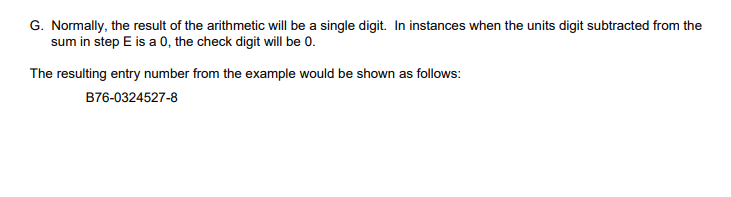

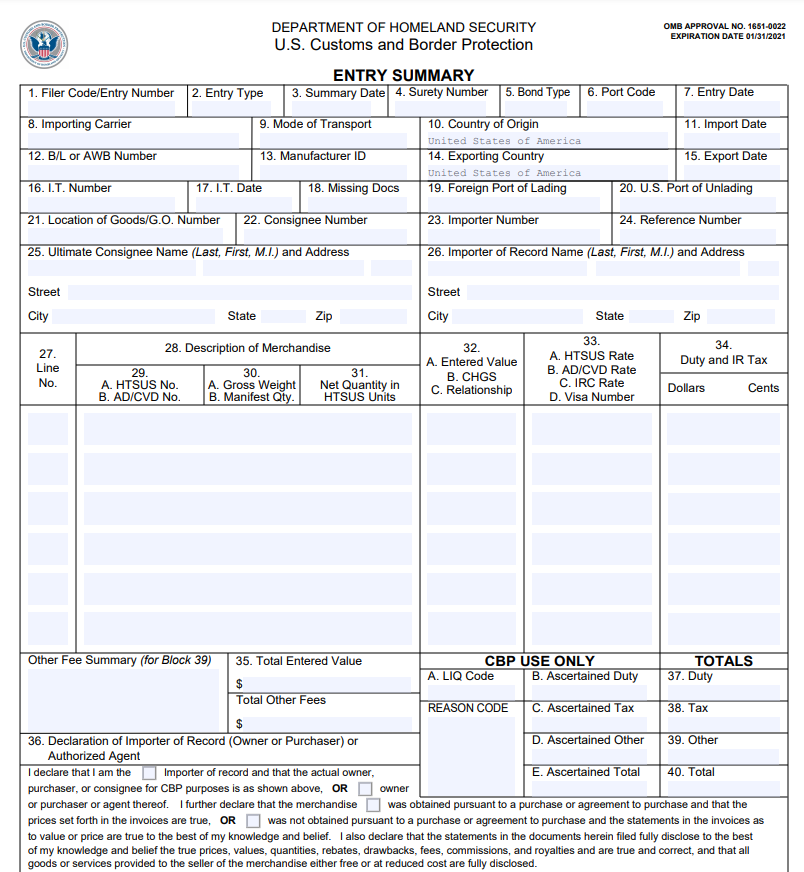

Filer Code/Entry Number

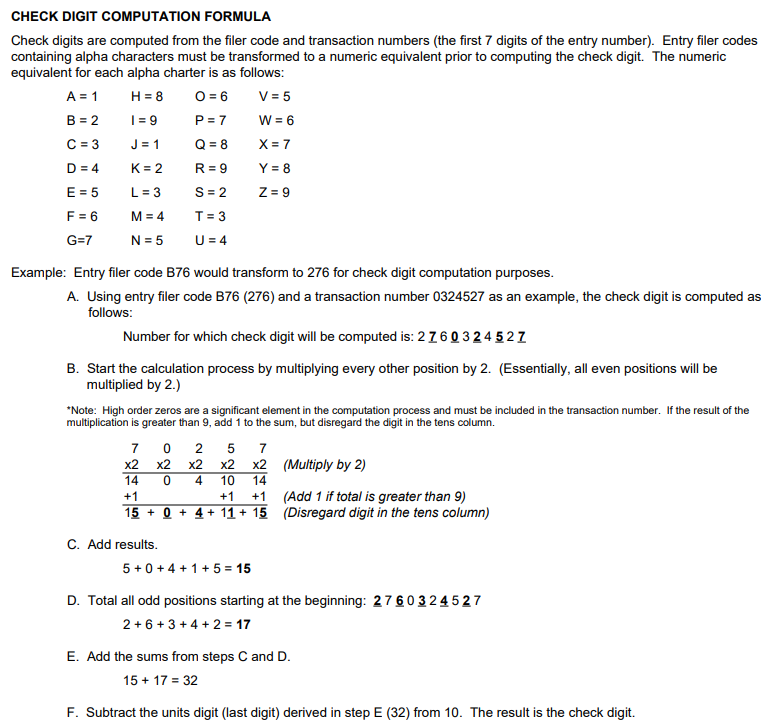

Record the 11-digit alphanumeric code. The entry number is comprised of the three-digit filer code, followed by the seven-digit entry number, and completed with the one-digit check digit. Entry Filer Code represents the three-character alphanumeric filer code assigned to the filer or importer by CBP. Entry Number represents the seven-digit number assigned by the filer. The number may be assigned in any manner convenient, provided that the same number is not assigned to more than one CBP Form 7501. Leading zeros must be shown. Check digit is computed on the previous 10 characters. The formula for calculating the check digit can be found in Appendix 1 。

Entry Type

Record the appropriate entry type code by selecting the two-digit code for the type of entry summary being filed. The first digit of the code identifies the general category of the entry (i.e., consumption = 0, informal = 1, warehouse = 2). The second digit further defines the specific processing type within the entry category. The following codes shall be used: Consumption Entries Free and Dutiable 01 Quota/Visa 02 Antidumping/Countervailing Duty (AD/CVD) 03 Appraisement 04 Vessel Repair 05 Foreign Trade Zone Consumption 06 Quota/Visa and AD/CVD Combinations 07 Duty Deferrals 08 Informal Entries Free and Dutiable 11 Quota Other than Textiles 12 Warehouse Entries Warehouse 21 Re-Warehouse 22 Temporary Importation Bond 23 Trade Fair 24 Permanent Exhibition 25 Foreign Trade Zone Admission 26 Warehouse Withdrawal For Consumption 31 AD/CVD 34 Quota/Visa and AD/CVD Combinations 38 Quota/Visa 32 CBP Form 7501 (5/22) Instructions Page 1 of 22 Government Entries Defense Contract Management Command (DCMAO NY) Military Only (P99 filer) 51 Note: When the importer of record of emergency war materials is not a government agency, entry type codes 01, 02, 03, etc., as appropriate, are to be used. Any U.S. Federal Government agency (other than DCMAO NY) 52 Transportation Entries Immediate Transportation 61 Transportation and Exportation 62 Immediate Exportation 63 Automated Broker Interface (ABI) processing requires an ABI status indicator. This indicator must be recorded in the entry type code block. It is to be shown for those entry summaries with ABI status only, and must be shown in one of the following formats: ABI/S = ABI statement paid by check or cash ABI/A = ABI statement paid via Automated Clearinghouse (ACH) ABI/P = ABI statement paid on a periodic monthly basis ABI/N = ABI summary not paid on a statement Note: Either a slash (/) or hyphen (-) may be used to separate ABI from the indicator (i.e., ABI/S or ABI-S). A “LIVE” entry is when the entry summary documentation is filed at the time of entry with estimated duties. Warehouse withdrawals are always considered “LIVE” entries. When a “LIVE” entry/entry summary is presented, an additional indicator is required to be shown in the following formats: ABI/A/L = ABI statement paid via ACH for a “live” entry/entry summary ABI/N/L = ABI “live” entry/entry summary not paid on a statement “LIVE” or “L” = non-ABI “live” entry/entry summary

SUMMARY DATE

Record the month, day, and year (MM/DD/YYYY) on which the entry summary is filed with CBP. The record copy of the entry summary will be time stamped by the filer at the time of presentation of the entry summary. In the case of entry summaries submitted on an ABI statement, only the statement is required to be time stamped. This block should not be printed or typed prior to presentation of the entry/entry summary. Use of this field is optional for ABI statement entries. The time stamp will serve as the entry summary date. The filer will record the proper team number designation in the upper right portion of the form above this block (three-character team number code). For ABI entry summaries, the team number is supplied by CBP’s automated system in the summary processing output message.

BOND TYPE

Record the single digit numeric code as follows: 0 - U.S. Government or entry types not requiring a bond 8 - Continuous 9 - Single Transaction

IMPORTING CARRIER

MODE OF TRANSPORT

10 - Vessel, non-container (including all cargo at first U.S. port of unlading aboard a vessel regardless of later disposition; lightered, land bridge and LASH all included). If container status unknown, but goods did arrive by vessel, use this code. 11 - Vessel, container 12 - Border, Waterborne (used in cases where vessels are used exclusively to ferry automobiles, trucks, and/or rail cars, carrying passengers and baggage and/or cargo and merchandise, between the U.S. and a contiguous country). 20 - Rail, non-container 21 - Rail, container 30 - Truck, non-container 31 - Truck, container 32 - Auto 33 - Pedestrian 34 - Road, other 40 - Air, non-container 41 - Air, container 50 - Mail 60 - Passenger, hand-carried 70 - Fixed transport installation (includes pipelines, powerhouse, etc.)

MPORT DATE

For merchandise arriving in the U.S. by vessel, record the month, day, and year (MM/DD/YYYY) on which the importing vessel transporting the merchandise from the foreign country arrived within the limits of the U.S. port with the intent to unlade. For merchandise arriving in the U.S. other than by vessel, record the month, day, and year (MM/DD/YYYY) in which the merchandise arrived within the U.S. port limits. For merchandise entering the customs territory for consumption from a U.S. FTZ, in compliance with 19 C.F.R. § 146.63, if the import date is not the date of removal from the zone, leave blank. For merchandise moving from a U.S. FTZ to a bonded warehouse in the customs territory, in compliance with 19 C.F.R. § 146.64, report the month, day, and year (MM/DD/YYYY) of importation.

MANUFACTURER ID (MID)

This block is provided to accommodate the manufacturer/shipper identification code.

IMMEDIATE TRANSPORTATION (IT) NUMBER

Record the IT number obtained from the CBP Form 7512, AWB number from the Transit Air Cargo Manifest (TACM), or Automated Manifest System (AMS) master in-bond (MIB) movement number.

MISSING DOCUMENTS

The following codes shall be used: 01 - Commercial Invoice 10 - CBP FORM 5523 (19 C.F.R. § 141.89) (Optional for footwear) 16 - Corrected Commercial Invoice (19 C.F.R. § 141.89, et al) 17 - Other Agency Form (19 C.F.R. § Part 12) 19 - Scale weight 21 - Coffee Form O 22 - Chemical Analysis 23 - Outturn Report 26 - Packing List (19 C.F.R. § 141.86(e)) 98 - Not Specified Above Instructions Page 7 of 22 99 - If three or more documents are missing, record the code number for the first document and insert code “99” to indicate more than one additional document is missing. If a document has been waived prior to entry summary filing or is not required at time of entry summary, it should not be recorded as a missing document. Be aware that the following forms cannot be waived and filers shall be obligated to file the forms within the appropriate time limits: 14 - Lease Statements (19 C.F.R. § 10.108) 15 - Re Melting Certificate (19 C.F.R. § 54.6(a)) 18 - Duty Free Entry Certificate (19 C.F.R. § 10.102; 9808.00.3000) 20 - End Use Certificate (19 C.F.R. § 10.138)

CONSIGNEE NUMBER

Record the Internal Revenue Service (IRS) Employee Identification Number (EIN), Social Security Number (SSN), or CBP assigned number of the consignee. This number must reflect a valid identification number filed with CBP via the CBP Form 5106 or its electronic equivalent. When the consignee number is the same as the importer of record number, the word “SAME” may be used in lieu of repeating the importer of record number. Only the following formats shall be used: IRS EIN NN-NNNNNNN IRS EIN with suffix NN-NNNNNNNXX SSN NNN-NN-NNNN CBP assigned number YYDDPP-NNNNN For consolidated shipments, enter zeros in this block in the IRS EIN format shown above (i.e., 00-0000000). The reporting of zeros on the entry summary is limited to consolidated shipments and consolidated entry summaries

IMPORTER NUMBER

Record the IRS EIN, SSN, or CBP assigned number of the importer of record. Proper format is listed under the instructions for Consignee Number.

HTS NUMBER

AD/CVD CASE NUMBER

CHECK DIGIT COMPUTATION FORMULA