities and construct portfolios and must promptly disclose any changes that might materially affect those processes.

- Disclose to clients and prospective clients significant limitations and risks associated with the investment process.

- Use reasonable judgment in identifying which factors are important to their investment analyses, recommendations, or actions and include those factors in communications with clients and prospective clients.

- Distinguish between fact and opinion in the presentation of investment analysis and recommendations.

Keep clients informed on an ongoing basis about changes to the investment process.

- Understanding the basic characteristics of an investment is important in judging suitability on a stand-alone basis, it’s especially important in determining the impact each investment will have on the characteristics of a portfolio.

Should inform clients about the specialization or diversification expertise of external advisers

(2)Different Forms of Communication

All means of communications are included here, not just research reports, so in person, over the call, or by the computer are okay.

If recommendations are in capsule form (such as a recommended stock list), should notify clients that additional information and analyses are available upon request.

(3)Identifying risk and Limitations of Analysis

Members and candidates must outline to clients and prospective clients significant risks and limitations of the analysis contained in their investment products or recommendations.

- In general, the use of leverage constitutes a significant risk and should be disclosed.

- Adequately disclose the general market-related risks

- Risks associated with the use of complex financial instruments that are deemed significant.

- Other types of risks that members and candidates may consider disclosing include, but are not limited to, counterparty risk, country risk, sector or industry risk, security-specific risk, and credit risk.

- Investment securities and vehicles may have limiting factors that influence a client’s or potential client’s investment decision.

- Examples of such factors and attributes include but are not limited to investment liquidity and capacity. Capacity is the investment amount beyond which returns will be negatively affected by new investments.

- Members and candidates have to disclose significant risks known to them at the time of the disclosure

Members and candidates cannot be expected to disclose risks they are unaware of at the time recommendations or investment actions are made.

- A one-time investment loss that occurs after the disclosure does not constitute a pertinent(直接相关的,有关的; 恰当的; 相宜的) factor in assessing whether significant risks and limitations were properly disclosed

- Having no knowledge of a risk or limitation that subsequently triggers a loss may reveal a deficiency in the diligence and reasonable basis of the research of the member or candidate, but may not reveal a breach of Standard 5-B

(4)Report Presentation

The member or candidate who prepares the report must include those elements that are important to the analysis and conclusions of the report so that the reader can follow and challenge the report’s reasoning.

- A report writer who has done adequate investigation may emphasize certain areas, touch briefly on others, and omit certain aspects deemed unimportant. As long as the analyst clearly stipulates the limits to the scope of the report.

- Investment advice based on quantitative research and analysis must be supported by readily available reference material and should be applied in a manner consistent with previously applied methodology.

- If changes in methodology are made, they should be highlighted.

Separate opinions from facts

- If not indicate that earnings estimates, changes in the dividend outlook, and future market price information are opinions subject to future circumstances, thus fail to separate past from future and violate 5-B.

- In the case of complex quantitative analyses, analysts must clearly separate fact from statistical conjecture and should identify the known limitations of an analysis.

- Should explicitly discuss the assumptions used in the investment models and processes to generate the analysis.

- Caution should be used in promoting the accuracy of any model or process to clients because the ultimate output is merely an estimate of future results and not a certainty.

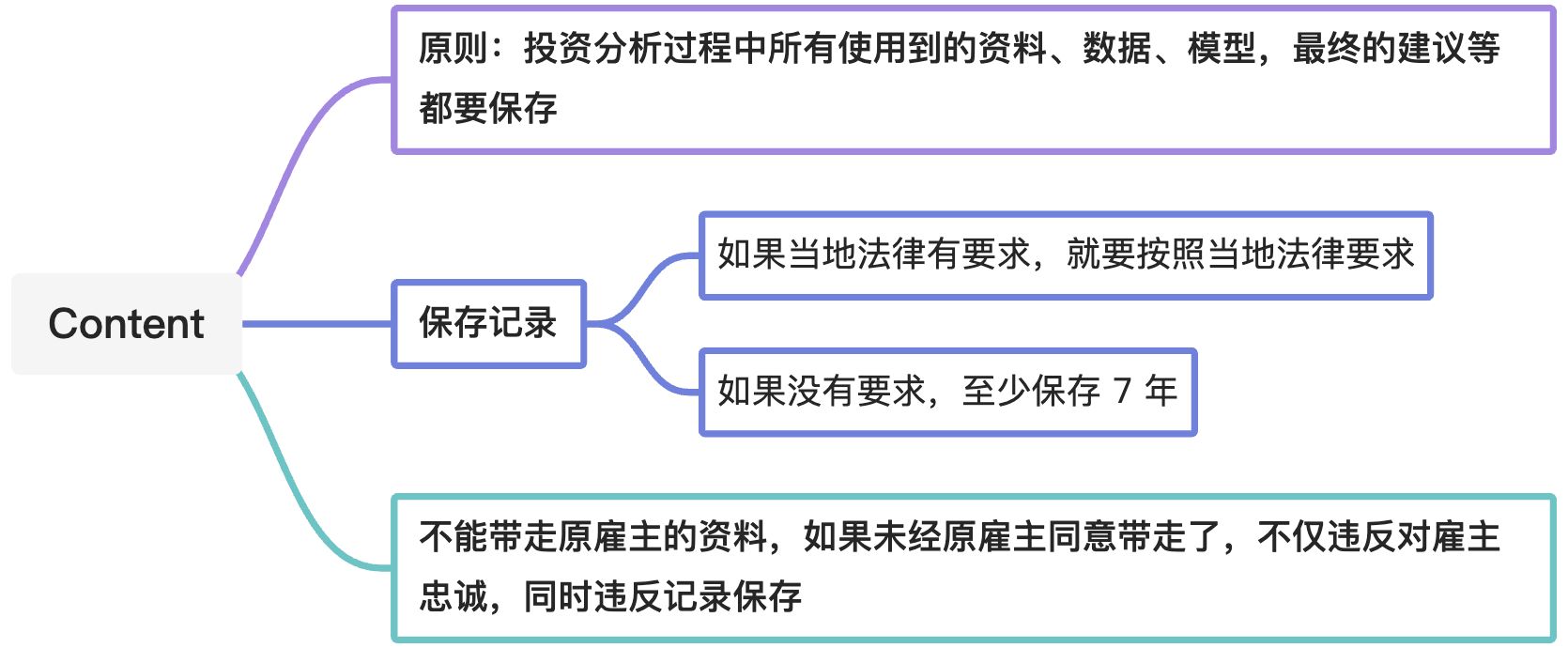

C:Record retention

Members and Candidates must develop and maintain appropriate records to support their investment analysis, recommendations, actions, and other investment-related communications with clients and prospective clients.

Records may be maintained either in hard copy or electronic form.

(1)Records Are Property of the Firm

Records created in professional activities are the property of the firm. When leaving the firm, cannot take those records, including originals or copies of supporting records of his work,to the new employer without the express consent of the previous employer.

- Cannot use historical recommendations or research reports created at the previous firm because the supporting documentation is unavailable.

For future use, must re-create the supporting records at the new firm through public sources, or directly from covered company, and not from memory or sources through previous employer unless with permission.

(2)New Media Records

Members and candidates should understand that employers and local regulators are developing digital media retention policies, but these policies may lag behind the advent of new communication channels.

Fulfilling local regulatory requirements also may satisfy the requirements of Standard 5-C, but should explicitly determine whether it does.

- If no regulatory guidance in place, CFA Institute recommends maintaining records for at least 7 years. If there is a legal requirement for retention period, follow the legal requirement.(有法律要求保存记录时长时,按法律要求;否则默认按 CFA Institute 建议,最少保存 7 年)