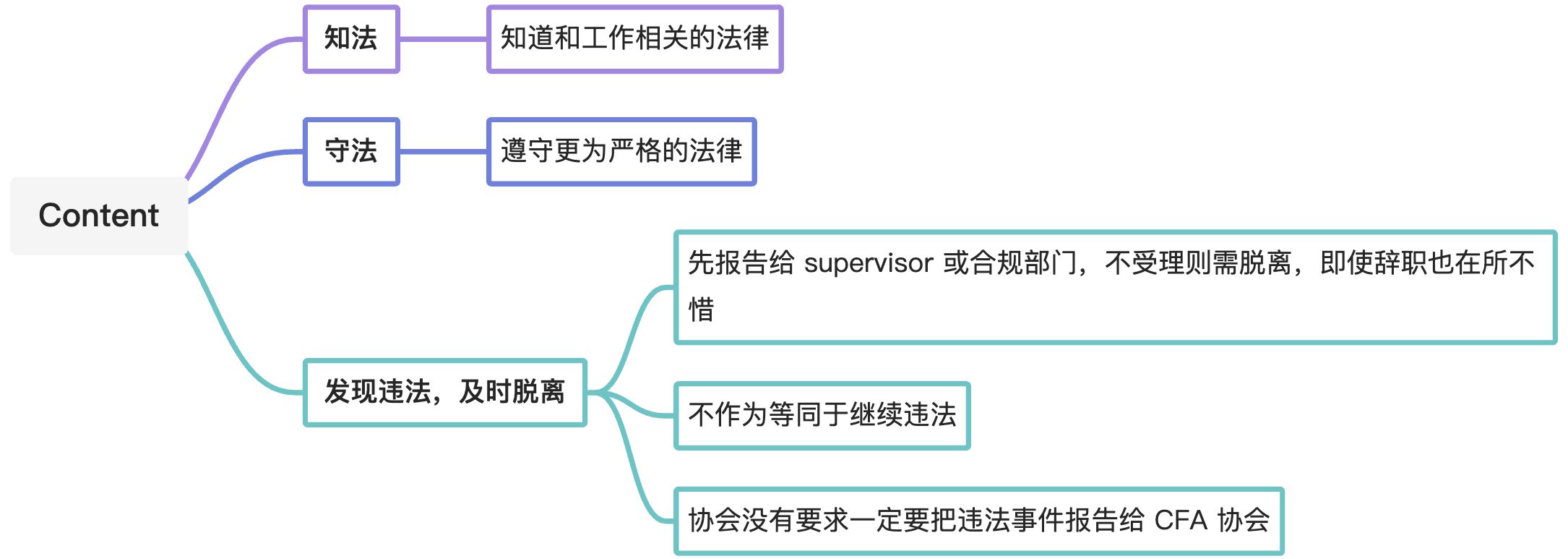

- A:Knowledge of the law

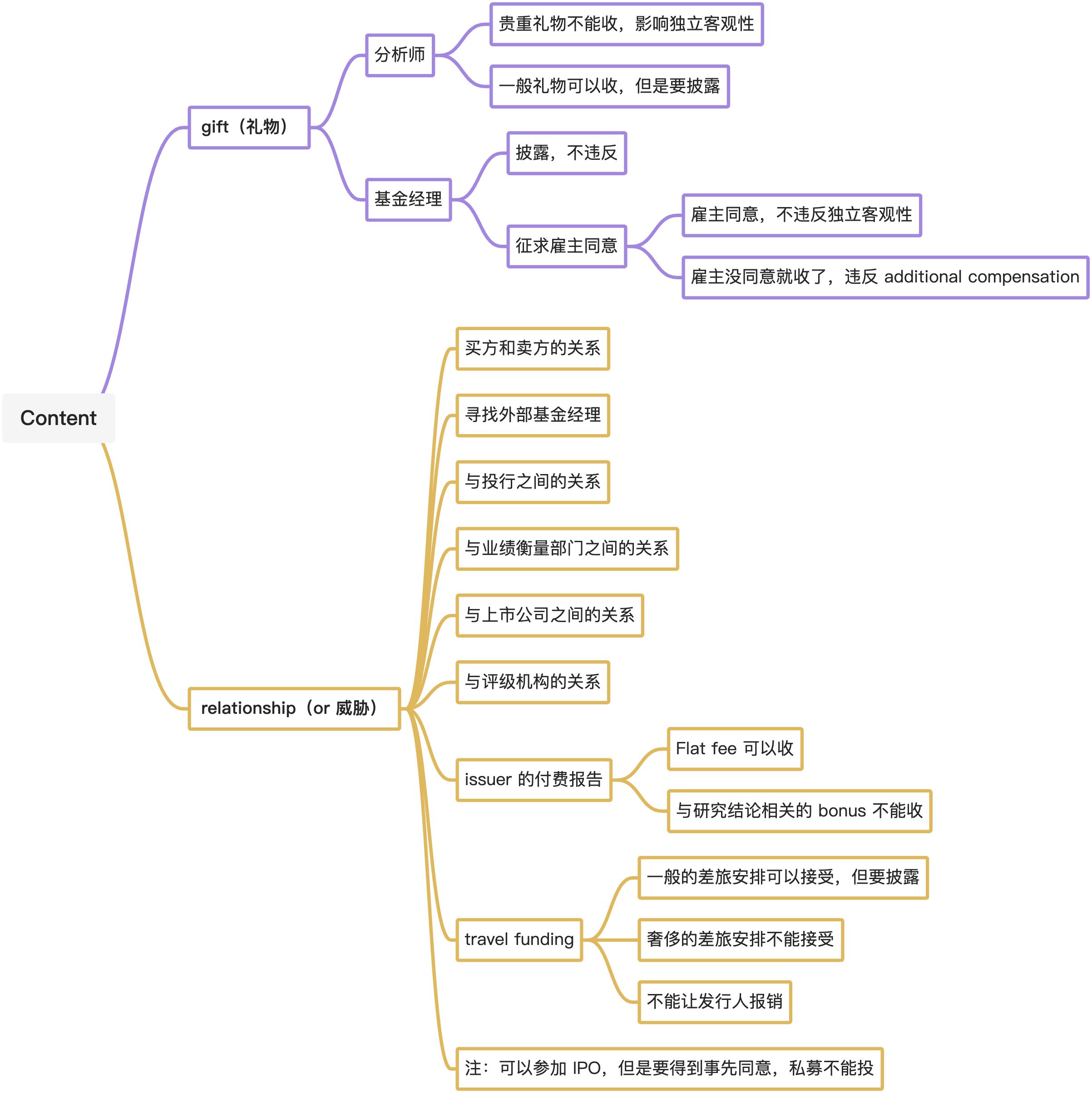

- B:Independence and objectivity

- (1)Guidance

- (a)Buy-Side clients

- (b)Fund manager relationships and Custodial Relationships

- (c)Investment banking relationships

- (d)Performance Measurement and Attribution

- (e)Public companies

- (f)Credit rating agency opinions

- (g)Influence during the Manager Selection/Procurement Process

- (h)Issuer-Paid research

- (i)Travel Funding

- (j)Social Activities

- (2)Recommended Procedures for compliance

- (1)Guidance

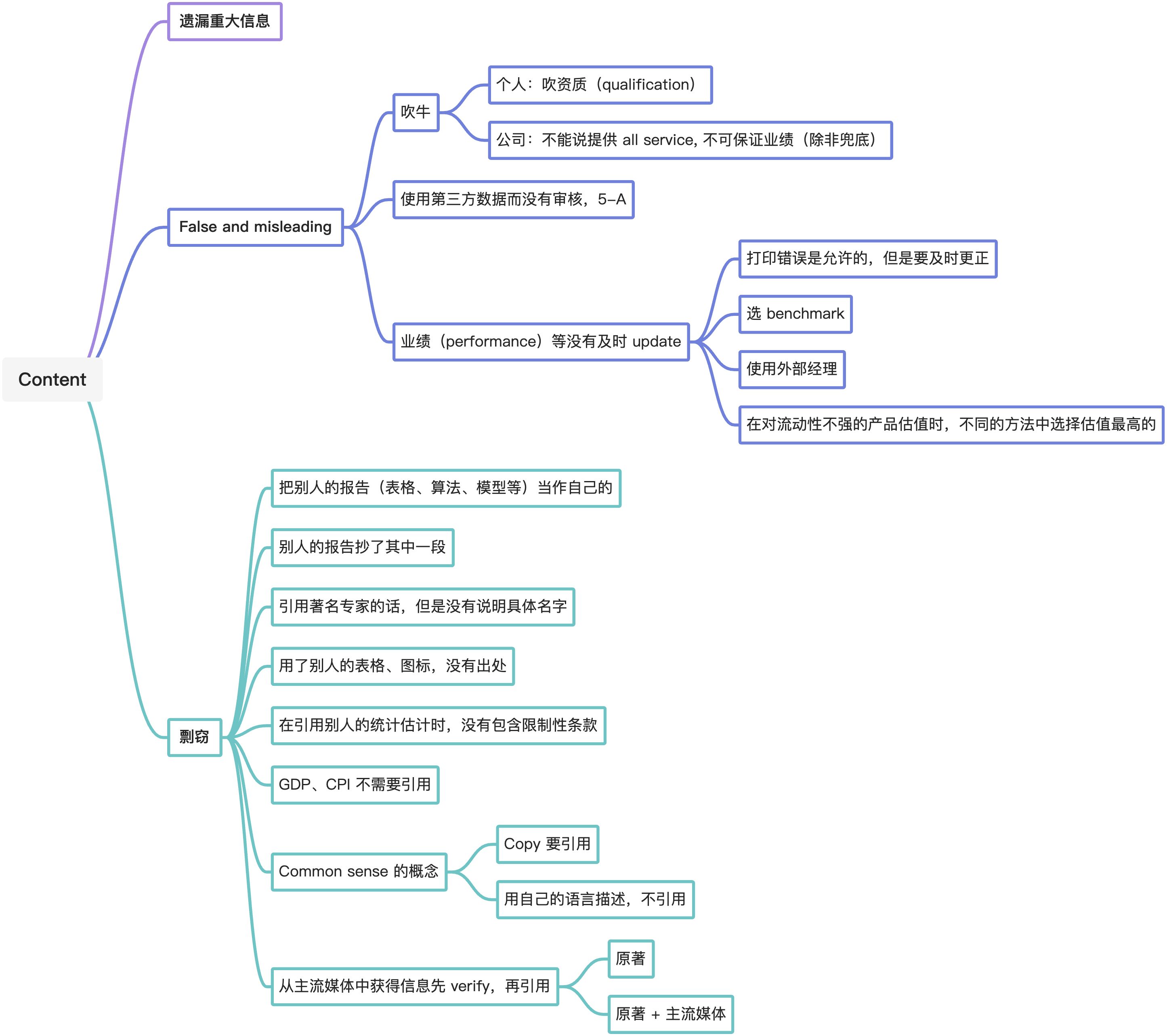

- C:Misrepresentation

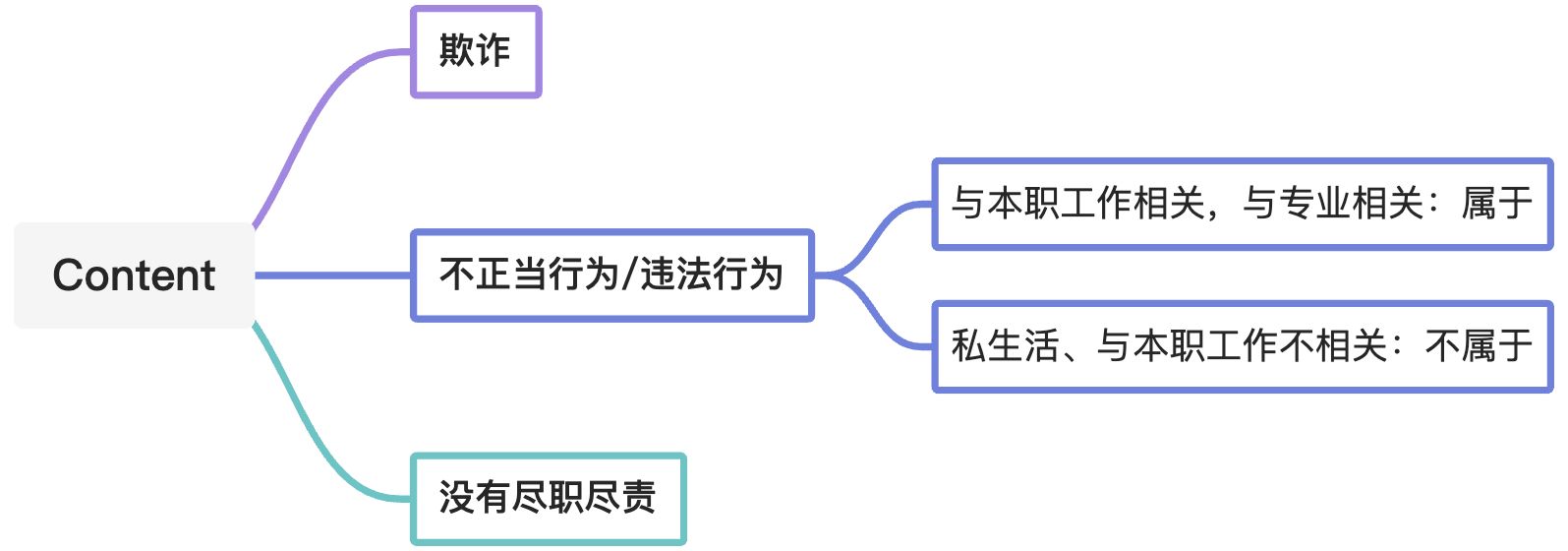

- D:Misconduct

A:Knowledge of the law

- Members and Candidates must understand and comply with all applicable laws, rules, and regulations (including the CFA Institute Code of Ethics and Standards of Professional Conduct) of any government, regulatory organization, licensing agency, or professional association governing their professional activities.

- In the event of conflict, must comply with the more strict law, rule, or regulation.

- Must not knowingly participate or assist in any violation of such laws, rules, or regulation.

Must dissociate from any violation of such laws, rules, or regulations.

(1)Guidance

(a)code and standards vs. local law

Must know and should know the laws and regulations related to their professional activities in all countries in which they conduct business.

- Not expert on all laws that could govern his activities,not expert on compliance, however must comply with law directly governing. (不需要成为法律专家,只需了解和工作相关的法规)

- Always adhere to the most strict rules and requirements(law or CFA institute Standards)that apply. Do not violate Code or Standards even if the activity is otherwise legal under local laws.

- Comply with the last applicable law if transferable applicability

总是遵循要求更严格的法律(这里的更严格,是 applicable laws 与 CFA Standards 相比)

(b)Participation or association with violations by others

Know —> report through supervisor or compliance department —> may consider confronting wrongdoers —> if unsuccessful, dissociate and document —> quit(如果有充足证据认为正牵涉在某违法现象之中,应退出该事件,即使辞职也在所不惜)

- Suspect —> Consult —> but can’t be absolved from requirements to compliance

- 确定深陷违法行为后的退出策略

- Step1:让上司了解该情况

- Step2:退出的几种表现形式:移除自己的名字,请求更换一个任务,拒绝对当前客户提供服务

- There is no requirement under Standards to report violations to governmental authorities, but this may be advisable in some circumstances and required by law in others.(协会没有要求一定要将违法的行为向政府汇报,也没有规定一定要向协会汇报,但鼓励向协会揭发)

Inaction combined with continuing association with those involved in illegal or unethical conduct may be construed as participation or assistance in the illegal or unethical conduct.(不作为等同于继续违法)

(c)Investment Products and Applicable Laws

Members and candidates involved in creating or maintaining investment services, investment products, packages of securities and derivatives should be mindful of where these products or packages will be sold as well as their places of origination. (the place of sales and origination)

- The applicable laws and regulations of the countries or regions of origination and expected sale should be understood by those responsible for the supervision of the services or creation and maintenance of the products or packages.

- Should make reasonable efforts to review whether associated firms that are distributing products or services also abide by the laws and regulations.

- Should undertake necessary due diligence when transacting cross-border business to understand the multiple applicable laws and regulations, in order to protect the reputation of the firm and themselves.

Seek appropriate guidance from the firm’s compliance or legal departments and legal counsel outside the organization when uncertain about which laws or regulations in conducting business in multiple jurisdictions.

(2)Recommended Procedures for compliance

Stay informed

- Should establish or encourage employers to establish a procedure by which employees are regularly informed about changes in laws, rules and regulations.

- In many instances, the employer’s compliance department or legal counsel can provide such information in the form of memorandums distributed to employees in the organization.

- Participation in an internal or external continuing education program is a practical method of staying current.

- 鼓励公司更新相关法律的变化,并做成小册子发给员工,使员工随时了解当地法律;鼓励组织内部或外部培训。

Review procedures

- Should review(or encourage their employers to review)the firm’s written compliance procedures on a regular basis to ensure that the procedures reflect current law and provide adequate guidance to employees about what is permissible conduct under the law or the Code and Standards.

- 鼓励上司审核下属提交的文件

B:Independence and objectivity

Members and Candidates must use reasonable care and judgment to achieve and maintain independence and objectivity in their professional activities.

Must not offer, solicit, or accept any gift, benefit, compensation, or consideration that reasonably could be expected to compromise their own or another’s independence and objectivity.

(1)Guidance

Mainly concerning how to deal with internal and external conflicts.

- Reject gift that could be expected to compromise their own or another’s independence and objectivity. (Best Practice)

- Ordinarily, modest and normal gift is OK only if its purpose is not to influence independence.

- Benefits may include gifts, invitations to lavish functions, tickets, favors, job referrals, and so on.

- Gift from corporate:should evaluate both the actual effect on his independence and objectivity and in the eyes of clients

- Gift from clients:Receiving a gift, benefit, or consideration from a client can be distinguished from gifts given by entities seeking to influence independence to the detriment of other clients. Client’s gift should be disclosed, if not, violate I(B).

- When possible, prior to accepting “bonuses”or gifts from clients, members and candidates should disclose to their employers such benefits offered by clients.

- If notification is not possible prior to acceptance, members and candidate must disclose to their employers benefits previously accepted from clients.

- Disclosure allows the employer of a member or candidate to make an independent determination about the extent to which the gift may affect the member’s or candidate’s independence and objectivity.

- When possible, prior to accepting “bonuses”or gifts from clients, members and candidates should disclose to their employers such benefits offered by clients.

- 1-B:业绩完成后,客户的奖励视为小费,可以收,但要向上司披露

- 4-B(额外报酬):必须获得雇主的书面许可

收取了客户的奖励,但没有披露,同时违反 1-B 与 4-B;若披露了,上司不允许收还是收下了,则只违反 4-B

(a)Buy-Side clients

Buy-Side Clients may try to pressure sell-side analysts.

- Institutional clients are the primary users of sell-side research, either directly or with soft dollar brokerage.

- Rating downgrade:some portfolio managers may support sell-side ratings inflation —> affect the portfolio’s performance and manager’s compensation.

- Portfolio performance is subject to media and public scrutiny, affect the manager’s professional reputation.

For portfolio managers:

- It is improper to threaten or engage in retaliatory(报复性的; 反击的)practices.

- Although most portfolio managers do not engage in such practices, the perception by the research analyst that a reprisal(报复; 报复行动)is possible may cause concern and make it difficult to maintain independence.

(b)Fund manager relationships and Custodial Relationships

Members and candidates responsible for hiring and retaining outside managers and third-party custodians should not accept gifts, entertainment, or travel funding that may be perceived as impairing their decisions.

- custodian:[kʌˈstoʊdiən] 监护人; 保管人; 看守人

Primary and secondary fund managers and third-party custodians often arrange educational and marketing events to inform others about their business strategies or investment process.

Firewall between research and investment banking should be built to minimize conflicts of interest.

- Separate reporting structures for personnel on the research side and personnel on the investment banking side.

- Compensation arrangement that minimizes the pressures on research analysts and rewards objectivity and accuracy. Compensation should not link analyst remuneration directly to investment banking assignments in which analyst may participate as a team member.

- It is appropriate to have analysts work with investment bankers only when the conflicts are adequately and effectively managed and disclosed.

- Firms should also regularly review policies and procedures to determine whether analysts are adequately safeguarded and to improve the transparency of disclosures relating to conflict of interests.

防止研究部为了投行部的业绩作出不客观的分析,部门之间必须建立防火墙

Members and candidates working within a firm’s investment performance measurement department may also be presented with situations that challenge their independence and objectivity.

- As performance analysts, their analysis may reveal instances where managers may appeared to stray from their mandate. Or the performance analyst may receive requests to alter the construction of composite indices due to negative results for a selected account or fund.

The member or candidate must not allow internal or external influences to affect their independence and objectivity as they faithfully complete their performance calculation and analysis related responsibilities.

(e)Public companies

Analysts should not be pressured to issue favorable research by the companies they follow. Can promise to cover the firm, should not promise favorable report about the firm.

Due diligence in financial research and analysis involves gathering information from public disclosure documents and also company management and investor-relations personnel, suppliers, customers, competitors, and other relevant sources.

(f)Credit rating agency opinions

Members and candidates at rating agencies should ensure that procedures at the agencies prevent undue influences from a sponsoring company during the analysis.

- Should abide by their agencies’ and the industry’s standards of conduct regarding the analytical process and the distribution of reports.

- The rating agencies need to develop the necessary firewalls and protections to allow the independent operations of their different business lines.

When using information provided by credit rating agencies, Should be mindful of the potential conflicts of interest.

(g)Influence during the Manager Selection/Procurement Process

Procurement:[prəˈkjʊrmənt] 采购; (尤指为政府或机构) 购买

- The need for members and candidates to maintain their independence and objectivity extends to the hiring or firing of those who provide many business services beyond investment management.

- When serving in a hiring capacity, members and candidates should not solicit gifts, contributions, or other compensation that may affect their independence and objectivity. Solicitations do not have to benefit members and candidates personally to conflict with Standard 1-B.

- Requesting contributions to a favorite charity or political organization may also be perceived as an attempt to influence the decision-making process.

- members and candidates serving in a hiring capacity should refuse gifts, donations, and other offered compensation that may be perceived to influence their decision-making process

- When working to earn a new investment allocation, members and candidates should not offer gifts, contributions, or other compensation to influence the decision of the hiring representative.

- The offering of these items with the intent to impair the independence and objectivity of another person would not comply with standard 1-B.

Such prohibited actions may include offering donations to a charitable organization or political candidate referred by the hiring representative. (pay to play scandal)

(h)Issuer-Paid research

Remember that this type of research is fraught with potential conflicts.

- Analysts’ compensation for preparing such research should be limited and the preference is for a flat fee that is not linked to their conclusions or recommendations (directly or indirectly)

- flat fee:统一收费(费用)

- Must fully disclose potential conflict of interest, including the nature of compensation. If not, misleading investors.

Conduct a thorough analysis of the company’s financial statements based on public information, benchmarking within a peer group, and industry analysis.

May be influenced by discussions exclusively with the company executives when flying on a corporate jet.

- Best practice:always use commercial transportation rather than accept paid travel arrangements from an outside company.

Should commercial transportation be unavailable, may accept modestly arranged travel to participate in appropriate information-gathering events, such as a property tour.

(j)Social Activities

When seeking corporate financial support for conventions, seminars or even weekly society luncheons, should evaluate both the actual effect on their independence and whether their objectivity might be perceived to be compromised in the eyes of their clients.

Protect the integrity of opinions:unbiased opinion and adequate system

- Establish policies that every research report concerning the securities of a corporate client should reflect unbiased opinion.

- Compensation systems should protect integrity in investment decision process by maintaining independence and objectivity of analysts.

- Create a restricted list for corporate client if not willing to issue adverse opinion and distribute only factual information about companies on the list.

- Restrict special cost arrangements:When attending meetings at an issuer’s headquarters, members and candidates should pay for commercial transportation and hotel charges. No corporate issuer should reimburse members or candidates for air transportation.

- reimburse:报销; 偿还; 补偿

- Limit gifts:token items only. Customary and ordinary business-related entertainment is okay as long as its purpose is not to influence independence; based on local customs and whether the limit is per gift or annual total amount.

Recommended procedures for Compliance(Con’t)

- Restrict investments:Firms set up policy related to:

- employee purchases of equity or equity-related IPO

- pre-approval for employee participation in IPO, and prompt disclosure of investment actions taken following the offering

- Restrict acquiring securities in private placements.

- Review procedures:Implement effective review procedures about personal investment activities to ensure compliance with firm policies.

- Independence policy:formal written policy to ensure that analysts are not controlled/supervised by any department that could compromise independence.

- Appointed officer:

- Restrict investments:Firms set up policy related to:

Must not knowingly make any misrepresentations relating to investment analysis, recommendations, actions, or other professional activities.

(1)Guidance

A misrepresentation is any untrue statement or omission of a fact or any statement that is otherwise false or misleading.

- Must not knowingly omit or misrepresent information or give a false impression of a firm, organization, or security in oral representations, advertising (whether in the press or through brochures), electronic communications, or written materials (whether publicly disseminated or not).

- brochure:[broʊˈʃʊr] 小册子; 资料(或广告)手册

- “Knowingly” means that either know or should have known that the misrepresentation was being made or that omitted information could alter the investment decision-making process.

- Omission of a fact or outcome:Although not every model can test for every factor or outcome, should ensure that the analyses incorporate a broad range of assumptions(from very positive scenarios to extremely negative scenarios).

(a)Omissions

- Must not knowingly omit or misrepresent information or give a false impression of a firm, organization, or security in oral representations, advertising (whether in the press or through brochures), electronic communications, or written materials (whether publicly disseminated or not).

The omission of a fact or outcome has increased in importance because of the growing use of technical analysis. Many members and candidates rely on models and processes to scan for new investment opportunities, to develop investment vehicles, and to produce investment recommendations and ratings. Findings from models shall not be presented as fact.

Omissions are also important in regards to what information is provided concerning the performance measurement and attribution process.

- Member and candidates should encourage their firms to develop strict policies for composite development to prevent cherry picking(situations in which selected accounts are presented as representative of the firm’s abilities). The omission of all accounts appropriate for the defined composite may misrepresent to clients the success of the manager’s implementation of its strategy.

(b)Impact on Investment Practice

- Member and candidates should encourage their firms to develop strict policies for composite development to prevent cherry picking(situations in which selected accounts are presented as representative of the firm’s abilities). The omission of all accounts appropriate for the defined composite may misrepresent to clients the success of the manager’s implementation of its strategy.

Guarantee the investment performance

- Prohibit:Guaranteeing specific return which is inherently volatile, because it is misleading to investors.

- Not prohibit:Providing clients with information on investments that have guarantees built into the structure of the product or for which an institution has agreed to cover any losses.

- Members and candidates must not misrepresent any aspect of their practice, including (but not limited to) their qualifications or credentials, the qualifications or services provided by their firm, their performance record and the record of their firm, and the characteristics of an investment.

- A company is prohibited from saying “we can provide all services you need”. Proper way is to provide a list of services available.

- Investing through outside managers

- If invest in areas outside a firm’s core competencies through outside managers, must disclosed intended use of external managers, members and candidates must not represent those managers’ investment practices as their own. For further detail, refer to 5-B.

Using third-party information

Members and candidates may misrepresent the success of their performance record through presenting benchmarks that are not comparable to their strategy.

- Best practice:selecting the most appropriate available benchmark from a universe of available options.

- Standard 1-C does not require that a benchmark always be provided in order to comply.

- Reporting misrepresentations may also occur when valuations for illiquid or non-traded securities are available from more than one source. When different options are available, members and candidates may be tempted to switch providers to obtain higher security valuations.

(d)Social Media

- When communicating through social media channels, members and candidates should provide only the same information they are allowed to distribute to clients and potential clients through other traditional forms of communication.

- The online or interactive aspects of social media do not remove the need to be open and honest about the information being distributed.

The perceived anonymity granted through these platforms may entice individuals to misrepresent their qualifications or abilities or those of their employer.

Definition:Copying or using in substantially the same form materials prepared by others without acknowledging the source of the material or identifying the author and publisher of such material.

- Applied in oral communications (e.g.:group meetings), visits with clients, use of audio/video media and telecommunications.

- Must not copy (or represent as their own) original ideas/material without permission. Must acknowledge and identify the source of ideas/material that is not their own. (e.g.:a computer model derived from others’ idea)

- Forms of plagiarism

- Take a study done by others, change name, and release.

- Using excerpts from others’ reports (whether verbatim or slight changes in wording) without acknowledgement.

- verbatim:[vɜːrˈbeɪtɪm] 一字不差的报道; 逐字翻译

- Citing “leading analysts” and “investment experts” without naming specific reference.

- Using charts and graphs without stating sources.

- Presenting statistical estimates of forecasts prepared by others and identifying the sources without including the qualifying statements or caveats that may have been used.

- Copying proprietary computerized spreadsheets or algorithms without authorization of the creators.

- Preparation of research reports based on multiple sources of information without acknowledging the sources. (e.g.:ideas, statistical compilations, and forecasts combined to give the appearance of original work).

- Cannot use undocumented forecasts, earnings projections, asset values, etc. Sources must be revealed to bring the responsibility directly back to the author or the firm involved.

- In distributing 3rd-party, outsourced research, may use and distribute reports as long as not representing oneself as the author.

- May add value for the client by sifting through research and repackaging it for clients.

- clients should be fully informed that they are paying for the ability of the member or candidate to find the best research from a wide variety of sources.

- Should disclose whether the research presented comes from another source, from either within or outside the member’s firm.

- This allows clients to understand who has the expertise.

- May add value for the client by sifting through research and repackaging it for clients.

When citing from mainstream media outlet:

- Cannot only cite the information from the intermediary, in case of misunderstanding and potential deviation from the viewpoint of the original author.

- Best practice:Either obtain the information directly from the author and cite only that author or use the information provided by the intermediary and cite both sources.

(f)Work Completed for Employer

Firm may issue future reports without attribution to prior analysts, but a member or candidate cannot reissue a previously released report solely under his or her name.

- May use other people’s work (research, models, etc.) within the same firm without committing a violation.

- When the original analyst leaves the firm, research and models developed while employed are the property of the firm. The firm retains the right to continue using the work completed after leaving.

Must not engage in any professional conduct involving dishonesty, fraud, or deceit or commit any act that reflects adversely on their professional reputation, integrity, or competence.

- 该准则用于界定是否影响会员个人的信誉,从而影响投资的行为,misconduct 的行为未必违法,但只要影响了本人的投资工作,属于该条款。

特例:违法行为,如果出于个人正确的信仰,且非暴力,不认为属于 misconduct。

(1)Guidance

Dishonest conduct

- Any act that involves lying, cheating, stealing, or other dishonest conduct would violate this standard if the offense reflects adversely on professional activities.

- offense:攻势; 冒犯; (球队的)前锋,锋线队员; 进攻方法

- Do not abuse this standard to settle personal, political, or other disputes unrelated to professional ethics.

- Any act that involves lying, cheating, stealing, or other dishonest conduct would violate this standard if the offense reflects adversely on professional activities.

- Absence of appropriate conduct and sufficient effort

- Member or candidate is expected to conduct the necessary due diligence to understand the nature and risks of investment before making investment recommendations.

- If not taking such steps, instead, relying on others, is violation.

Conduct that damages trustworthiness or competence may include behavior that negatively affects ability to perform professional activities.

- E.g.:abusing alcohol during business hours. Because it could have a detrimental effect on the ability to fulfill professional responsibilities.

- Personal bankruptcy may not reflect on the integrity or trustworthiness of the person declaring bankruptcy, but if the circumstances of the bankruptcy involve fraudulent or deceitful business conduct, the bankruptcy may be a violation of this standard.

(2)Recommended Procedures for compliance

Code of ethics:Adopt a code of ethics to which every employee should subscribe and make clear that any personal behavior that reflects poorly on the individual, institution, or investment industry will not be tolerated.

- List of violations:Disseminate a list of potential violations and associated disciplinary sanctions to all employees.

- Employee references:Check references to ensure good character and eligible for work in the investment industry.