Dfi.Money

By Carbon Chain Value

The code can be copied, but the community cannot be rent it.

If we look at it in a further abstraction, instead of saying that YFII’s “local-friendly” design has attracted many YFI users in the Chinese community, it is better to say that it is a self-governing portal for the Chinese DeFi elite community, forking YFI with collective will and boosting it to succeed.

“Liquid mining” detonated the DeFi field.

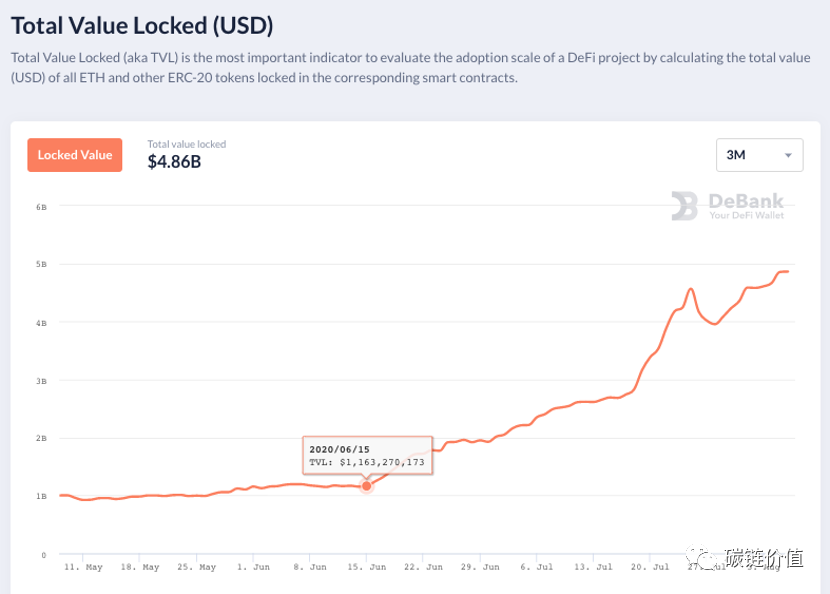

Since Compound launched liquid mining on June 15, more than a dozen projects including Sythetix, Aave, Balancer, Curve, NEST, etc. have followed. Along with it, the overall lock-up amount of DeFi has increased almost all the way. As of August 10, the locked up amount of the entire DeFi market has reached 5.13 billion U.S. dollars, continuing to hit a record high.

DeFi TVL amount|Source: Debank

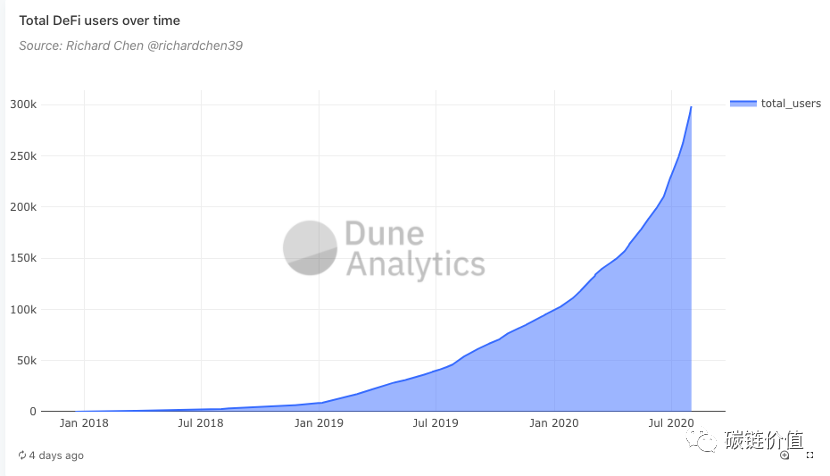

At the same time, the total number of users in the DeFi market is also rising parabolicly. According to Dune Analytics statistics, as of August 1, the total number of DeFi users was close to 300,000, an increase of approximately 50,000 compared to June 15.

Total DeFi users|Source: Dune Analytics

In this boom, the YFI series is undoubtedly the most eye-catching. Positioned as a “DeFi revenue aggregator” and known as the “DeFi Barometer”, yearn.finance, after its launch in mid-July, has locked up more than $400 million. Even at the end of the mining activity, the locked up amount is still It holds nearly 170 million US dollars and ranks in the top ten in DeFi Pulse. Its governance token YFI once recorded a 1500X increase.

01. Rare success stories in the history of forks

In addition to the amazing wealth effect, what makes YFI even more famous is the fork that draw attention to everyone in the crypto industry.

Two weeks after YFI went live, due to irreconcilable differences on the YIP-8 proposal, some YFI community members announced that they would fork the project. On July 27, YFI’s brother YFII was launched. The Chinese community jokingly called YFI the “big uncle” and YFII the “second uncle”.

YFII, which is forked from YFI, also has dazzling data: According to Etherscan data, as of August 10, the lock-up amount of YFII pool one + pool two is close to 100 million U.S. dollars, and its token price has recorded 1128 The high dollar. In other words, YFII also brings amazing wealth effects.

Under YFII’s “successful demonstration”, YFII’s “brothers” soon turned out, such as YFIII, YYFI…These YFX series projects are dazzling; however, they turned to scams soon after they were born and dead quickly. Only YFII survived and remains active until today.

In the eleven-year history of crypto currency, there are not many forks, but 99% of the forks eventually went into decline. When the Chinese community forked out YFII, many people believed that this kind of story would inevitably be staged again. It was impossible for YFII to defeat YFI, nor could it develop. However, more than two weeks have passed, and YFII has shown great vitality. Whether it is the activity of the community, the frequency with which the community launches new strategies and new products, or the yield farming players participating in the lock-up are increased quickly.

YFII is a special phenomenon in the history of forks.

This is the first time that the Chinese community has shown its potential on an excellent forked project. Before YFII, BCH was the only one that attracted widespread attention in the cryptocurrency community. At that time, the big blockchain activists represented by Wu Jihan forked Bitcoin, and causing the the most of bitcoin miners to participate in the “hard fork battle”. The money spent was in the hundreds of millions, but it ended in a disastrous defeat. Soon after the hard fork of Bitcoin, the BCH community covered up the split. Satoshi Aoben carve up the democratic community members and forked out BSV; among other members who opposed Satoshi Aoben, Liu Changyong initiated the FreeCash project. Even Wu Jihan’s teammate Yang Haipo announced recently will fork against BCH…

In fact, the final fate of most fork projects is also defeated by the decline of consensus.

Why, YFII succeed. This matter deserves our careful study: Why can YFII successfully fork? Why did those fork tokens followed YFII fail so quickly? Can YFII’s experience be uploaded and copied? After the successful fork, What is the relationship with the original YFI project?

The author combines public information with observations and interviews on the YFI community to try to clarify the motivation behind the YFI community competition, the logic behind the bright data, and the context of the development of DeFi when we insert it into liquid mining. Environment, how these stories happened.

02. Legit or Scam

“Never short YFII community… and we will win glory for everyone in the community!”

“The more they suppress, the braver we are.”

“This is the centralized DeFi gang with ulterior motives doing us, but the community did not shame the YFII people!”

The birth of YFII originated from the YIP-8 proposal that the YFI community failed to pass. According to the original design, the total number of YFI tokens is 30,000. Since YFI was originally a community-based project that was not well-known, most of YFI’s token miners were friends of founder Andre, as well as capital institutions close to him. Therefore, after the YFI token price skyrocketed and became popular in the entire crypto community, latecomers soon discovered that the initial miners had become vested interests. So in late July, community member Merk Jeffery made a proposal for additional token issuance. Although the proposal received a support rate of more than 80%, it failed because the total vote rate was only 9.73%, which did not meet the minimum requirement of 33%.

There are many reasons for the low vote rate of the YIP-8 proposal. One of the factors that cannot be ignored is that among the holders of YFI tokens, few will willingly watch the tokens in their hands become diluted. However, the latter think that such a game is unfair to them-especially DeFi players in the Chinese community. Due to the gap between the East and West communities, this DeFi project, which was born purely in the West, has no place for Chinese players from the beginning. When the late Chinese players arrived at the scene, they found that there was almost no place for themselves in the game.

Therefore, the new community members proposed to fork the YFI project in order to preventing YFI from being controlled by the giant whales, code-named YFII. YFII adopts the halving increase mechanism similar to Bitcoin in the YIP-8 proposal to ensure the distribution of tokens to community members. The total amount of YFII is 40,000, and each of the two pools is 20,000. The initial state of each pool is 10,000, and the output is halved every 7 days. According to the share of liquidity provided by DeFi users for each pool, the corresponding proportion of YFII is allocated. YFII will complete the distribution in the next 10 weeks. According to community information, YFII will adopt different product ideas from YFI in the future.

In the discussion of YFII in a certain community, some people think that the emergence of YFII is not a “fork”, but should be defined as “rebellion” because it is seizing the governance right of the yearn ecology rather than a fork at the product and code level. Cao Yin, managing director of the Digital Renaissance Foundation, said: “This is very similar to the French Revolution. YFI held a three-level meeting but failed to pass the YIP-8 proposal (which led to the emergence of YFII).

03. What do you think about YFII? YFI team: from exclusion to competition

With this sudden fork, the YFI community was also frying.

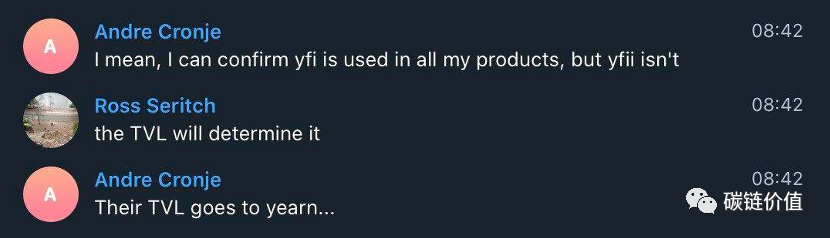

YFI founder Andrea Cronje hinted in the community at the beginning of the fork that YFII may not have a large scope of application, and the TVL (locked value) of YFII still has to flow to the yEarn. This statement represents the views of some people in the YFI community when YFII was born. They are not optimistic about the development of the fork project, thinking that such attempts are not going to be very promising.

As of this writing, the YFII community is still building its own liquidity pool.

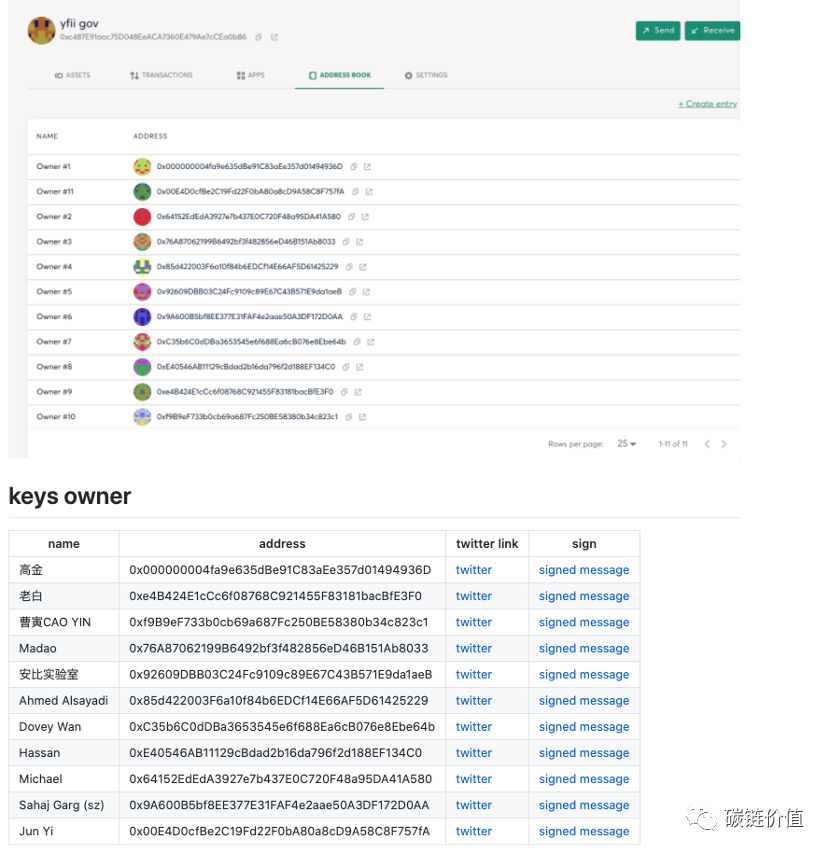

However, the bearishness of the YFI community has not prevented the development of the YFII community. It is worth noting that the YFII community quickly established a preliminary governance and produced 8 key holders. Judging from Andrea’s Twitter, YFI and KOLs in the YFII community seem to have had a pleasant communication. Andrea started to repost YFII’s meme, and even proposed to distribute the income of yearn.finance to other communities including YFII in the YFI community. Forked tokens, and stated that if the proposal is passed, YFII holders and YFI holders will enjoy the same governance rights in the yearn.finance community.

Andrea changed his attitude towards YFII and actively reposted the latter’s meme|Source Andrea’s Twitter

I have to say that Andre himself is indeed a DeFi founder with a lot of blockchain spirit. Although he created this project, he unreservedly distributed these tokens in the form of “liquid mining” without pre-mining. This is also a major reason why YFI has become popular in the crypto community. After active communication between the YFII community and Andre, although his project was forked, he was still able to accept it with an open mind. If the people here are replaced by Justin Sun, it is estimated that there will be a good show.

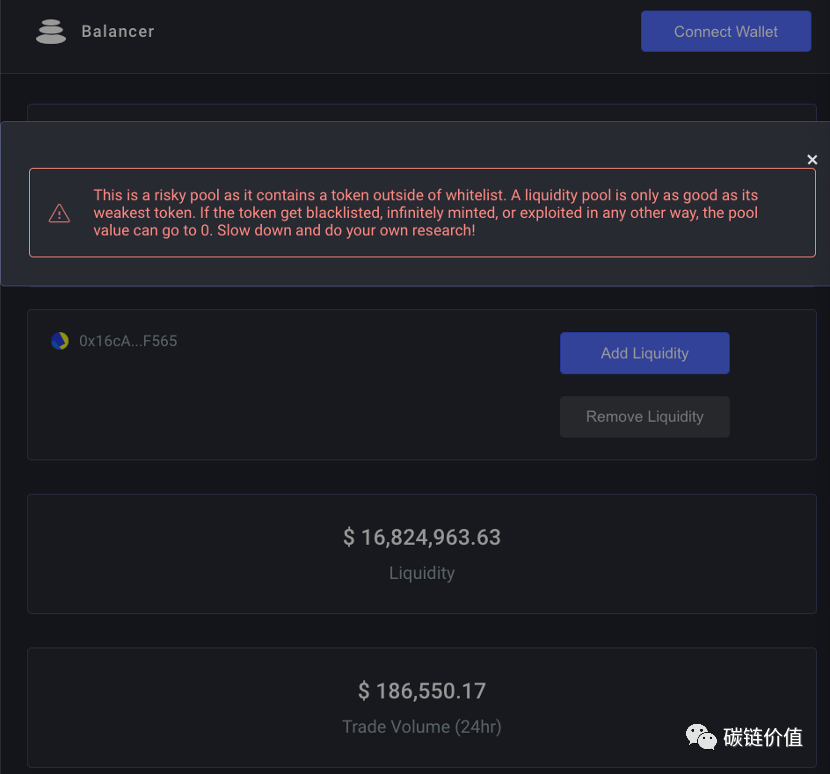

However, despite Andrea’s favor with YFII, the crypto community still expressed doubts about the YFII project. Balancer initially identified YFII as “scam” (fraud); after removing the identification of YFII “scam”, they still retained the “risk warning”. According to the sharing in the YFII community, they are still communicating with Balancer.

YFII’s flow pool on Balancer was labeled “risky”

The cautious attitude of the crypto community towards YFII is not unreasonable. After YFII, YYFI, YFIII and other projects that were referred to as “scam exit” (scam exit) were derived, some of which were entirely used to steal funds from farmers.

YFII community KOL Dovey Wan pointed out in the community that the fork coin YFIII is an ERC-20 shell without any actual content, while other fork coins YFFI and YYFI also have no community support and high control (a single address holds There are more than 90% of the tokens), and ran away after a hype surge. This undoubtedly adds to the outside world’s doubts about the YFI series.

However, with questions, the YFII community completed the revolution established the initial order of the community. They form their own global community, absorb the opinions of community members, have their own development team, and constantly update the code. Star DeFi projects like Compound and Aave have also come to cooperate with them. To outsiders, they can finally be regarded as a project, not a scam.

From the early days of “separation” to the present, the YFI and YFII communities have formed a magical state of competition: on the one hand, went to the venue to wrestle with the lock-up amount, currency price, number of users and other indicators, and try to separate the two; On the one hand, the founders of the two parties have shown full cooperation intentions and seek common development. After established its own core communities foundations , YFII began to absorb international members and tried to become more international.

04. Why is YFII successful? Why did YFX fail?

After telling the story of YFI and its fork tokens, an important question needs us to find an answer: Why is the fork of YFII successful? And the fork coin after YFII is going to fail?

1. YFI series of explosive dual-drive wheels: “siphon effect” + “quantity restraint”

Before summarizing the successful experience of YFII, let’s take a look at why YFI series products can explode-in fact, why YFI exploded.

“Liquidity mining” is a typical “one coin, two sides” thing. Users may be able to reap tens or even hundreds of times of considerable income, but at the same time they need to adapt to a relatively high operating threshold and costs across between Dex, stable coins, lending, DeFi products and protocols in various categories.

For most users, will be a challenge job to learn how to adapt to the Uniswap AMM (automatic market maker) mechanism, how to inject liquidity into Sythetix, Balancer, Curve, etc. to obtain their tokens or fee sharing, and how to obtain loan income through Aave, Compound, etc. ..YES. None is easy.

yearn.finance is to simplify the above-mentioned complex liquidity mining mechanism. Users can obtain YFI tokens by providing assets to the protocol, and the protocol will help users to capture the value through pre-designed algorithms between Aave, Compound and other different protocols and earn income.

For yearn.finance, it can “suck blood” on several “DeFi giants” “with little effort”, and users can enjoy the convenience of “one-stop investment” (compared to the previous liquid mining Mechanism). The author believes that this is a key factor in YFI’s outstanding performance in terms of lock-up amount and token price.

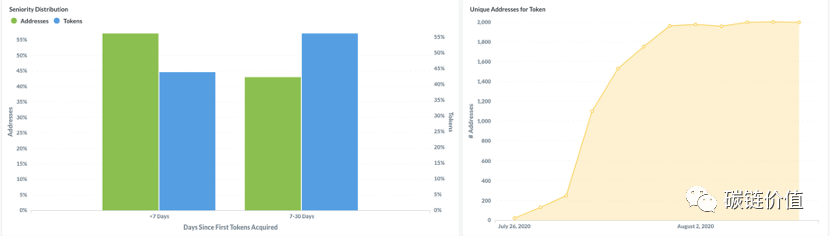

As of August 6, the number of independent addresses of YFI and YFII has changed (from left to right) | Source: Nansen.ai

The steep user growth curve further proves the uniqueness and effectiveness of this model. According to the statistics of blockchain data service provider Nansen.ai, the independent addresses of YFI and its main fork, YFII, have shown an overall upward trend. As of August 6, the number of independent addresses of YFI reached 4214, and the independent addresses of YFII were 2000, which are about 1/5 and 1/10 of the same index of Compound.

On the basis of yearn.finance’s ability to capture the value of many DeFi products and agreements, the small amount of its token YFI and the characteristics of controlling additional token issuance also provide support for its price, lock-up amount and other indicators to rise.

According to the block explorer Etherscan, the number of YFI tokens is 30,000. The YFI community also rejected the proposal to issue additional tokens (YIP 30) on August 2 with a 61.26% opposition rate; its main fork, YFII, The amount is also 30,000. According to the audit report of SECBIT Lab, YFII’s main fork token YFII has also added a regular automatic halving mechanism.

YFI Token Distribution Process| Flipside Crypto

In addition to the numerical indicators, the founder Andre’s project philosophy and personal reputation have also provided blessings to the success of the YFI system to a certain extent. Unlike regular “liquid mining” launched by other institutions are generally “pre-mined”, YFI token distribution follows the principle of zero pre-mining/pre-sale, and users provide liquidity for the agreement/secondary market to buy enough To get tokens. This relatively fair design has earned YFI an initial reputation in the crypto community. In addition, since Andre is an early member of the crypto community, some early members of the Bitcoin community chanted for it, which laid the foundation for the success of the project.

- Reasons for the successful fork of YFII

We have already mentioned YFII’s Chinese community background above. Yes, unlike YFI, YFII’s strong Chinese culture is the unique driving force for its growth.

The 11 key holders of YFII projects have a distinct Chinese background|Source: gov.yfii.finance

Blockchain developer Tina Zhen told encryption industry media Decrypt that shortly after YFII went online, Chinese practitioners who were previously in CeFi (exchanges, mining pools and even digital currency hedge funds) rushed into the project. Decrypt believes that the Chinese-friendly design of the project breaks language restrictions for many local Chinese investors and helps them enter the DeFi field.

In fact, the Chinese players who support the YFII project are probably one or two group friends in WeChat groups.

But if people remember the history of Bitcoin and Ethereum, they should be very strange about this phenomenon. Nowadays, if anyone proposes to fork out a Chinese community’s Bitcoin, or a Chinese community’s Ethereum, they will only be recognized as a liar. However, why does this story make sense in YFII? Or, why didn’t the Chinese fork other successful DeFi projects, such as Compound and Uniswap?

The crux of the problem lies in the four characters of “profit distribution.”

The so-called “national sentiment” covers up the issue of “profit distribution.” Although Bitcoin was initiated by some English-speaking foreigners, one of the biggest profitable groups is Chinese miners. In addition, Chinese geeks are also one of the first groups to explore and spread Bitcoin. Many Chinese people have changed their destiny and even realized the freedom of wealth because of Bitcoin. Therefore, no one cares whether Bitcoin is a Chinese project or not. More people think about defending their own interests.

Although in 2017, big blockchain activists led by Wu Jihan (many of whom are located in China) chose to fork Bitcoin, however, no one would support Wu Jihan because he is a Chinese. More members of the Chinese community believed that Wu Jihan’s fork infringed on their own interests, so they chose to turn to Core. There are almost no Chinese in the Core organization.

Similarly, if the YFI community has Chinese people participating from the very beginning and a group of Chinese people will benefit from it, this hard fork will probably not succeed. Even if there is no Chinese participation at the beginning, if the original YFI community agrees to issue additional tokens when the Chinese community wants to participate in order to take care of the interests of latecomers, then the hard fork will still die. It is precisely because the “people who got rich first” did not take care of the interests of the latecomers, the latecomers did not regard these people as members of a community, but instead fork the code and form their own community.

If we look at it in a further abstraction, it is not so much that YFII’s “local-friendly” design has attracted many YFI users in the Chinese community, it is better to say that it is a self-supporting portal for the Chinese DeFi elite community, forking YFI with collective will and boosting it. Success.

The successful cases of YFII have inspired us from the positive and negative aspects:

On the positive side, what kind of fork can succeed? In a project that is not internationalized enough, vested interests cannot take care of the interests of latecomers, but has achieved rapid success, the most such project is the easiest to succeed in forking. The so-called under-internationalization does not mean that the distribution of project team members and community members is under-internationalized, but rather that the distribution of benefits is not internationalized enough. The distribution of benefits of Bitcoin is very international. Whether in North America or Europe, whether in China or Russia, geeks all over the world have participated in the early mining and spread of Bitcoin. In this way, there can be no Bitcoin in a certain country-which is a very ridiculous concept in itself.

The so-called quick success of the project is easy to be forked successfully, which is easy to understand. If a project is unsuccessful, then there is no need to fork; if a project becomes successful step by step, then the timing of the fork is very difficult to control, and its community members are very stable, it is even more difficult Bifurcation. Only projects that succeed quickly, their community is unstable, forks are profitable, and are prone to FOMO, so they are suitable for forks.

The last and most important thing: if a project’s token distribution mechanism cannot resolve the conflict of interest between vested interests and latecomers, then it is very easy to cause forks. Latecomers are fully motivated to create a brand new project by using open source code and organizing their own community. When this distribution of benefits is linked to country, it becomes even worse. Subject to the problem of language barriers between countries, a project operated purely by a certain country’s people is obviously closer to the experience of the people of that country and therefore more likely to be welcomed.

On the other hand, as a successful project party, if you want to avoid forks, you should design token distribution rules in advance to prevent the community from forming vested interests in a short period of time. Just like the YFI this time, the total number of tokens is 30,000, but in less than 20 days, more than 20% of the tokens were distributed. Such an easily formed group of vested interests is bound to hinder the further development of the community.

05 3 Reasons for token failure after YFII

After YFII tokens, why did other series of tokens fail?

In fact, this can still be explained by the word “profit”. After the fork, China’s elite DeFi players have basically participated in the YFII project. Thanks to the blessings of these elites, YFII was able to obtain thousands of addresses in a week or so, the contract security audit passed, and the lock-up amount once surpassed YFI. Naturally, the participants who led this bifurcation movement received substantial returns. This has further stimulated the entry of successors. The enthusiasm of the five WeChat communities of YFII that is close to the “pyramid scheme” every day is proof.

Through YFII, their demands and needs were basically met. They themselves are the main body of the YFII community. At this time, the YFIII, YYFI and other projects that were forked again have no community foundation at all; in other words, they actually have no community at all.

Fork projects have no investors. If there is no community, it means that no one is willing to develop and make products for it. In this way, what is the point of copying the same code as YFI? Users looking at two identical products, why not go to a place with a good reputation?

Due to the lack of actual demand groups, the YF series of projects after YFII eventually became Ponzi schemes. From their failure, we can see that the code can be copied, but the community cannot rent it. For DeFi projects, the importance of the community is self-evident.

Source: Carbon Chain Value (ID: cc-value)