| - 分享主题:SFM - 论文标题:Stock Price Prediction via Discovering Multi-Frequency Trading Patterns - 论文链接:https://www.eecs.ucf.edu/~gqi/publications/kdd2017_stock.pdf - 分享人:唐共勇 |

|---|

1. Summary

【必写】,推荐使用 grammarly 检查语法问题,尽量参考论文 introduction 的写作方式。需要写出

- 这篇文章解决了什么问题?

- 作者使用了什么方法(不用太细节)来解决了这个问题?

- 你觉得你需要继续去研究哪些概念才会加深你对这篇文章的理解?

We usually use LSTM to model the long-term dependence between time series. If we regard the change of stock price as a signal processing task, using LSTM to predict the change of stock price only captures the information in the time domain and ignores the information in the frequency domain. For stock price signals, the information in the frequency domain is very useful. The high-frequency part reflects the volatility of stock price, and the low-frequency part captures the long-term trend and law. Based on the time-domain and frequency-domain information, SFM modeling is proposed. On the basis of LSTM, Fourier transform is added, so that LSTM can be updated in multiple frequency domains, and then restored to the original structure through inverse transform. This paper uses the stock price data of 50 stocks from 2007 to 2014 as the training set, the data of 2015 as the verification set, and the data of 2016 as the test set. SFM performs best in predicting the stock price after 1 day, 3 days, and 5 days.

2. 你对于论文的思考

需要写出你自己对于论文的思考,例如优缺点,你的takeaways

优点:

- 将LSTM中的记忆细胞

变成状态-频率矩阵(the state-frequency matrix)

- 将遗忘门改成联合状态-频率遗忘门

- 利用傅里叶变换和逆变换使信号能够在时域与频域之间转换。

缺点:

1.短期预测和长期预测其依赖的频率是不一样的,短期波动性更大,长期更依赖低频成分

2.更新太过复杂,每一步的更新都要大量的运算,相较于LSTM其开销更大

3. 其他

【可选】

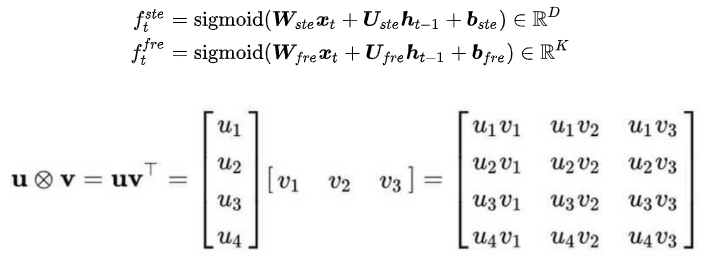

遗忘门被分为状态遗忘门(state forget gate)和频率遗忘门(frequency forget gate)

:

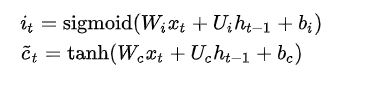

输入门和当前时刻信息的更新方式:

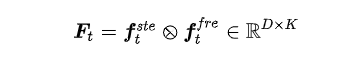

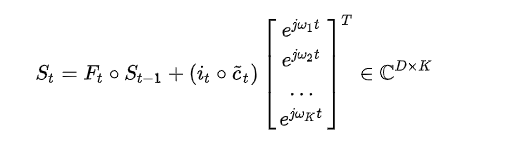

状态-频率矩阵的更新方式:

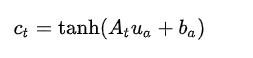

其中,

是

个频率部分的傅立叶基函数。

有了当前时间步的状态-频率矩阵,之后要更新当前时间步的隐藏状态

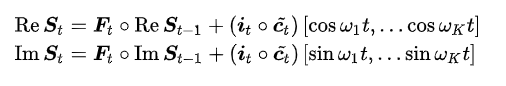

。首先利用欧拉公式

把

的更新公式分为实部和虚部两部分:

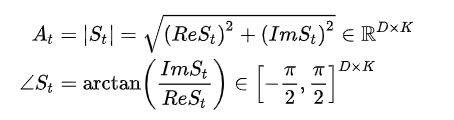

复数可以表示成振幅和相位

:

利用振幅信息获取记忆状态: