What is Golff Lend:

Golff Lend is a one-click aggregated lending service that will continue to aggregate current mainstream DeFi lending platforms, such as AAVE, Compound, dYdX, etc. This will greatly expand the underlying assets that can be used for lending, enhance the user’s asset liquidity, and also optimize the best interest rate, reducing the user’s borrowing cost. At the same time, Golff Lending will adopt a new on-chain fee alternative to solve the Ethereum high rate problem, greatly reduce contract fee, and lower the threshold for user participation.

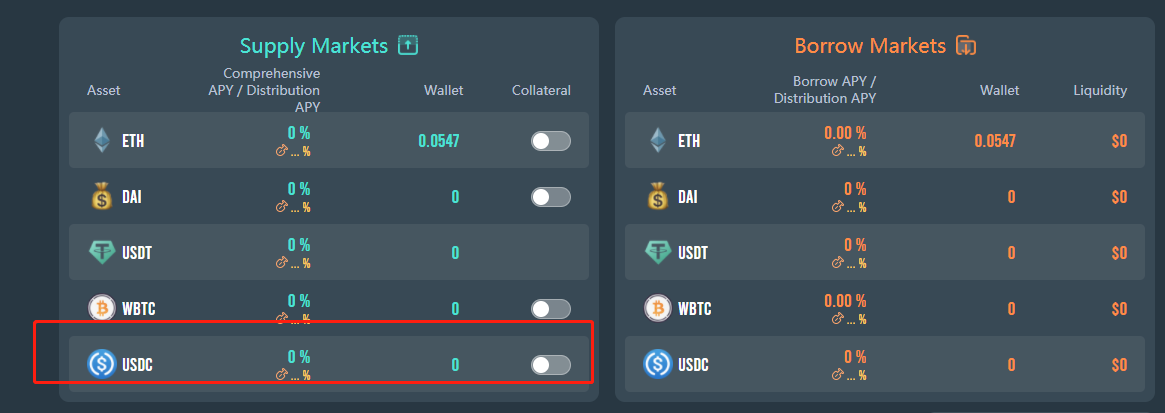

Navigate to the loan page through Golff’s official website (golff.com/golff.finance), or directly visit (golff.finance/lend) and link to the wallet (currently support Metamask, ImToken, BitKeep, Huobi Wallet, Maizi Wallet, TokenPocket and other regular wallets , The following uses Metamask as an example). Currently, Golff supports five currencies: USDT, USDC, DAI, ETH, and WBTC. We can borrow these currencies from Golff Lend for GOF mining.

What are the advantages of Golff Lend

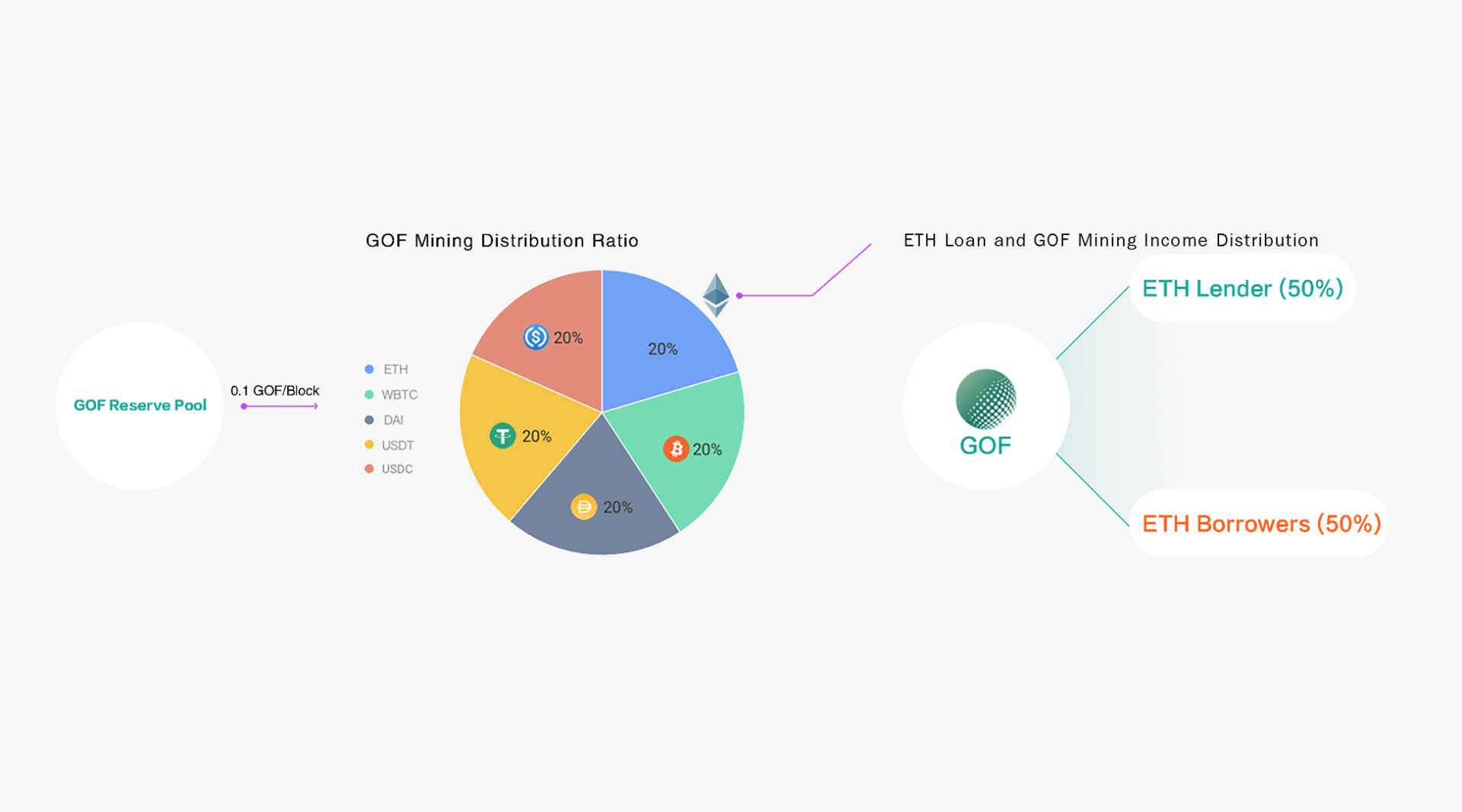

Add mining protocol : increase mining income, deposit and borrow can get GOF mining income

- Users can participate in yield farming when depositing and borrowing coins

- Each block generates 0.1 GOF, which is distributed proportionally to the supply pool and lending pool of each currency. The total amount of borrowing and mining per week is about 4320 GOF

Low commission:V2 will soon launch an on-chain fee alternative to solve the Ethereum high rate problem, greatly reducing fee and lowering the threshold for user participation.

- Aggregated lending: V3 will successively aggregate the current mainstream DeFi lending platforms, and automatically provide users with the best solution for the interest rate of deposit and lending.

How to deposit?

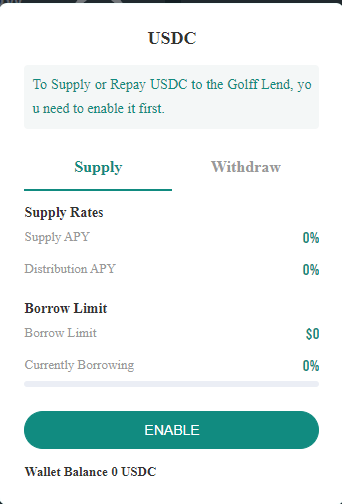

The following is an example of storing USDC

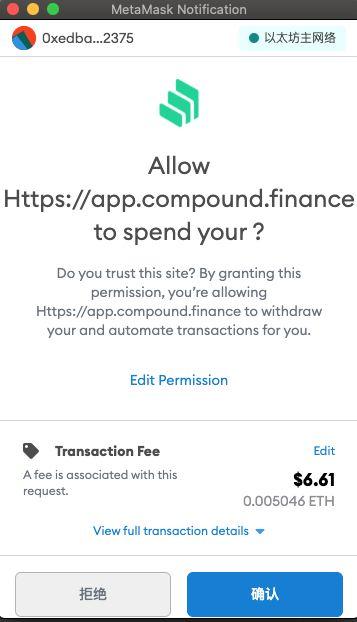

Find the USDC currency in the supply market list, and click on the USDC deposit pop-up window. The first operation requires authorization to use the USDC currency in the account of the Smart Contract of Golff Lend. Click the “Enable”button to confirm the authorization transaction in the pop-up Metamask wallet window.

After the confirmation is completed, enter the amount of USDC to be deposited in the deposit pop-up window, and we can see the estimated annualized income in the pop-up window. The annualized income of a single currency will increase with the increase in the loan amount, that is, the higher the usage rate of the currency, the higher the annualized income. After entering the quantity, click the “Deposit” button, and confirm the deposit transaction in the Metamask wallet window that pops up.

(At present, it may take a lot of gas fee to deposit and withdraw, because the current price of Ethereum is relatively expensive. After the deposit is successful, you can see the deposit balance of the account at the top of the page. At the same time, you will receive G-Lendtoken in your account, and you need to use G-Lendtoken to redeem your mortgage assets.)

How to mortgage?

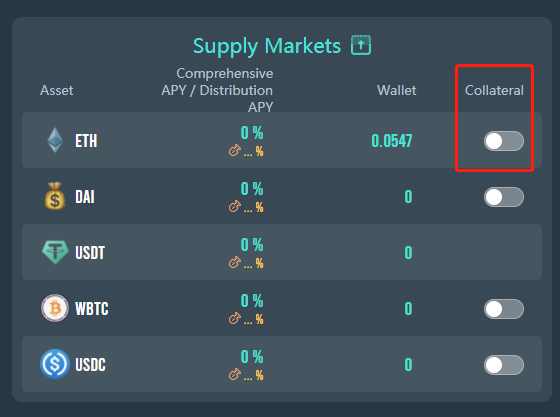

If you want to lend a currency in Golff Lend, you need to deposit an asset in Golf Lend and mortgage the asset, then you can lend other assets. Please note that when the prices of collateral and loaned assets fluctuate, the collateralized assets may be seized during liquidation.

If you want to mortgage assets, you need to click the “Mortgage” switch in the supply market list to enable the mortgage of the currency. Click “Use USDC as pledge” in the pop-up interface, and then confirm this operation in the Metamask wallet window that pops up.

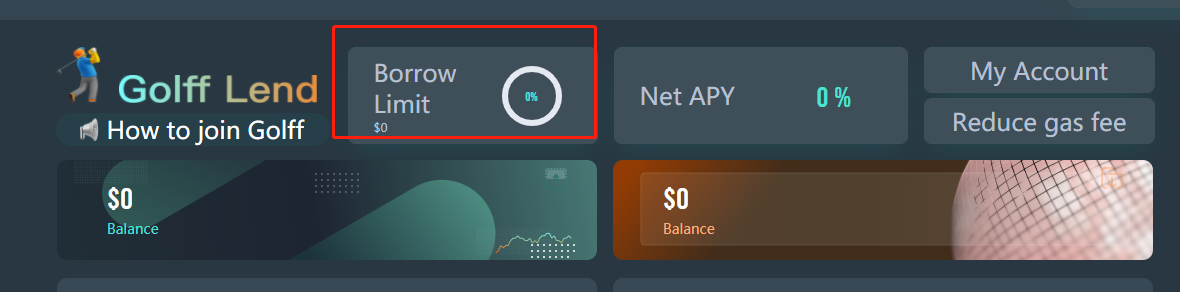

At the top of the page, you can see the mortgaged funds and the loaned funds

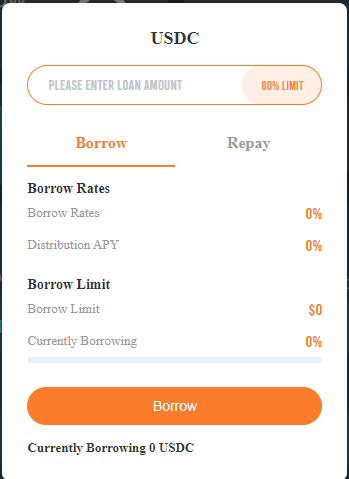

How to borrow?

In the lending market, select the currency to be lent, click on the list to display the borrowed currency pop-up window, enter the amount of currency to be lent, click the “borrow” button, and then confirm the amount in the Metamask wallet window that pops up. After the on-chain operation is completed, you will receive the loaned currency in your wallet.。

How to repay?

Click the currency you are borrowing in the loan market, select the “repayment” operation in the pop-up window, enter the amount to be repaid, and click the “repayment” button, and confirm the transaction in the Metamask wallet. After the operation on the chain is completed, you will see an increase in the number of tokens that can be loaned on the page.

After the repayment is complete, you can redeem the collateral, select the currency in the supply market, and select the “Withdraw” operation in the pop-up window, enter the amount to withdraw, click the “Withdraw” button, and confirm the transaction in the Metamask wallet. If the asset is being mortgaged or the amount that can be withdrawn is insufficient, the withdrawal operation cannot be performed.

Liquidation mechanism

When borrowing, the borrower needs to mortgage a certain asset in Golf Lend. The amount the borrower can borrow is determined by the mortgage coefficient, that is, the upper limit of the loan is: mortgage asset value mortgage coefficient.

When the prices of collateral and loaned assets fluctuate, the collateralized assets may be seized during liquidation.Therefore, Golf Lend will monitor each borrowing account in real time. When the loaned assets exceed the loan limit, the user’s loaned assets will be at risk of liquidation.

At this time, the user can trigger the liquidation procedure as a liquidator and obtain collateral at a certain discount. Thus, the borrower repays the loan of the DeFi lending system, avoiding debts and bad debts on the DeFi lending platform, maintaining the solvency of the system, and at the same time , The liquidator has gained revenue, and the platform can operate normally.

For example, user A deposits 10,000U worth of USDC and performs mortgage lending, and lent 5 ETH. At this time, the price of 5 ETH rises to 7500U, and user A’s assets trigger the liquidation boundary. At this time, liquidator B liquidates this, and he repays 2.5 ETH for user A (The maximum limit for a single liquidation is 50% of the loan amount), and he can obtain the G-LendUSDC corresponding to the liquidation amount 108%.

.